What Is the Role of a Finance Manager?

A finance manager ensures that a company operates within budget and complies with financial regulations and reporting requirements. In addition, they may be involved in securing funding for the company, managing investment portfolios, negotiating financial contracts, and ensuring the flow of information from the various departments to decision-makers.

Finance managers, thus, must wear multiple hats:

- They must be able to understand, transform, and present data.

- They need to be able to understand the company’s core business enough so that they can make predictions and forecasts and work with budgets.

- They need to be masters in financial management, financial reporting, and risk mitigation.

What Is the Typical Job Description of a Finance Manager?

A typical job description for a finance manager might include the following duties and responsibilities:

- Accounting: Oversee the day-to-day operations of the accounting department, including accounts payable, accounts receivable, and general ledger.

- Budgeting: Develop and manage the organisation’s budget and monitor performance against budget targets through variance analysis.

- Financial Planning and Analysis: Develop and implement financial plans, budgets, and forecasts to support the organisation’s strategic goals. Analyse financial performance and provide insights to support decision-making.

- Financial Reporting: Prepare and analyse financial statements, financial reports, and presentations to stakeholders, including management, boards of directors, and external parties.

- Treasury Management: Oversee the organisation’s cash flow and liquidity, including managing bank relationships and negotiating loan agreements.

- Financial Management Systems and Processes: Evaluate and improve the organisation’s finance management systems and processes, including financial software and analysis tools.

- Risk Management: Identify and evaluate financial risks and implement strategies to mitigate or manage those risks.

- Compliance: Ensure compliance with financial regulations and laws, including GAAP, tax, and banking regulations.

- Team Management: Lead, motivate, and manage a team of finance professionals, including financial analysts and accountants.

- Business Partnership: Partner with other departments, such as sales, marketing, and operations, to understand their financial needs and provide financial insights and guidance.

- For more information, see the Job Description here.

What Requirements Are There for a Finance Manager?

The qualifications for finance managers can vary depending on the specific role and industry, but generally, finance managers should have the following qualifications and training:

- Education: Most finance manager positions require a bachelor’s degree in finance, accounting, economics, or a related field. Some finance manager positions may also require a master’s degree in finance or business administration.

- Work experience: Finance managers typically have several years of experience in finance or accounting and may have held positions such as financial analyst, accountant, or controller.

- Professional certifications: Many finance managers hold professional certifications, such as the CMA, ACA, ACCA, or CPA, and the country-chartered equivalent depending on the jurisdiction (for example, in Spain, this is the Registro Oficial de Auditores de Cuentas / ROAC and the Ordre des Experts -Comptables In France).

- Hard skills: Finance managers should have a strong understanding of financial principles and techniques and may receive training in financial modelling, analytical skills, and financial reporting skills.

- Soft skills: Finance managers should receive training in interpersonal skills, leadership skills, and other soft skills, as these are critical to their success in the role.

- Technology Knowledge: Finance managers should be proficient in using financial tools such as spreadsheet software, accounting software, and enterprise resource planning (ERP) systems.

- Commercial acumen: Finance managers may receive training in industry-specific regulations, such as financial reporting standards, tax laws, and banking regulations, to understand the specific industry requirements.

Finance managers should have a finance, business, or accounting degree. These degrees are mathematically focused and cover a lot of concepts that finance managers must deal with in their day-to-day operations. In addition to these finance degrees, other degrees with a similar mathematical focus might also work. Economics would be a good example, and even formal accounting certifications work well.

These courses should be enough for general finance managers. However, large companies will have specialised roles within the finance department. For example, a finance manager might handle only the company’s receivables and payables. At the same time, there might be another finance manager who will work on the reporting aspect. And there might be yet another finance manager managing capital expenditures. In such cases, it is possible to enrol in specialised courses or training that cover various specialisations within the broader world of finance.

These courses should be enough for general finance managers. However, large companies will have specialised roles within the finance department. For example, a finance manager might handle only the company’s receivables and payables. At the same time, there might be another finance manager who will work on the reporting aspect. And there might be yet another finance manager managing capital expenditures. In such cases, it is possible to enrol in specialised courses or training that cover various specialisations within the broader world of finance.

What Professional Certifications Are Available for a Finance Manager?

There is a list of well-recognised certifications available to become a finance manager. Each certificate offers specialisation in a particular aspect of financial management. These qualifications are categorised as financial management, risk management, and accounting certifications.

Some of the certifications are listed below, and which courses to pursue depends upon the career preferences of the candidate.

- Certified Management Accountant (CMA): The Chartered Institute of Management Accountants (CIMA) UK offers the CMA certification for finance professionals in management accounting and finance management.

- Associate Certified Chartered Account (ACCA): Offered by the Association of Certified Chartered Accounts (ACCA), the ACCA programme is intended for accountants who work in corporate treasury, acquisitions, and mergers.

- Associate Chartered Accountant (ACA): The Institute of Chartered Accountants of England and Wales (ICAEW) UK offers the ACA certification, intended for accounting professionals working in public accounting, industry, government, and education.

- Financial Risk Manager (FRM): The Global Association of Risk Professionals (GARP) offers the FRM certification created for risk management specialists.

- Chartered Public Finance Accountant (CPFA): The CPFA certification is available from the Chartered Institute of Public Finance and Accountancy (CIPFA) UK for financial experts who offer financial and accounting services in the public sector.

What Professional Experience Is Needed to Be a Finance Manager?

Those looking to build a career in financial management can start at the primary level with little experience. At the same time, roles in the finance department can go as high as the Chief Finance Officer’s position. There is usually a role available for almost anyone, ranging from junior posts to finance director roles with varying levels of experience.

Academic expertise is equally beneficial in the domain of financial management. This only means that a lot of the work that finance managers must do can also be taught in the classroom, not that on-the-job expertise isn’t recognised or respected. This is often advantageous since it allows young graduates to start their careers in finance immediately without having to work hard to gain a lot of experience.

What Technical Skills Do Finance Managers Need?

Finance managers should have specific technical or hard skills to excel in their jobs. Here are some of the most crucial abilities that financial managers should have:

- Cash management expertise and experience with capital management are treasury management abilities. Knowledge of capital budgeting, investment analysis, financial possibilities, and financial management methods are among the corporate finance abilities.

- Budgeting and forecasting skills: ability to develop and implement budgeting and forecasting processes, including short-term and long-term financial projections.

- Taxation: knowledge of tax laws, regulations, and compliance requirements; and the ability to prepare and file tax returns.

- Financial planning and analysis: ability to analyse and interpret financial data, create financial models, and provide insights to support decision-making.

- Knowledge of generally accepted accounting principles (GAAP), international financial reporting standards (IFRS), financial statement preparation, and financial analysis. Financial accounting and reporting abilities.

- Risk management skills: understanding financial risk assessment and management, including credit, market, and operational risks. An integral part of a finance manager’s job is to identify, quantify, and mitigate all sorts of risks faced by the business.

- Business strategy: understanding of business operations and the ability to align a company’s financial goals with the overall business strategy and market trends.

What Soft Skills Do Finance Managers Need?

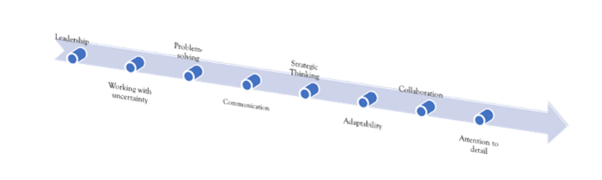

In addition to technical skills, successful finance managers possess both solid and soft skills to enhance their capabilities. Some of the top finance managers’ skills include:

- Communication and interpersonal skills: the ability to communicate financial information and recommendations clearly and effectively to non-financial stakeholders, including executives and board members.

- Working with uncertainty: ability to predict and respond to uncertain situations with accurate and timely information.

- Leadership skills: the ability to lead and manage a team of finance professionals and to inspire confidence and trust in others.

- Problem-solving and analytical skills: the ability to identify and solve financial problems and to make sound financial decisions.

- Strategic thinking abilities: the capacity to design and implement financial plans that align with the organisation’s overall business strategy. Critical and strategic thinking about the financial goals of the organisation.

- Adaptability skills: the ability to respond quickly and effectively to changing financial conditions and to make decisions in a fast-paced environment.

- Collaboration skills: the ability to work effectively with other departments, including accounting, operations, and sales, to support the organisation’s financial goals.

- Attention to detail: the ability to manage complex financial information and to ensure the accuracy and completeness of financial reports and statements.

Continuous learning and professional development programmes may help to acquire these finance manager skills.

Do Finance Managers Need To Have Technology Knowledge?

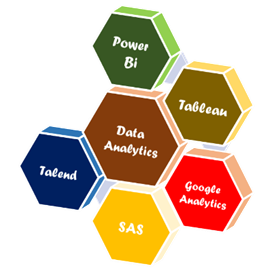

It is essential for finance managers to keep up to date with technological developments and financial tools and to continually improve their technology skills. Here are some critical areas of technical knowledge that are important:

Accounting Software: Knowledge of accounting software, such as QuickBooks, Xero, or SAP, is essential for finance managers to manage financial records and prepare financial statements.

Spreadsheets: Advanced knowledge of spreadsheet software, such as Microsoft Excel, is essential for finance managers to use analytical skills to create budgets and financial models and prepare reports.

Data and Financial Analysis: Knowledge of data and financial analysis tools, such as Power BI, Tableau, and Google Analytics, is vital for finance managers to collect and analyse large amounts of financial data and make informed decisions based on that data.

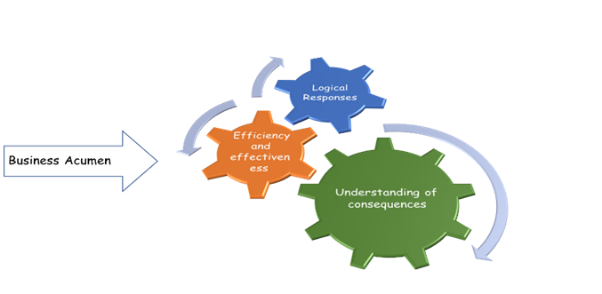

Is Commercial Acumen Required for Finance Managers?

While the role of finance managers is generally not to generate sales, they still have a role to play in making the company’s overall business more commercially viable. Commercial acumen refers to a deep understanding of how industries operate and make money and an appreciation of the financial and economic factors that impact business success. In addition to assessing financial data and finding trends and patterns that might guide business choices, this entails comprehending the organization’s revenue sources, cost structures, and competitiveness.

Strong commercial acumen helps finance managers communicate financial information to non-financial stakeholders effectively.

Commercial acumen is one of the critical Finance Manager skills, as it enables an understanding of the bigger picture and the ability to collaboratively work with other departments, such as sales, marketing, and operations, to support the business’s overall success.

How Are Finance Managers Positioned Within the Organisation Structure?

Finance managers are typically in senior-level positions in an organisation, and their role and positioning can vary depending on the size and structure of the organisation.

In larger organisations, the finance manager may report to the chief finance officer (CFO) or another senior-level executive responsible for managing a team of finance professionals.

In small organisations, the finance manager may be the only finance professional responsible for all financial activities, including accounting, budgeting, forecasting, and risk management.

Regardless of the organisation’s size, the finance manager plays a crucial role in supporting the organisation’s financial goals and providing financial advice and support to senior management.

What Job Opportunities Are Available for Finance Managers?

Finance managers can find job opportunities in a variety of industries and organisations, including:

- Accounting firms: Finance managers can work in public accounting firms, providing financial consulting services to clients.

- Government agencies: Finance managers can work in government agencies, where they manage the agency’s financial operations and ensure compliance with financial regulations.

- Corporate finance: Finance managers can work for large corporations, overseeing the organisation’s financial operations.

- Healthcare: Finance managers can work in the healthcare industry, managing the financial operations of hospitals, clinics, and other healthcare organisations.

- Banking: Finance managers can work in commercial banks, investment banks, and other financial institutions.

- Non-profit organisations: Finance managers can work for non-profit organisations, overseeing financial operations and ensuring compliance with financial regulations.

Finance managers can also find job opportunities in other industries, such as retail, manufacturing, and technology. The demand is generally strong, as organisations hire professionals who can help them achieve their financial goals and navigate the complexities of financial regulations.

How Much Can Finance Managers Earn?

The salary of a finance manager can vary widely depending on several factors, including the size and type of organisation, the industry, the location, and the level of education and experience.

According to data from Glassdoor, the average base salary for a finance manager in the United Kingdom is approximately £50,000 per year. However, this can range from £30,000 to £80,000 or more, with top finance managers in large organisations earning significantly more.

In addition to a base salary, finance managers may receive other compensation and benefits, such as bonuses, stock options, pension contributions, and health insurance. The specific compensation package will vary depending on the organisation, role, and responsibilities.

It is important to note that salary is one of many factors to consider when evaluating a finance manager position. Other essential factors include:

- Job duties and responsibilities.

- Work-life balance.

- Career growth opportunities.

- Organisational culture and value.

More information on salary and pay is here.

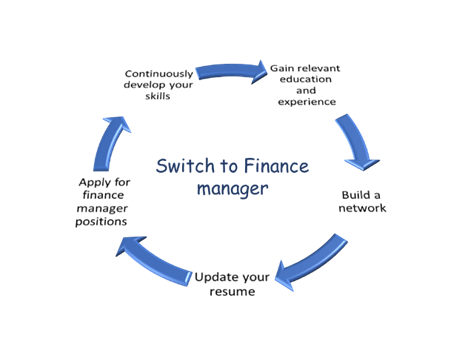

How To Switch Profession to a Finance Manager?

To switch your profession to finance manager, consider the following steps:

- Gain relevant education and experience: Consider getting a degree in finance, accounting, or a related field. You can also gain experience in the finance field through internships or entry-level positions.

- Build a network: Connect with professionals in the finance industry and attend industry events to expand your network.

- Update your resume. Highlight relevant education, experience, and skills that would be useful for a finance manager position.

- Apply for Finance Manager positions: Use job search engines, your network, and company websites to find open positions. Prepare for interviews by researching the company and practicing your responses.

- Continuously develop your skills: Keep yourself up to date with the latest trends and developments in the finance industry, and consider getting professional certifications such as ACCA or ACA.

Keep in mind that switching careers may take time, patience, and perseverance, but with dedication and hard work, you can successfully transition to a finance manager.

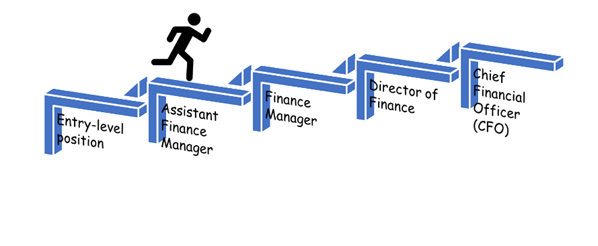

What Is the Career Path of a Finance Manager?

The career path of a finance manager can vary depending on several factors, including their level of education and experience, the type and size of the organisation they work for, and their personal career goals and aspirations.

The career path of a finance manager can vary depending on several factors, including their level of education and experience, the type and size of the organisation they work for, and their personal career goals and aspirations.

Typically, a finance manager starts in audit (Big 4), then moves into a finance controller or internal auditor position, and then a finance manager.

They can also start as financial analysts or junior accountants and work up to become finance managers.

- Some finance managers may also choose to specialise in a particular area of finance, such as investment management, corporate finance, or tax, and progress to a more senior role.

Career advancement in finance management typically requires a combination of education, experience, and demonstrated skills and expertise.

Career advancement in finance management typically requires a combination of education, experience, and demonstrated skills and expertise.

What Details Should a Finance Manager’s Resume Contain?

Generally, a resume for finance professionals includes a summary of your professional career, educational background, previous finance-related work experience, professional certifications, a list of relevant technical and soft skills, key accomplishments, and other information such as relevant courses or training, hobbies, languages, etc. For more information, see the section on Finance Manager CVs.

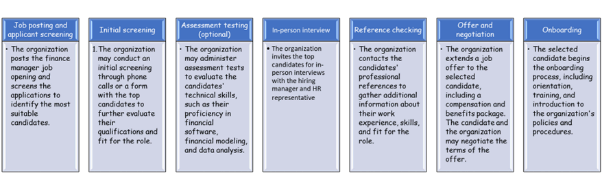

What Is the Process for Hiring a Finance Manager?

- The hiring process for a finance manager may vary depending on the specific organisation, but the following are the typical steps involved in most hiring processes:

What Is the Future of Finance Manager Jobs?

The future of finance manager jobs depends on several factors, including emerging technology, increasing globalisation, and a changing business environment.

Technology will continue to play a significant role in redefining finance processes and creating new data-driven positions, leading to a greater demand for finance professionals with technical skills.

- At the same time, globalisation and a changing business environment will increase the complexity of financial operations, particularly for companies operating across multiple countries, leading to a growing demand for finance professionals with strong analytical and strategic thinking skills.

Conclusion

Despite various challenges, finance manager jobs will likely remain in high demand as businesses continue to require expertise in financial planning, analysis, and decision-making. Companies increasingly rely on finance managers to provide strategic guidance and drive growth, making this an exciting and dynamic career path.

To learn more about a finance career, please visit our resources page or search for finance roles here.

Job Seekers

On the hunt for your next role? Upload your CV below and we’ll be in touch to discuss your requirements.

Employers

For employers seeking the right skills and cultural fit for your business, send us your vacancy to find out more about how we can help.

Submit CV Send Us Your VacancySearch Jobs

Popular this week

- What Qualifications And Skills Are Needed To Be An Accountant?

- How Does Industry 4.0 Differ From The Previous Generation?

- Agile For Accountants: Six Steps To Provide Necessary Tools And Relevant Processes

- What Are The Main Differences Between ACA and ACCA?

- What Are The Top Five Financial Accounting Facts For #AccountantsDay