Tax Accountant Job Description and Profile

Paying tax is more than a legal obligation. Businesses and organisations have a moral duty to “pay their way.” They must ensure that their tax responsibilities are accurate and lawful.

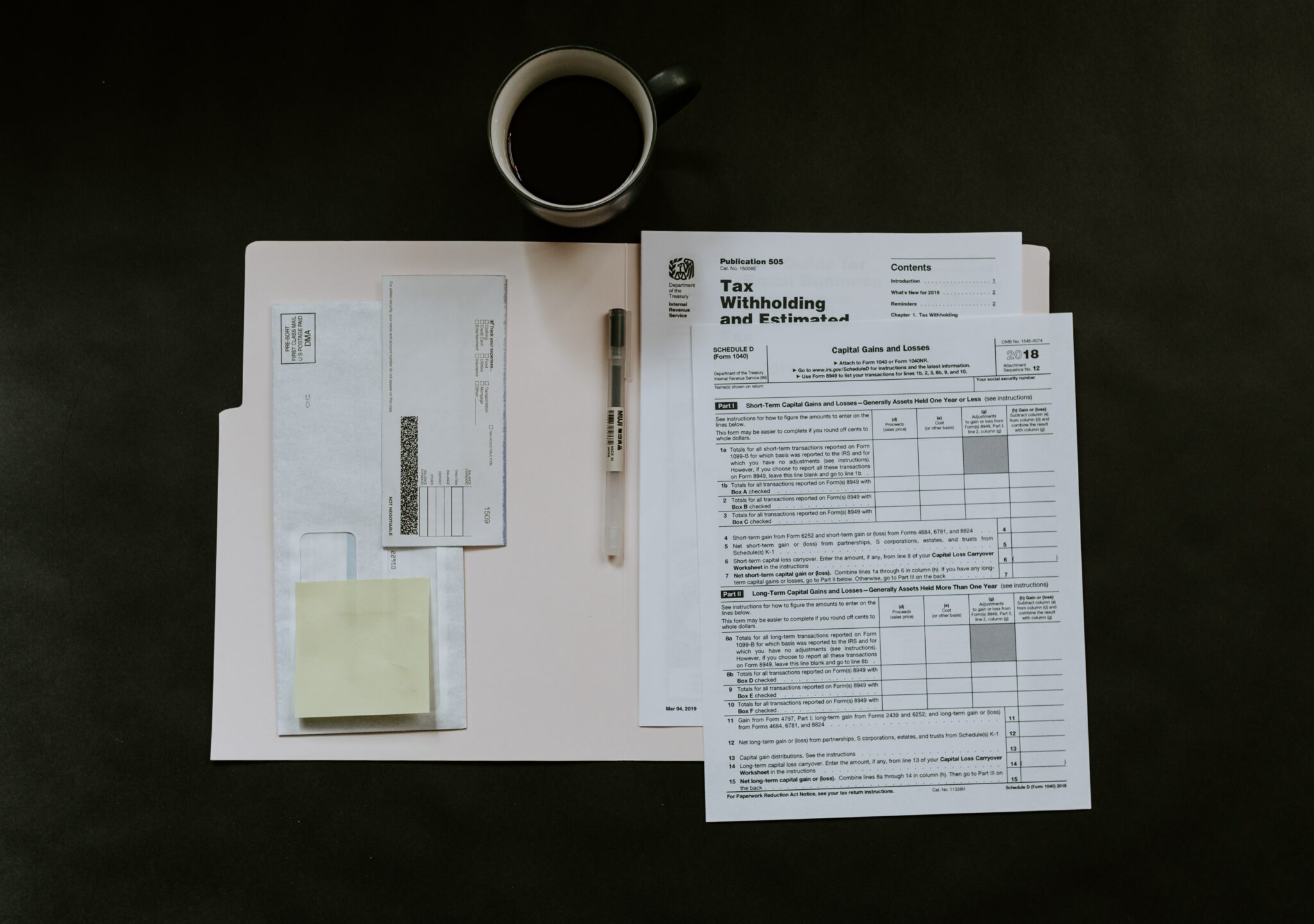

Photo by Kelly Sikkema on Unsplash

Tax accountants sit in the engine room of enterprise, charity, government, or personal finance. They report on and maintain tax records. They ensure companies and individuals follow tax rules and pay taxes on time.

Tax accountants audit tax filings. They also manage tax teams and advise senior financial and non-financial staff. They often work independently in a hybrid tax advisory/accountancy role. Tax accountants are vital, specialised finance pros. Any job description for this role must list the wide array of skills needed for success.

Here Are Some of the Primary Job Responsibilities of a Tax Accountant:

- Cross-departmental communication. Tax accountants have to prioritise clarity of communication above all else. For instance, departments and teams must copy the attention to detail needed to submit a tax payment. They must do this through reporting and collaboration. Larger companies, charities, and public bodies must pay their taxes. It’s a financial and moral obligation. Ensuring the account balance is vital at year-end. It is needed for legal and public standing. It also helps with investment opportunities, good press, and personal achievement.

- Attention and obsession with detail. Tax professionals of any stripe cannot afford to be loose with detail, but this is especially the case with tax accountants. After all, tax returns are a legal obligation, and any mistakes on a tax return can result in harsh penalties.

- Completing and submitting tax returns. The nuts and bolts of being a tax accountant are completing and submitting a tax return for an individual or a business. Naturally, these reports have to be legally compliant, accurate, and delivered on time.

- Tax Planning. Tax accountants will also handle tax planning and preparation behind the scenes. Company leaders only sometimes set enterprise tax strategies. Yet, tax accountants’ expertise will guide and advise on some areas of tax settlement.

- Preparing clients for legislative changes. Another cross-business function of tax accounting is preparing for tax legislation changes. CFOs have the final say on changing a company’s tax strategy. But they will call on tax accountants for advice and practical, experience-based changes to handle tax law changes.

Search other articles to learn more about tax accountant careers:

CV Template & Examples, Salary & Pay, Qualifications, Skills & Requirements, How to Become.

Search Jobs to find out about the tax accountant job roles we currently have available.

Job Seekers

On the hunt for your next role? Upload your CV below and we’ll be in touch to discuss your requirements.

Employers

For employers seeking the right skills and cultural fit for your business, send us your vacancy to find out more about how we can help.

Submit CV Send Us Your VacancySearch Jobs

Popular this week

- What Qualifications And Skills Are Needed To Be An Accountant?

- How Does Industry 4.0 Differ From The Previous Generation?

- Agile For Accountants: Six Steps To Provide Necessary Tools And Relevant Processes

- What Are The Main Differences Between ACA and ACCA?

- What Are The Top Five Financial Accounting Facts For #AccountantsDay