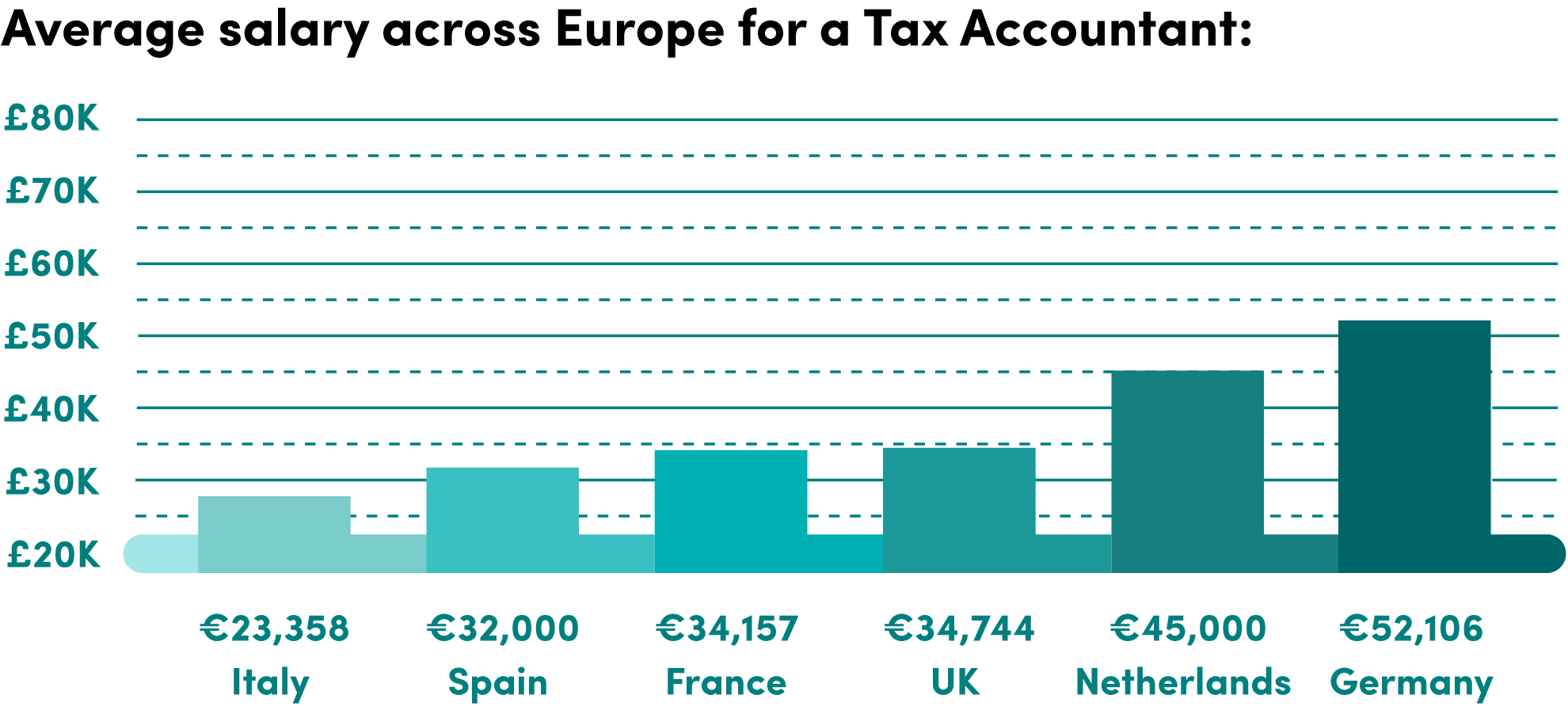

(Note: Salaries can differ based on industry, experience, and company policies. The above figures are based on estimates taken from glassdoor.co.uk and payscale.com.).

Tax accountants are highly regarded. They are key financial professionals for businesses. They command a competitive salary, no matter their region.

Germany, the EU’s economic superpower, is followed by the United Kingdom and the Netherlands in salary for tax accountants. London, Amsterdam, and Frankfurt dominate investment, start-up curation, and enterprise placement across Europe. They also dominate tax accounting.

Business Centrality

Tax accountants are the not-so-secret weapons of a finance team and wider business.

This isn’t just down to their hard work and eagle-eyed, visionary application of skills to tax reporting and payment. Their position as tax advisors and planners also makes all the difference.

People judge tax accountants based on their skill at following tax laws and payment schedules. They are also judged on their ability to help finance teams and business leaders navigate the future of tax. They help them prepare for legal changes, tax payments, and audits. This means tax accountants are not silent partners in a company’s financial system. They are at the centre of financial planning, advice, and diligence.

Job and Career Growth

It takes a specific financial talent to be a good tax accountant. Entering accountancy is hard, but working in and training for tax in any business is even harder.

Yet, tax accountants need to understand tax law, business tax, and auditing. These areas straddle tax accounting and broader tax planning. So, many financial opportunities are open to them.

Tax accounting training provides a baseline skillset. It includes understanding tax law, compliance, and a knowledge base. This skill set enables work in various roles. These roles include global auditors, advisory enterprises, and in-house positions. Additionally, it applies to board-level positions within charities, public service, and governmental bodies. It is also relevant to work in banking and the financial start-up sector. There is a rich vein of employment opportunities within tax accounting and beyond!

Learn More About Tax Accountant Careers

The following articles cover the job description, salaries, CV-building tips and more:

Job Description & Profile, CV, Template & Examples, Qualifications, Skills & Requirements, How to Become

Search Jobs to find out about the tax accountant job roles we currently have available.

Job Seekers

On the hunt for your next role? Upload your CV below and we’ll be in touch to discuss your requirements.

Employers

For employers seeking the right skills and cultural fit for your business, send us your vacancy to find out more about how we can help.

Submit CV Send Us Your VacancySearch Jobs

Popular this week

- What Qualifications And Skills Are Needed To Be An Accountant?

- How Does Industry 4.0 Differ From The Previous Generation?

- Agile For Accountants: Six Steps To Provide Necessary Tools And Relevant Processes

- What Are The Main Differences Between ACA and ACCA?

- What Are The Top Five Financial Accounting Facts For #AccountantsDay