How To Hire a Financial Controller

The role of a Financial Controller is to manage an organisation’s financial operations and ensure that the company’s finances are accurate, efficient, and compliant with the relevant regulations. Financial Controllers play a crucial role in the financial management of a company, so it’s worth investing the time and effort to carefully evaluate candidates for the position to ensure that you find the best person for the job.

What Is the Role of a Financial Controller?

Financial Controllers play a critical role in ensuring that the financial operations of an organisation run smoothly and efficiently whilst also providing strategic financial guidance to the senior economic executive team. Here are some of the critical responsibilities of a Financial Controller:

- Financial Reporting

- Budgeting and Forecasting

- Financial Planning & Analysis

- Risk Management

- Internal Controls

- Compliance

Why Do Businesses Need Financial Controllers?

Regardless of size and industry, most companies need a Financial Controller to manage their financial operations effectively.

Small and Medium-Sized Businesses

In a small company where resources are limited, the effective management of finance is critical to ensure that the company remains financially stable and can continue to operate and grow. An experienced Financial Controller can help small companies navigate financial challenges and position themselves for long-term success.

Large Corporations

Large corporations typically have complex financial operations. Here a Financial Controller works alongside the Chief Financial Officer (CFO) to ensure the smooth running of the organisation’s day-to-day financial transactions and accounting operations, including accounts receivable, accounts payable, budgeting, forecasting, analysing the financial data and creating financial reports. The CFO works closely with the executive team to develop and implement financial strategies that support the organisation’s goals and objectives.

Non-Profit Organisations and Government Agencies

Non-profit and government organisations are accountable to their stakeholders, including donors, taxpayers, and the public. Financial Controllers are crucial in managing the finance department and ensuring transparency and accountability by providing accurate and timely financial information.

Start-Ups

Most start-ups lack an effective internal control and reporting system due to various factors, such as limited resources, rapid growth, a focus on innovation, and informal culture, which leads to non-compliance and financial irregularities. With a Financial Controller, start-ups can attract investors and position themselves for long-term financial success and growth.

What Is a Typical Process for Hiring a Financial Controller?

Hiring a Financial Controller can be a critical decision for any business, as they are responsible for managing the routine activities of the accounting department.

The first step is to define their role in the organisation to determine what specific skills and experience they are looking for and what responsibilities the candidate should have.

Then create a job description that accurately reflects their role and responsibilities.

Post the job on your website, job boards, and other relevant online platforms. Be clear about the requirements, the responsibilities, and the compensation.

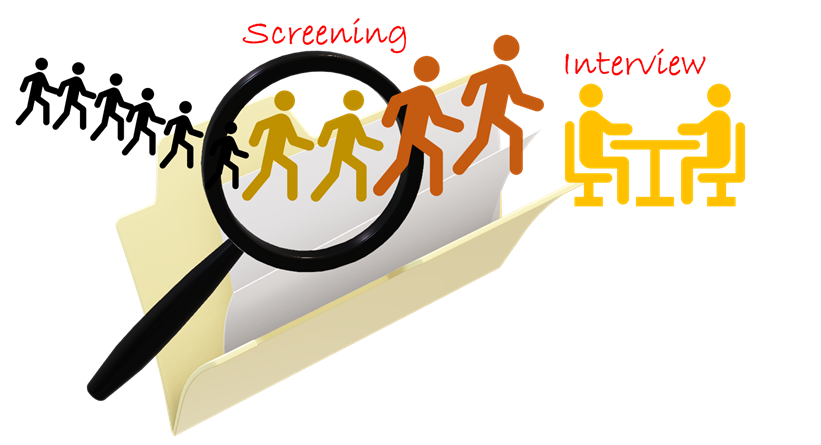

Review resumes and cover letters to identify candidates who meet the requirements listed in the job description.

Conduct initial phone or video interviews to screen candidates further and then invite the top candidates for in-person interviews. Prepare a list of questions that will help you assess their experience, skills, and ability to perform the job.

Check the references provided by the candidates to verify their work history, qualifications, and overall fit for the job.

Once you have identified the best candidate, make a fair and competitive offer. Be sure to outline the job details, including salary, benefits, and other terms and conditions.

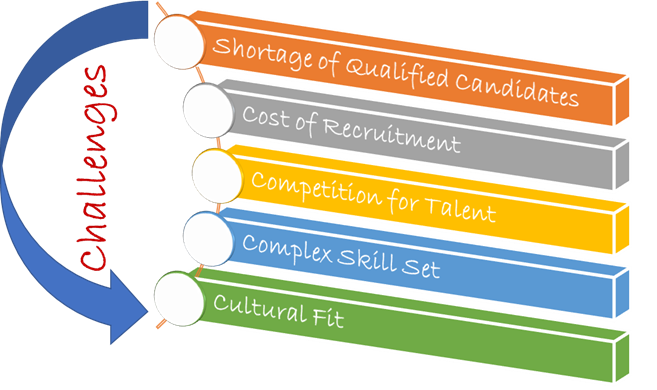

Challenges in the Hiring Process

Hiring a Financial Controller can be a complex process that presents various challenges and problems. There may be a limited pool of qualified candidates available for the position, particularly in niche industries or for companies with unique financial needs. The competition for top financial talent is another challenge, particularly in larger cities or for well-funded start-ups leading to a longer hiring process or the need to offer a more competitive compensation package.

It can be challenging to find a candidate who is not only a good fit for the company’s culture and values but possesses the right mix of technical and soft skills; therefore, the company may need to invest significant resources in the recruitment process, which can be a problem for smaller businesses or start-ups.

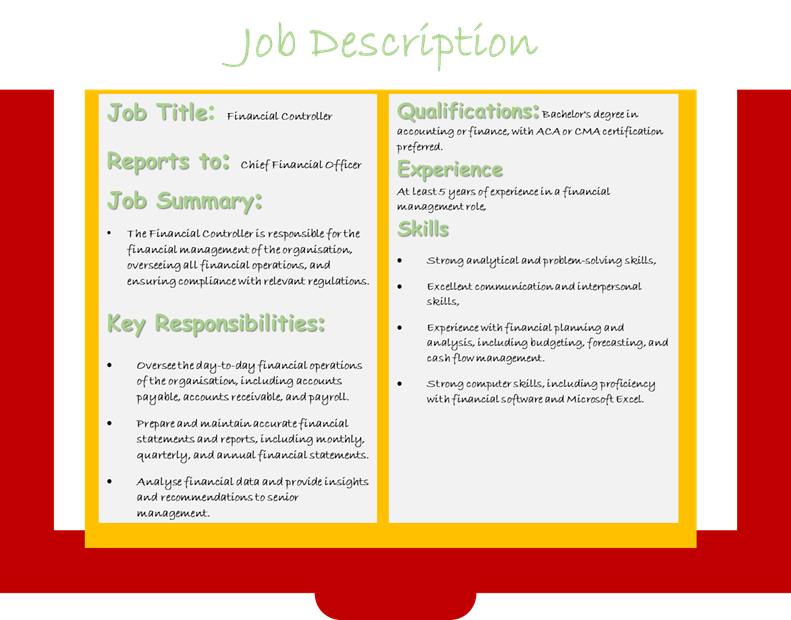

Financial Controller Job Description

The Financial Controller is a crucial role in any organisation, and a well-written job description will help attract top talent and ensure the selection of the right candidate for the job. The job description is tailored to meet an organisation’s specific needs and includes the job title, reporting lines, key responsibilities, qualifications, experience and skills.

Job Description Example:

Below is a sample job description for a Financial Controller. See also here:

Common Mistakes in Hiring a Financial Controller

There are several potential areas where things can go wrong when hiring a Financial Controller, and companies may not use the right strategies to avoid these mistakes. Some common errors include a need for more clarity in job requirements, a limited pool of qualified candidates, a flawed screening process, and inadequate compensation offers.

Therefore, it is essential to have a clear understanding of the job requirements, invest in a robust screening process, consider the cultural fit, offer a competitive compensation package, check references, and be flexible in your approach to hiring. By doing so, the company can increase the likelihood of finding the right candidate for the Financial Controller role.

How To Screen CVs?

Screening CVs can be challenging, as the role requires specific technical and soft skills. First, you should start by looking for candidates who have relevant financial qualifications, such as a bachelor’s or master’s degree in accounting or business administration, and relevant certifications, such as ACA, CMA or CFA.

Then look for candidates with experience in finance roles, such as financial analysis, accounting, or financial reporting. Candidates with experience in industries similar to yours can also be precious. Also, check whether the candidate has experience with relevant financial software and systems, such as QuickBooks, Oracle, or SAP – specific experience in implementing and managing economic software systems can add significant value.

Other essential factors to consider are communication and leadership skills and past accomplishments with measurable results in their previous roles, such as reducing costs, increasing revenue, or improving financial processes. Achievements indicate that the candidate has a track record of success and can add immediate value to your organisation. More information on CVs is here.

How To Handle a Shortage of Talent for a Financial Controller Role?

If you are facing a shortage of talent for the Financial Controller role, there are several strategies you can use to overcome this challenge. For example, consider expanding your search to a broader pool of candidates, such as those open to remote work or willing to relocate or candidates in other industries or geographic areas. Developing the talent of existing employees within your organisation may also be valuable. Identify employees who have the potential to fill the Financial Controller role and invest in their professional development.

Additionally, a strong employer brand and offering competitive compensation can help attract and retain top financial talent. In this regard, they are developing a positive workplace culture and offering industry standards for payment and related benefits such as bonuses, stock options, or other incentives.

Outsourcing is also an option for companies. If you are still looking for the right candidate for the Financial Controller role, consider outsourcing the position to a reputable accounting firm. Collaborating with recruitment or executive agencies can also be helpful. These agencies can help you find candidates who match your requirements and may have access to a broader talent pool.

What To Consider Whilst Interviewing a Candidate?

When interviewing a candidate for the role, consider several factors to ensure you make an informed decision. Primarily you need to assess the candidate’s technical skills related to financial management, accounting, and financial reporting. Ask them about their experience with relevant financial software and systems and their knowledge of financial regulations and compliance requirements.

Evaluate the candidate’s leadership, communication, and problem-solving skills and his ability to work collaboratively with other departments by asking scenario-based questions. An interview also provides an opportunity to ask the candidates about their past accomplishments in various finance roles, such as cost savings or revenue growth.

What Are the Typical Interview Questions for a Financial Controller Role?

Here are some typical questions you might ask during an interview for a Financial Controller role:

- What experience do you have in financial management, accounting, and financial reporting?

- How do you prioritise and manage financial tasks?

- How do you communicate complex financial information to non-financial stakeholders?

- Describe your experience in managing budgets and forecasting financial performance.

- How do you stay current with changes to financial regulations and industry best practices?

- Describe when you had to implement a cost-saving measure or improve financial performance. How did you go about it, and what was the outcome?

- Describe a time when you had to make a difficult financial decision. How did you approach the situation, and what was the outcome?

- How do you ensure the organisation’s financial function aligns with the overall goals and strategy of the company?

- Describe your experience in implementing financial software and systems.

By asking these questions, you can gain a deeper understanding of the candidate’s skills, experience, and approach to financial management and evaluate whether they fit your organisation’s Financial Controller role.

How To Negotiate the Salary?

Negotiating the salary for a Financial Controller role is essential to the hiring process. Before the negotiation, it is important to research industry standards for corresponding wages in your location and industry and consider particular factors such as the candidate’s experience, education, and certifications.

During the negotiation, discuss your expectations for the role; if the candidate’s salary expectations are higher than your offer, consider offering additional benefits such as stock options, performance-based bonuses, or extra time off to enhance the offer.

The candidate may return with a counteroffer higher than your initial offer. Consider the candidate’s qualifications and their value to the organisation before deciding whether to accept or decline.

Keep the negotiation professional and respectful. Remember that the goal is to find a mutually acceptable salary package that is fair to both parties. By following these tips, you can negotiate a fair and competitive salary package with the Financial Controller candidate, which will help to attract and retain top financial talent for your organisation.

More information on salaries is here.

Outsourced vs Inhouse Financial Controllers

The decision to outsource or hire an in-house Financial Controller depends on the specific needs of the company and several other factors, including the company’s size, budget, and operations.

Smaller companies with limited resources may benefit from outsourcing which can provide a cost-effective option with specialised and flexible expertise, whilst larger companies may prefer to hire in-house help to provide more comprehensive financial support.

Companies should carefully consider their options and assess their financial and operational needs before deciding.

For help and advice with recruiting the best people, call one of our consultants at +44 (0)20 7553 6320 or drop us an email at info@renaix.com or Send Us Your Vacancy.

Job Seekers

On the hunt for your next role? Upload your CV below and we’ll be in touch to discuss your requirements.

Employers

For employers seeking the right skills and cultural fit for your business, send us your vacancy to find out more about how we can help.

Submit CV Send Us Your VacancySearch Jobs

Popular this week

- What Qualifications And Skills Are Needed To Be An Accountant?

- How Does Industry 4.0 Differ From The Previous Generation?

- Agile For Accountants: Six Steps To Provide Necessary Tools And Relevant Processes

- What Are The Main Differences Between ACA and ACCA?

- What Are The Top Five Financial Accounting Facts For #AccountantsDay