Financial controllers are essential in organisations. They manage finances and budgets and make sure financial information is accurate. This article discusses how much financial controllers in the UK and other significant countries get paid.

How Much Are the Salaries of Financial Controllers Around the World?

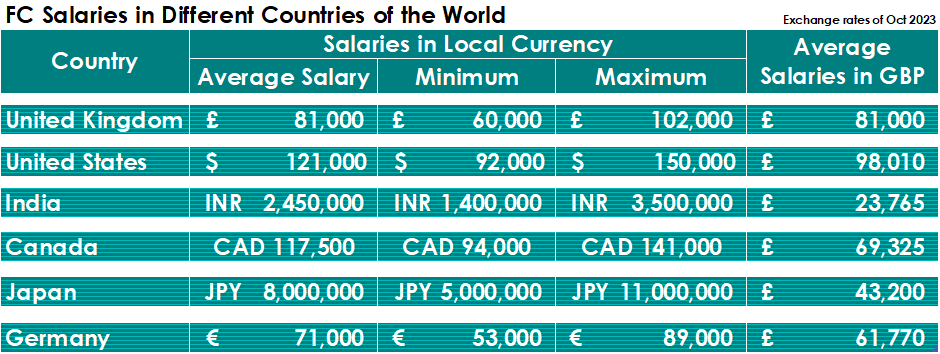

Financial controllers’ salaries vary globally due to experience, taxes, and the cost of living. We compared financial controller salaries in different countries using Glassdoor.com data.

- United States. In the United States, financial controllers can earn a high income. The average base salary ranges from $92,000 to $150,000 per year. Yet, salaries can be higher in major financial hubs such as New York City and San Francisco. Besides the base pay, an average of $29,693 per year is also paid. The extra pay could include cash bonuses, commissions, tips, and profit sharing.

-

Canada. In Canada, financial controllers usually make between CAD 94,000 and CAD 141,000 each year. The amount can change depending on their experience and where they work. The average extra cash compensation for a controller in Canada is $13,561, ranging from $7,392 to $24,880.

-

United Kingdom. In the UK, the average base salary for a financial controller ranges from £60,000 to £102,000 per year. Salaries in London tend to be higher due to the higher cost of living. On average, financial controllers in the UK receive an extra £8,671 in cash compensation. The range is £4,698 to £16,004.

-

India. The average salary for a finance controller is ₹2,488,143 per year in India. The average extra cash compensation for a finance controller in India is ₹226,407, ranging from ₹92,717 to ₹511,991.

-

Japan. In Tokyo, Japan, the financial controller’s pay ranges from ¥ ~5,000,000 to ¥ ~11,000,000 annually. The median salary is ¥6,300,220 per year. The estimated extra pay is ¥1,067,948 per year. Extra pay could include cash bonuses, commissions, tips, and profit sharing.

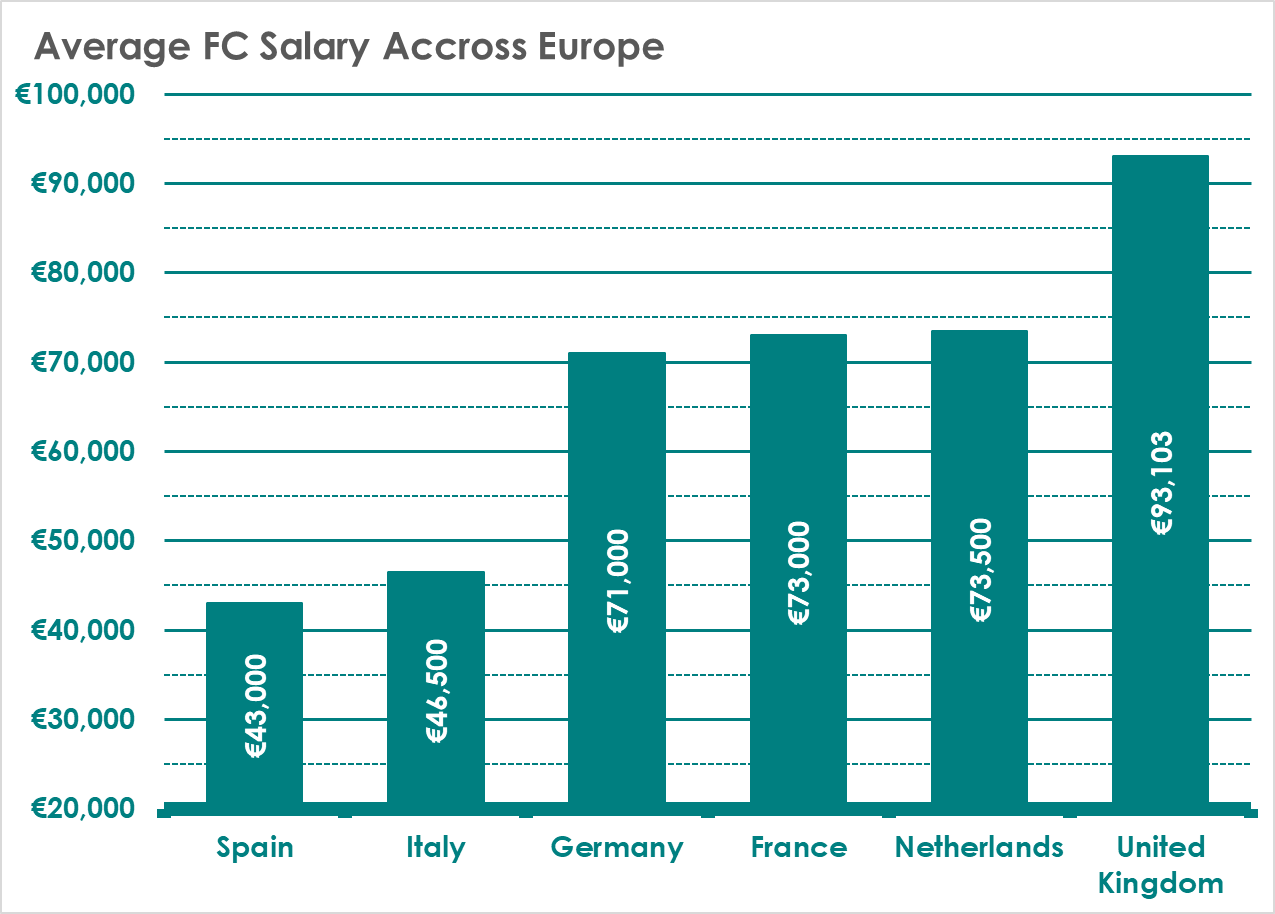

How Much Are the Salaries of Financial Controllers Around Europe?

The salaries of financial controllers in Europe differ due to varying living costs, economies, and demand. This shows how much people in European countries get paid, according to Glassdoor.com.

- United Kingdom. The average salary for a financial controller in the UK is between £60,000 and £102,000 per year. The average salary is €93,103. Salaries in London tend to be higher due to the higher cost of living.

-

Germany. Financial controllers in Germany can expect an average salary ranging from €53,000 to €89,000 per year. Salaries can be higher in major financial centres like Frankfurt.

-

France. Financial controllers in France earn between €51,000 and €95,000 per year. Salary varies based on experience and location.

-

The Netherlands. Financial controllers make between €57,000 and €90,000 annually in the Netherlands. On average, they earn €73,552. Salaries may be higher in cities like Amsterdam.

-

Spain. In Spain, financial controller salaries tend to be more modest, with an average range of €28,000 to €58,000 per year. The estimated extra pay is €4,311 per year.

-

Italy. In Italy, financial controller salaries can vary from €34,000 to €59,000 a year. The range depends on where you work and how much experience you have. The estimated extra pay is €4,916 per year.

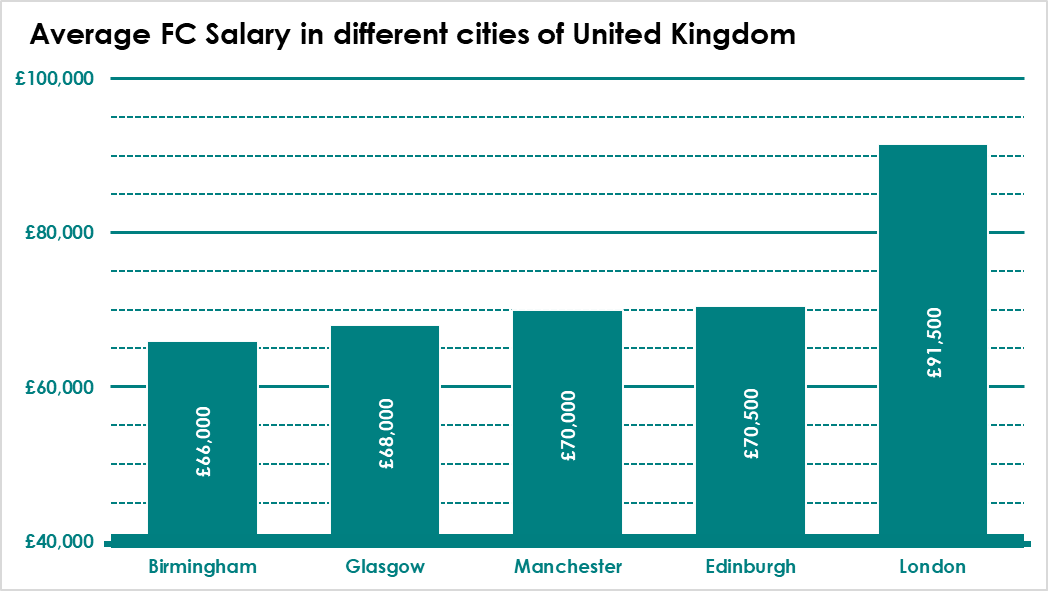

How Much Are the Salaries of Financial Controllers Across the UK?

In the UK, financial controllers can earn different salaries. This is because of living costs, the economy, and demand. Glassdoor.com has data on the salaries of financial controllers in various cities across the UK.

- London. London offers some of the highest salaries for financial controllers in the UK. This is because of its high cost of living and many financial institutions. Financial controllers earn an average salary of £70,000 to £113,000 per year in the capital city.

-

Manchester. In Manchester, financial controllers can earn competitive salaries. The average range is £50,000 to £90,000 per year. The city’s thriving business sector contributes to these salaries.

-

Birmingham. Birmingham is a big business centre in the UK. Financial controllers in Birmingham make £54,000 to £78,000 a year.

-

Edinburgh. In Edinburgh, financial controllers earn between £52,000 and £89,000 annually. The presence of the financial sector in Edinburgh can impact salaries.

-

Glasgow. Financial controllers in Glasgow have an average salary range of £55,000 to £81,000 per year. The local economy and industry demand influence this range.

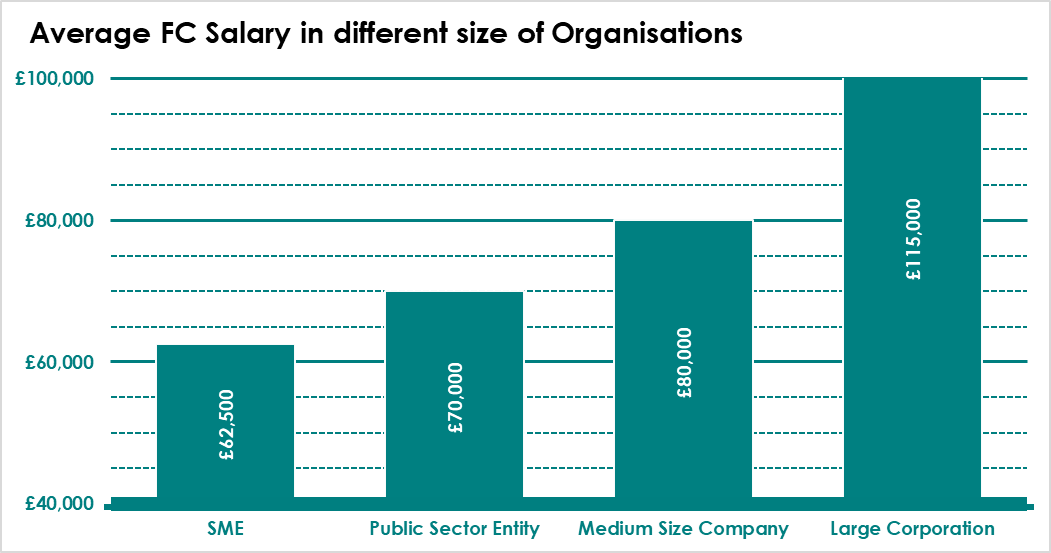

How Much Does a Financial Controller Earn in Different Sizes of Organisations?

The size of the organisation can affect the salaries of financial controllers. Big companies pay more because they have more duties and need experienced leaders. We estimate the salaries mentioned in the following paragraphs. Salaries can change depending on the industry, location, and how the company works.

- Financial controllers often have a more active role in smaller companies, like SMEs. They manage finances and also handle operational tasks. Employees in some firms may hold many titles, such as finance manager or business unit controller. In the UK, financial controllers in SMEs make between £45,000 and £80,000 per year. Their salary depends on factors like industry, location, and experience.

-

Mid-sized Companies. Mid-sized companies may offer more competitive salaries to attract experienced financial controllers. Financial controllers in mid-sized UK companies can make between £60,000 and £100,000 per year. Salary can vary based on location and industry.

-

Large Corporations. Large corporations, including multinational companies, offer the highest salaries to financial controllers. In the UK, financial controllers in big companies can earn anywhere from £80,000 to over £150,000 a year. These jobs manage finances and global finance and follow rules.

-

Public sector and non-profit organisations. Financial controllers in the public and non-profit sectors earn good salaries. Salaries in these sectors are more standardised compared to the private sector. In the UK, salaries can vary from £50,000 to £90,000 annually. The range depends on the size and funding of the organisation.

How Much Does a Financial Controller Earn in Different Industries?

- Financial controllers’ salaries can differ based on the industry they work in. The salaries mentioned here are estimates. They may change based on industry needs and job duties.

- Banking and Finance: Financial controllers in banking and finance earn high salaries. This is because they deal with complex financial operations and regulations. Salaries in the UK can range from £80,000 to £150,000 or more per year, with significant bonuses and other benefits.

- Technology and IT The technology industry often offers competitive compensation to financial controllers. In the UK, salaries in this sector can vary from £70,000 to £120,000 per year. The amount you earn depends on the company’s size and financial complexity.

- Healthcare and pharmaceuticals. Healthcare and pharmaceutical controllers make a good salary of £65,000–£110,000 per year. These industries often need specialised financial expertise due to regulatory and compliance requirements.

- Retail and consumer goods. Financial controllers in the retail and consumer goods sectors earn £55,000 to £95,000 annually. The size and scope of the retail operations may impact the pay range.

- Financial controllers in the energy and utilities sectors can earn competitive salaries. These salaries range from £70,000 to £120,000 per year. These industries have complex financial operations and regulatory requirements.

Photo by Karsten Würth on Unsplash

What Other Perks and Benefits Do Financial Controllers Receive Besides Their Salaries?

Financial controllers may get extra perks and benefits besides their regular pay. Their gross salary includes these perks. These perks and benefits depend on the employer and the industry. Some standard perks and benefits for financial controllers may include:

They offer bonuses, health insurance, and pension plans. They also provide flexible working hours, professional development, and generous holiday allowances. They also give employee discounts.

What Factors Influence a Financial Controller’s Salary and Pay?

Following is a list of factors that influence the salaries of financial controllers:

-

Experience and seniority. Professional experience influences a financial controller’s salary. Senior financial controllers with a proven track record often command higher compensation packages.

-

Industry. Compensation can vary across industries. Employees in banks and finance firms earn more than those in non-profit organisations.

-

Location. Location is also an essential factor that influences salaries. Salaries in London are generally higher than in other parts of the UK due to the higher cost of living. Recruiters should consider regional differences in compensation when matching candidates with job opportunities.

-

Company Size. The size and complexity of the organisation also play a role. Experienced financial controllers earn more at big companies because of their complex duties.

-

Qualifications. Financial controllers can earn more money by getting advanced degrees or certifications like ACCA or CIMA.

Photo by Daniel Dan on Unsplash

Conclusion

Financial controllers play a critical role in managing the accounting departments of companies. They handle the accounting systems and keep records to make reports for business decisions. Managers consider experience, industry, location, company size, and qualifications when hiring. They use these factors to find suitable candidates. To ensure candidates get fair pay, staying updated on industry trends, salaries, and market conditions is crucial.

Search other articles to learn more about financial controller careers:

Job Description & Profile, Qualifications, Skills & Requirements, CV Template & Examples, etc.

Search Jobs to find out about the financial controller job roles we currently have available.

Job Seekers

On the hunt for your next role? Upload your CV below and we’ll be in touch to discuss your requirements.

Employers

For employers seeking the right skills and cultural fit for your business, send us your vacancy to find out more about how we can help.

Submit CV Send Us Your VacancySearch Jobs

Popular this week

- What Qualifications And Skills Are Needed To Be An Accountant?

- How Does Industry 4.0 Differ From The Previous Generation?

- Agile For Accountants: Six Steps To Provide Necessary Tools And Relevant Processes

- What Are The Main Differences Between ACA and ACCA?

- What Are The Top Five Financial Accounting Facts For #AccountantsDay