An accountant is crucial to ensuring the financial health and success of the organisation. Keeping accurate and current financial records is one of an accountant’s most important duties.

Accountants keep track of financial transactions. They prepare financial statements and manage accounts payable and receivable. This ensures that the company has a clear picture of its financial standing. This information makes critical business decisions. It helps determine whether to invest in new projects or cut costs.

Photo by Volkan Olmez on Unsplash

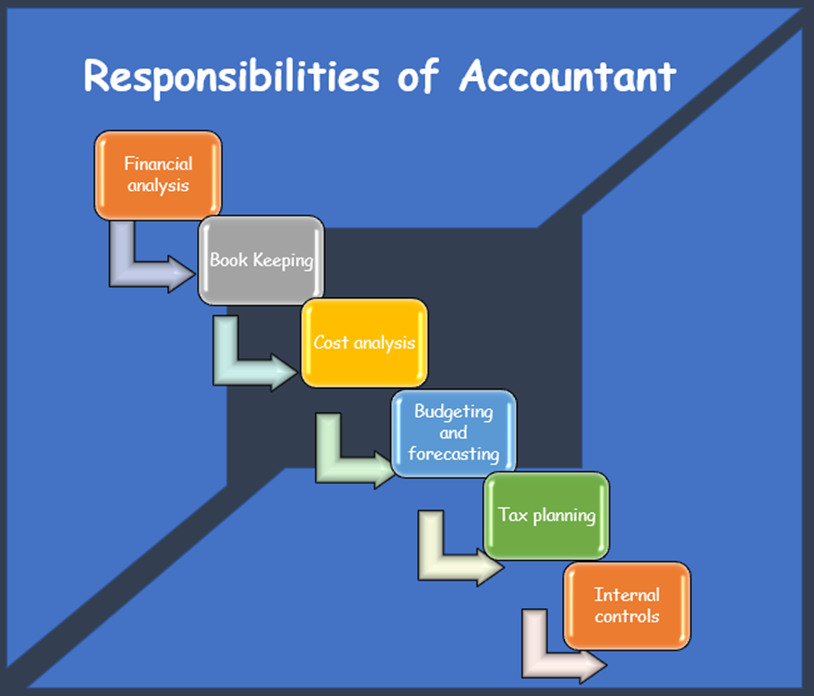

What Are the Main Responsibilities of an Accountant?

- Accountants bring financial expertise and knowledge. They ensure accurate financial reporting. They identify opportunities for savings and growth. They also help build a strong finance team. Businesses with a strong accounting department are more likely to succeed in the long term. They are also more likely to remain stable.

- Accountants prepare financial reports. These include balance sheets, income statements, and cash flow statements. They follow accounting principles. These reports provide insights into the company’s financial health. They help management make informed business decisions.

- They often develop and manage budgets. This includes preparing revenue and expense projections. It also involves monitoring the actual results against the budget. If necessary, it involves making recommendations for corrective action.

- They also ensure the company complies with all relevant tax laws and regulations. This includes preparing tax returns, monitoring changes in tax laws, and providing tax planning advice.

- Most of the time, accountants establish and track internal controls. This is to ensure that the company’s financial transactions are recorded. They also ensure that there is no fraud or misappropriation of funds.

How Much Does an Accountant Earn?

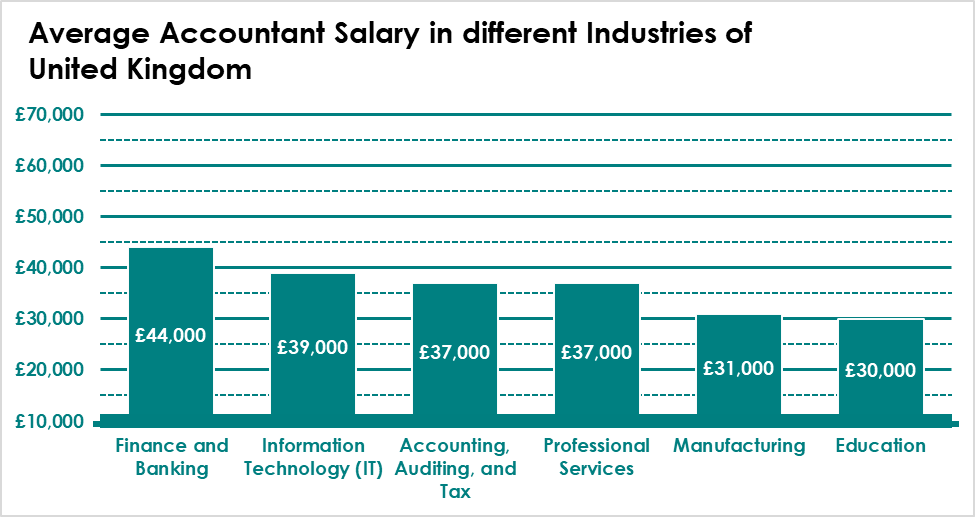

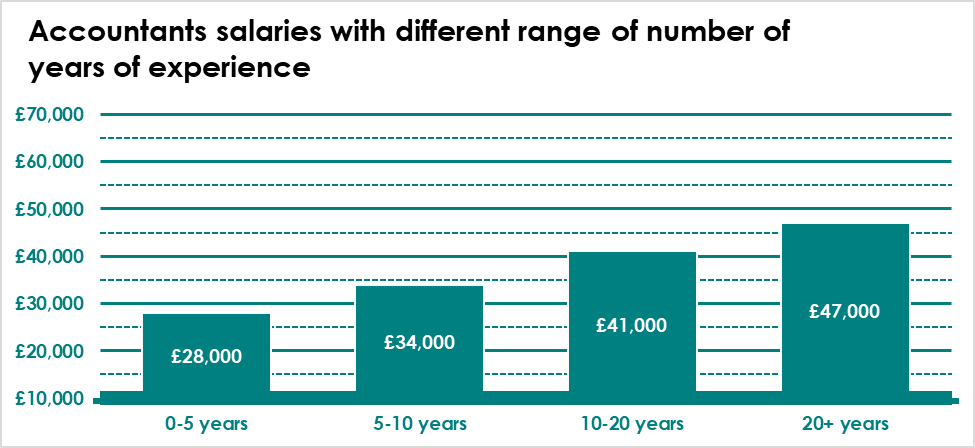

An average accountant earns a competitive salary in the UK and other parts of the world compared to other occupations. Yet, the same salary levels can vary depending on the level of experience, qualifications, and industry.

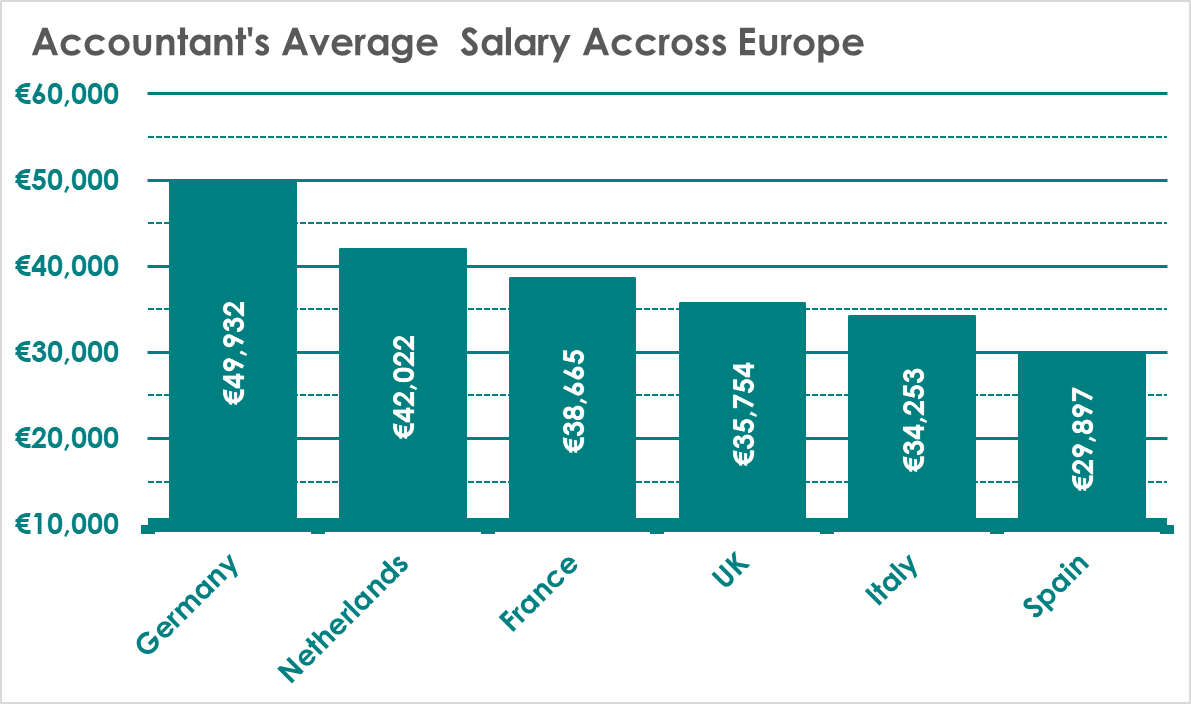

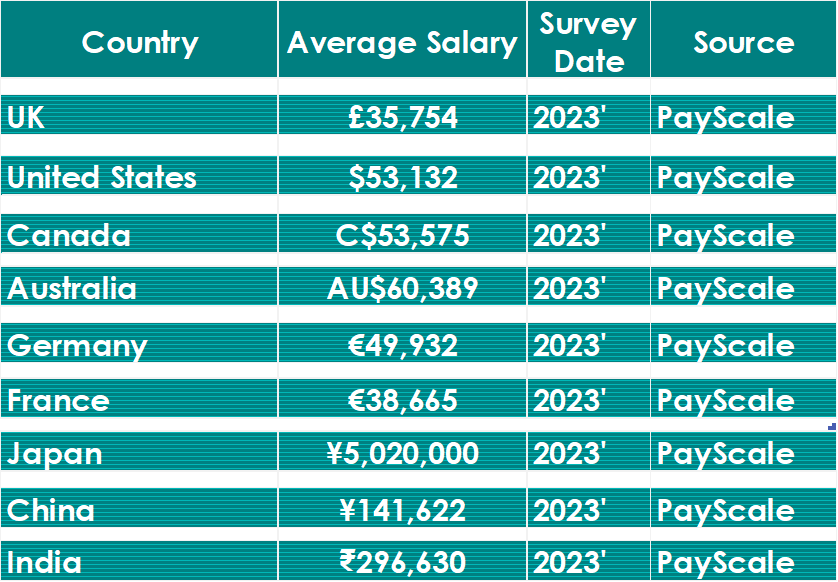

In 2021, the annual average salary for accountants and auditors in the UK was £38,373, according to data from the Office for National Statistics (ONS). This is higher than the UK’s median salary for all occupations, which was £28,840. Additionally, data from PayScale shows an accountant’s average wage in Germany is €49,932, the highest in the European market. The minimum salary of €29,897 is in Spain.

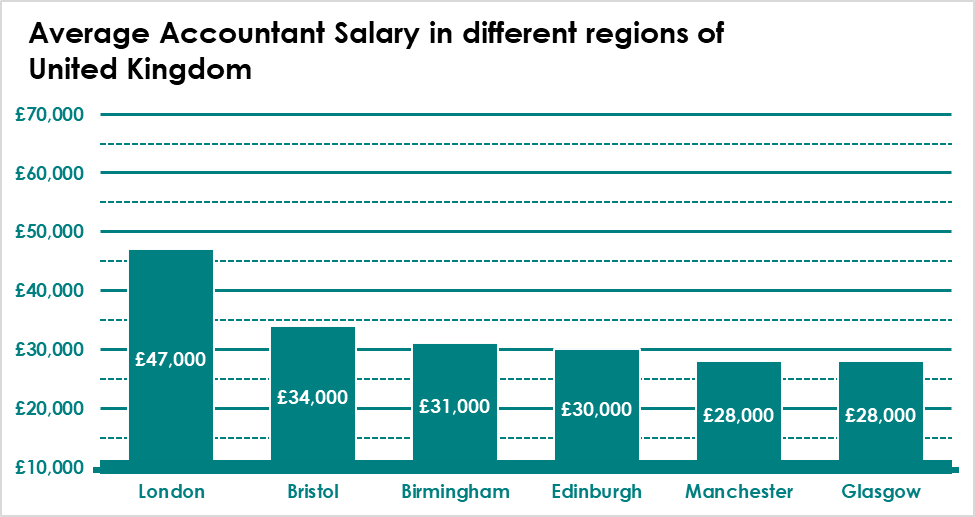

The following tables provide insight into accountants’ salaries. They consider factors such as geographic location, industry, and years of experience.

These figures are median salaries. They may not reflect the range of wages within each country, city, or industry.

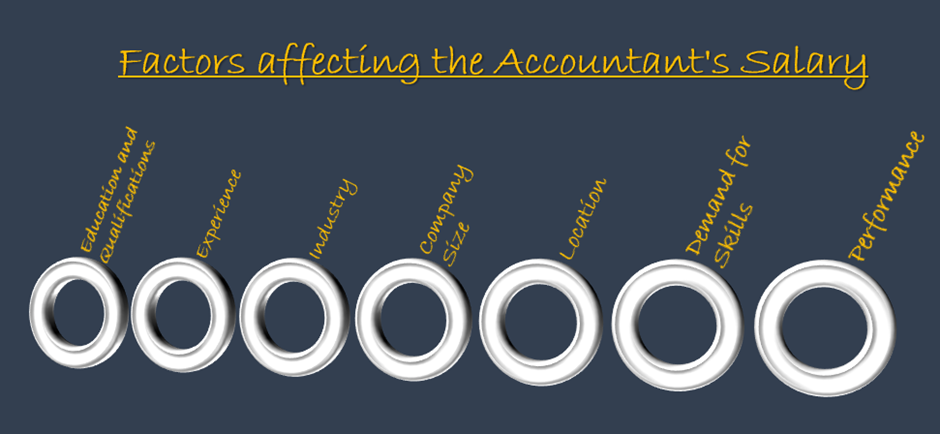

What Factors Affect Accountants’ Salaries?

Generally, accountants earn a good salary. Yet, several factors can affect wages. Here are some of the most common ones:

- Education and qualifications. A bachelor’s degree alone does not guarantee a higher salary for an accountant. Those with advanced degrees, like a Master of Business Administration (MBA) or Chartered Accountant (ACA), do. Experience. Generally, accountants with more experience earn higher salaries. This is because knowledge is often linked to greater expertise and skill in the field.

- Industry. Accountants in certain businesses, like technology or finance, could make more money than those in other sectors.

- Company Size. Accountants who work for larger companies may earn more than those who work for smaller companies. This is because larger companies tend to have more complex accounting needs.

- Location. The cost of living and the local job market can impact an accountant’s salary. For example, accountants working in major cities with higher living costs may earn more than those working in rural areas.

- Demand for skills. Specific accounting skills, such as expertise in tax accounting or financial analysis, may be in higher demand. Accountants with these skills may be able to command higher salaries.

- Performance. An accountant’s job performance can also affect their salary. High-performing accountants earn salary increases.

What Are the Other Perks and Benefits Accountants Get Besides Their Salaries?

Besides their base salary, accountants may receive various perks and benefits. These include an average bonus and pension scheme, which are part of their gross salary. These perks and benefits depend on the employer and the industry. Some standard perks and benefits for accountants may include:

There are bonuses, health insurance, and pension plans. Plus, there are flexible working hours. Additionally, there is professional development, generous holiday allowances, and employee discounts.

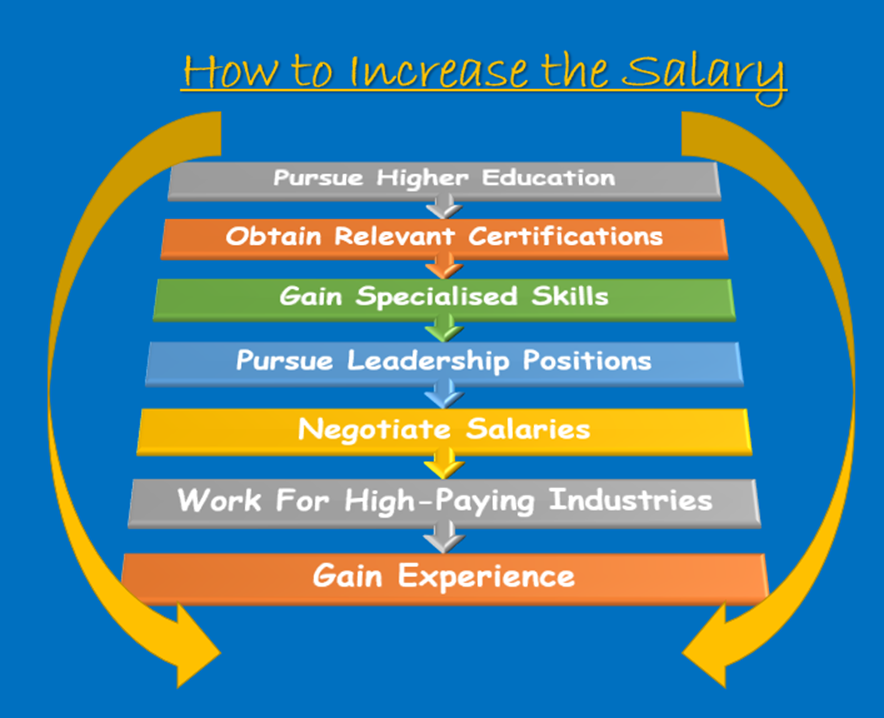

How Can an Accountant Increase Their Chances of Getting a Higher Salary?

Accounting is a vast field, and there is a role for everyone with the varying levels of experience it entails. If you are an entry-level accountant with low earnings, you can increase your earning potential and get a higher salary. You can do this by taking the following steps:

- Higher Education. Accountants can increase their earning potential by obtaining advanced degrees. For example, they can pursue a Master’s degree in accounting or an MBA. These degrees show a higher level of education and expertise.

- Certifications. The Certified Public Accountant (CPA) or Chartered Accountant (ACA) credential is a certification. It helps you stand out in the employment market. They can also help you command higher salaries.

- Specialised Skills. Accountants may earn more if they have expertise in areas like risk management, financial analysis, or tax planning. This is because of their unique expertise.

- Leadership Positions. Accountants who take on leadership roles, such as finance manager, CFO, or controller, may be able to command higher salaries. This is because of their extra responsibilities and leadership skills.

- Negotiate Salaries. You can negotiate salaries by demonstrating your value to employers. Research the market rates for your skills and experience.

- High-Paying Industries. Accounting specialists often get better pay in certain sectors. These sectors include banking, technology, and consulting. This is because of the complexity and importance of financial management in these sectors. You can find jobs in these high-paying industries.

- Experience. Gaining experience in accounting and doing well in previous employment will help you command a higher salary in future roles.

What Are the Factors Other Than Salary That an Accountant Should Consider?

Companies strive to hire and keep good accountants because they are crucial for the success of any business. Their expertise and insights are invaluable in making important business decisions. Their attention to detail and commitment to accuracy help prevent costly mistakes and losses.

Not all companies can afford to pay higher salaries to their accountants. This includes start-ups, small entities, and not-for-profit organisations. However, these companies may offer something other than high salaries to attract and keep a good accountant. Below are some of the factors that an accountant may consider, as well as wages, before choosing an employer:

- Accountants may settle with an employer who pays low wages. The employer provides a supportive and collaborative workplace. It encourages employees to share ideas and take on new challenges.

- Accountants are always looking to improve their skills and advance their careers. Companies that provide training and development opportunities are regarded as the best places to work. They also encourage employees to pursue professional certifications.

- Accountants want to know that their organisations have opportunities for growth and advancement. Clear career paths are more appealing than just salary. They outline the skills and experience needed to progress to higher-level positions.

- Trust and transparency are essential for building strong relationships between employees and management. Most accountants would prefer to work in a place that values open communication and collaboration.

What Is the Career Path of an Accountant?

The career path in the accounting profession can vary. It depends on your education, experience, and professional goals. Generally, an accountant has to go through the following stages to reach the peak of the profession:

- Entry-level positions. Many accountants begin their careers in an entry-level position. Examples include junior accountants or accounting assistants. They may also hold other posts with related job titles. In these roles, they are responsible for data entry. They also reconcile accounts and prepare financial statements.

- Staff Accountant. After gaining a few years of experience, accountants may move into a staff accountant role. This position demands more complex tasks. For example, preparing tax returns, analysing financial data, and helping to prepare budgets.

- Senior Accountant. Senior accountants have several years of experience. They oversee staff accountants and handle complex accounting tasks. These tasks include preparing financial reports, reviewing financial statements, and managing audits.

- Management Positions. Experienced accountants may move into management positions. For example, an accounting manager, controller, or CFO. These roles involve overseeing the accounting department. They also involve managing budgets and making strategic financial decisions.

- Specialisations. Throughout their careers, accountants may choose to specialize in a particular area. This might be tax accounting, auditing, or forensic accounting. Specialising can lead to advancement and higher salaries.

- Entrepreneurship. Experienced accountants may start their own accounting firm or consulting business. They provide services to clients in a particular industry or speciality.

Conclusion

Accountants earn competitive salaries. They are comparable to or higher than those in many other professions, such as human resources, IT, and marketing. Yet, as with any other profession, salaries can vary depending on the abovementioned factors.

Salaries are important when considering a career. It is important to consider the harmony between work and life. Also, consider career advancement opportunities, job happiness, and employment stability. The best option will depend on personal preferences, aptitudes, and interests.

The following articles cover job descriptions, salaries, qualifications, skills, and more.

Job Description & Profile, Qualifications, Skills & Requirements etc.

Search Jobs to find out about the accountant job roles we currently have available.

See also Finance Manager Salary & Pay for reference here.

Job Seekers

On the hunt for your next role? Upload your CV below and we’ll be in touch to discuss your requirements.

Employers

For employers seeking the right skills and cultural fit for your business, send us your vacancy to find out more about how we can help.

Submit CV Send Us Your VacancySearch Jobs

Popular this week

- What Qualifications And Skills Are Needed To Be An Accountant?

- How Does Industry 4.0 Differ From The Previous Generation?

- Agile For Accountants: Six Steps To Provide Necessary Tools And Relevant Processes

- What Are The Main Differences Between ACA and ACCA?

- What Are The Top Five Financial Accounting Facts For #AccountantsDay