How to Become a Freelance Accountant

In today’s dynamic and evolving business environment, freelance accountants have emerged as a valuable resource for businesses of all sizes.

Freelance accountants are self-employed professionals who provide accounting and financial services to businesses and individuals on a project-by-project basis. They work independently and offer their services to clients through various channels, such as online marketplaces, personal networking, or referrals.

Who Should Start a Career in Freelance Accounting?

Freelance accounting can be a great career choice for those who value flexibility and autonomy. A qualified accountant with experience in accounting, a solid understanding of finance, and a desire to work independently may consider starting just such a career.

They typically work with small business owners, entrepreneurs, and individuals needing help with financial management, taxes, and other accounting-related tasks.

Freelance accountants need to have strong communication skills and work well with clients remotely. Additionally, they should be familiar with accounting software and understand accounting standards, tax laws, and regulations.

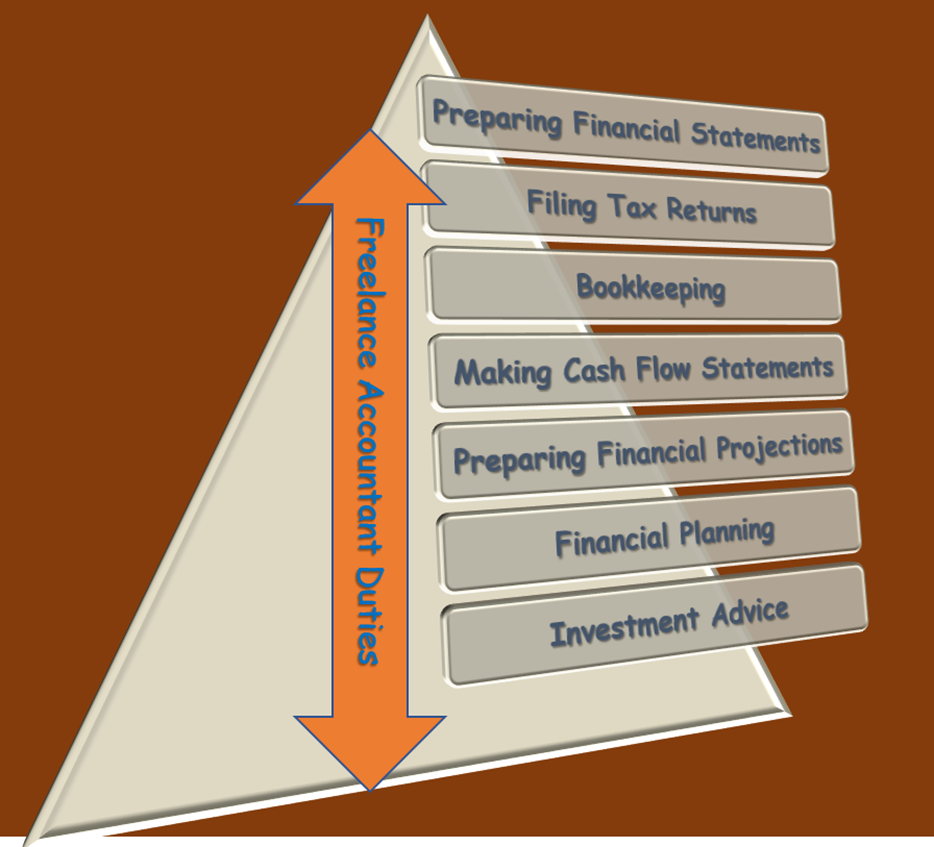

What Does a Freelance Accountant Do?

Freelance accountants are responsible for performing various financial and accounting services for their clients. They may prepare financial statements, analyses, tax returns, and other reports required by the businesses.

Freelance accountants also assist businesses in managing payroll & employee benefits, developing budgets, business plans, and financial projections.

They may also offer consulting services to clients on various financial and accounting issues, including risk management, financial planning, and investment advice.

In addition to their accounting and financial expertise, they must possess strong communication and interpersonal skills to succeed. They must effectively communicate complex financial information to their clients and develop strong working relationships based on trust and mutual respect.

Additionally, they should be familiar with accounting software and understand tax laws and regulations well.

How Do I Become a Freelance Accountant?

Becoming a freelance accountant requires education, experience, and dedication. With the right qualifications, skills, and hard work, you can enjoy the flexibility and independence of working for yourself.

Obtaining a bachelor’s degree is typically required; however, depending on jurisdiction, this does not necessarily have to be in accounting or finance.

It is beneficial to pursue advanced education, such as a master’s degree or specialised courses, to enhance your knowledge and skills in the field.

Certifications in accounting, such as Certified Public Accountant (CPA), Chartered Accountant (ACA) or Certified Management Accountant (CMA), can help you stand out from the competition and demonstrate your expertise.

Prior experience in accounting or related fields is crucial. It is advisable to gain experience by working for an accounting firm or in a company’s accounting department before starting a freelance business.

Based on your experience, create a portfolio of your work with examples of financial reports, tax returns, and other relevant documents to showcase your skills and expertise to prospective clients. Utilise social media, online marketplaces, and networking events to connect with potential clients.

What Are the Benefits of Becoming a Freelance Accountant?

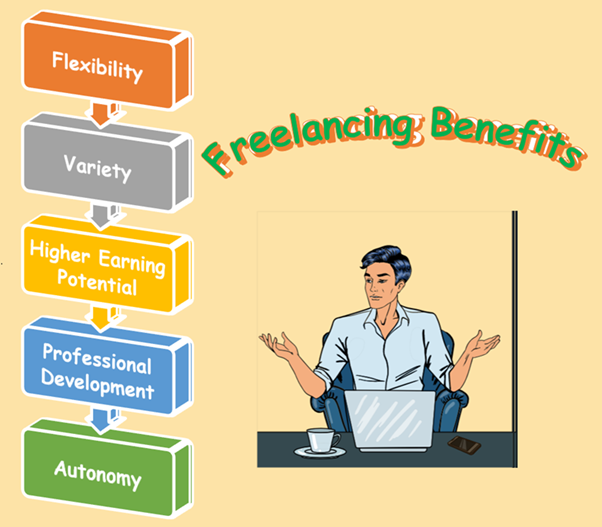

Starting a freelance accounting practice gives you a sense of having your own business and can offer numerous benefits, such as increased flexibility, autonomy, and independence. It can be a rewarding career choice for those who value freedom and want to become their boss. Some of the benefits include:

Flexibility

Freelance accountants can have the flexibility to set their schedule and work from anywhere, whether it’s from home, a coffee shop, or while travelling. They can thus control their workload and take on as much or as little work as they want.

Variety

This role allows you to work with various clients and industries, exposing you to different business models and accounting practices.

They can choose which clients they work with, allowing them to select clients who align with their values and work style.

Higher Earning Potential

They can often charge higher rates than traditional employees due to their specialised skills and the flexibility they offer clients. According to Upwork, a freelance accountant earns 75% more than a typical accountant employed in the industry.

Professional Development

There is the opportunity to continuously develop their skills and knowledge in the field as they work with various clients and accounting challenges.

Autonomy

They have significant autonomy in their work and can make decisions independently, allowing them to work more creatively and efficiently.

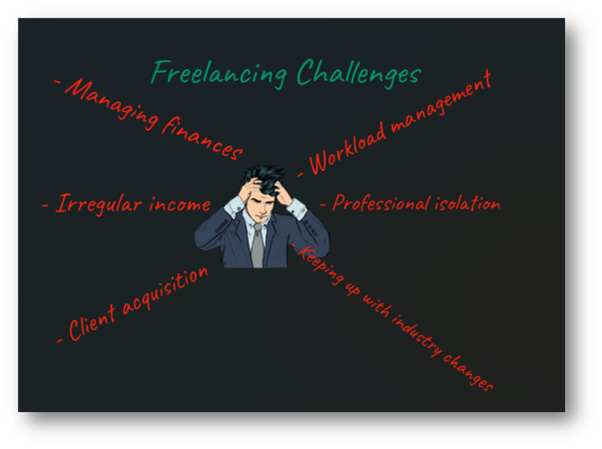

What Are the Challenges of Becoming a Freelance Accountant?

While there are many benefits to becoming a freelance accountant, there are equally some challenges. Here are some potential challenges they may face:

Irregular Work

They may not find regular work, and their income may fluctuate from month to month, which can be challenging for those who need a stable income to manage their expenses.

Finding the Clients

They are responsible for finding their clients, which can be time-consuming and challenging. It may require significant effort to build a solid client base.

Workload

They need to manage their workload, which can be challenging when dealing with multiple clients and deadlines.

Multitasking

As self-employed, freelance accountants must manage various aspects of the business, from bookkeeping and invoicing to marketing and customer service.

Professional Isolation

They often work alone and may experience professional isolation, which can be challenging for those who enjoy collaborating with others.

Keeping up with Market Trends

They must stay updated with industry developments and trends, requiring continuous learning and professional development.

Those professionals willing to invest the time and effort required to build a successful business can enjoy the benefits of greater independence, flexibility, and control over their work environment.

How Do Freelance Accountants Get the Clients?

How Do Freelance Accountants Get the Clients?

Attracting new business and clients as a freelance accountant can be done with several strategies.

These include attending professional events, joining local business groups, and participating in online communities to connect with potential clients and build relationships.

Additionally, having a robust online presence is essential for attracting clients. Building a professional website, creating social media profiles, and optimising your LinkedIn profile to showcase expertise and experience.

Encouraging your existing clients to refer new clients by offering a referral program may also be helpful, including a discount on services or a reward for successful referrals.

Freelance accountants can offer their services to businesses and individuals using freelancing platforms, such as Upwork, Freelancer, PeoplePerHour and Fiverr.

Creating valuable content such as blog posts, white papers, and webinars and offering a free consultation may also help attract new clients.

They may also consider partnerships with other professionals, such as lawyers, financial planners, or marketing consultants, to offer complementary services to clients, which can help you reach a broader audience and build a more comprehensive service offering.

Freelance accountants can attract new clients and build successful businesses by utilising these strategies. It’s important to remember that building a successful freelance accounting business takes time and effort, so be patient and persistent.

Which Markets Are Available for Freelance Accountants?

Many markets are available for freelance accountants, and the key is to identify the market that aligns with your expertise and interests. By focusing on a specific need, freelance accountants can develop specialised skills and expertise, leading to increased demand for their services.

Some potential markets for freelance accountants include:

Small Businesses

Small businesses often require accounting services but may need more money or resources to hire a full-time accountant. Freelance accountants can offer affordable accounting services to small businesses, including payroll management, bookkeeping, tax preparation, and financial analysis.

Start-ups

Start-ups may require specialised accounting services like financial forecasting, budgeting, and fundraising support. Freelance accountants with exposure to start-ups may find this market a good fit.

Non-Profit Organisations

Non-profit organisations also require accounting services tailored to their unique needs, including grant accounting, compliance, and financial reporting. Freelance accountants with experience working with non-profit organisations may find job opportunities in this market.

Freelancers and Solopreneurs

Freelancers and solopreneurs may require accounting services to manage their business finances, including invoicing, bookkeeping, and tax preparation. Freelance accountants can offer affordable accounting services to this market.

Consulting Firms

Consulting firms sometimes require specialised accounting services for their clients, including financial modelling, due diligence, and valuation services. Freelance accountants with prior consulting experience may find this market helpful.

Remote Work

As more businesses shift to remote work, there is an increasing demand for freelance accountants who can work remotely. Freelance accountants can offer their services to companies and clients anywhere in the world, which can expand their potential market.

Expert Tips for Starting and Running a Freelance Accounting Business

You can use the following tips to build a successful freelance accounting business that provides high-quality services to clients and generates steady income over the long term:

- Specialise in a particular industry or service; this can help you differentiate yourself from other Freelance Accountants and Bookkeepers. Determine which services you want to offer and identify the sectors or clients you want to target.

- Identify the best marketing channels for reaching your target audience and develop a marketing plan that includes a mix of online and offline tactics. Use social media, email marketing, networking events, and other strategies to promote your services.

- Develop a strong brand that communicates your values, expertise, and personality. Your brand should be consistent across all your marketing materials, including your website, social media profiles, and business cards.

- Provide exceptional customer service to build long-term client relationships and generate repeat business. Be responsive, professional, and communicative, and go above and beyond to meet your client’s needs.

- Use accounting software to streamline your workflow and make it easier to manage client accounts. Consider using software like QuickBooks, Xero, or Zoho to manage your business finances.

- Continuing education and professional development are essential for staying updated with industry developments and maintaining expertise. Consider attending industry conferences, taking courses, and pursuing certifications to stay ahead.

- Set up a separate office or dedicated workspace that is quiet, well-lit, and free from distractions to stay organised and focused.

- Familiarise yourself with business and tax laws to follow relevant regulations. Tax information is available from HM Revenue & Customs (HMRC) websites in the UK and the Internal Revenue Service (IRS) websites in the USA.

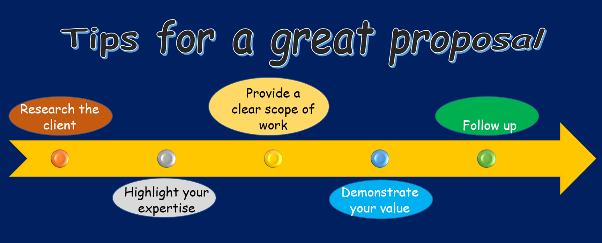

Tips For Making a Great Proposal for a Freelance Accounting Job

Well-designed proposals are essential for attracting prospective clients for freelance work. The following tips may help to showcase your expertise, value, and professionalism and increase your chances of winning the project:

- Before submitting a proposal, research the client and their business. Learn as much as you can about their accounting needs, goals, and challenges, and use this information to tailor your proposal to meet their specific needs.

- In your proposal, highlight your expertise and experience in accounting and bookkeeping. Be specific about your services and explain how your skills and experience make you the best candidate for the job.

- Clearly outline the scope of work for the project, including the specific tasks you will perform, the timeline for completion, and the fees associated with your services. Be transparent about your pricing and billing practices.

- Demonstrate your value to the client by explaining how your services will help them achieve their business goals. Provide examples of how you have helped other clients achieve similar goals.

- Ensure that your proposal is professional, well-written, and error-free. Be responsive to any questions or concerns the client may have, and provide prompt and courteous communication throughout the proposal process.

- Follow up with the client after submitting your proposal to express your continued interest in the project and answer any additional questions they may have, demonstrating your commitment to the project and helping you stand out from other candidates.

Do Freelance Accountants Earn a Good Income?

Freelance Accountants can make good money, but their earnings vary depending on several factors, such as their level of experience, expertise, size of their client base, and the type of accounting services they provide.

According to a survey by “Talent”, the average Freelance Accountant salary in the United Kingdom is £40,950 per year or £21 per hour. Entry-level positions start at £31,588 annually, while most experienced workers earn up to £320,531 annually.

- Moreover, Freelance Accountants could earn more money by taking on additional clients, offering extra services such as tax planning or financial consulting, and increasing their hourly rate as they gain more experience.

It’s essential to remember that freelance accounting can be unpredictable, and the amount of work available can fluctuate depending on the season and the state of the economy. However, Freelance Accountants can earn a good income with hard work, dedication, and a solid client base.

Future of Freelance Accounting Business

The future of freelance accounting looks promising, with the demand for remote work and flexible work arrangements increasing worldwide.

The COVID-19 pandemic has accelerated remote work, which has opened up opportunities for freelance accountants to work with clients from different parts of the world.

With the availability of cloud-based accounting software, it is now easier for accountants to collaborate with clients in real-time.

Many businesses require specialised accounting services, such as tax planning, financial analysis, and forensic accounting. Freelance accounting allows clients to hire an accountant for these services on a project-by-project basis, which can be more cost-effective for businesses than hiring a full-time employee.

Conclusion

Before embarking on a freelance career, one should consider all the aspects, including the prerequisites, benefits, challenges, and earning potential of a freelance accounting business.

There is excellent scope for freelance accounting as more businesses and individuals seek out flexible and specialised accounting services. With the right skills, experience, and marketing strategies, freelance accountants can build successful and profitable companies.

Similar posts: The Next Big Thing In Freelance – Finance?

To learn more about a career as an accountant, please visit our resources page or search for accountant roles here.

2 thoughts on “How to Become a Freelance Accountant”

Leave a Reply

Job Seekers

On the hunt for your next role? Upload your CV below and we’ll be in touch to discuss your requirements.

Employers

For employers seeking the right skills and cultural fit for your business, send us your vacancy to find out more about how we can help.

Submit CV Send Us Your VacancySearch Jobs

Popular this week

- What Qualifications And Skills Are Needed To Be An Accountant?

- How Does Industry 4.0 Differ From The Previous Generation?

- Agile For Accountants: Six Steps To Provide Necessary Tools And Relevant Processes

- What Are The Main Differences Between ACA and ACCA?

- What Are The Top Five Financial Accounting Facts For #AccountantsDay

Just to let you know that ‘Obtaining a bachelor’s degree in accounting or finance is typically required’ is not true.

I qualified with ICAS at EY London 4 years ago and people who I qualified with had all kinds of degrees, and they absolutely didn’t need to be accounting or finance related. I know this is also true of ICEAW. I heard at the time that in the UK only 50% of people who qualify with ICAS have accounting related degrees.

I heard from American colleagues that you needed an accounting related degree to qualify in the US, so perhaps in other countries it is a requirement, but it certainly isn’t in the UK.

Hi Sophia, thanks for your interest and comments. We have updated the article accordingly.