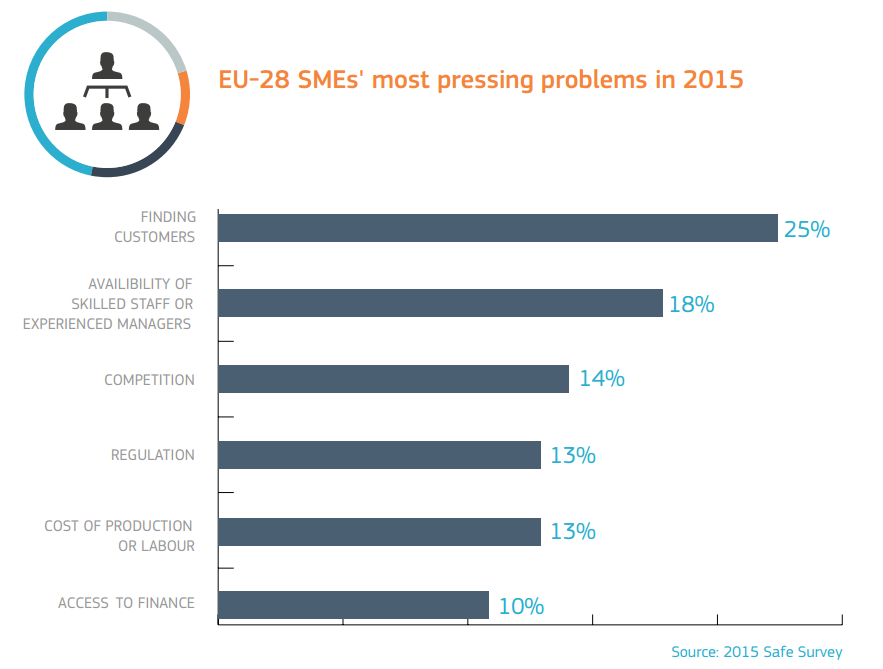

Small European businesses are taking on the world. Small companies are big business in Europe. It is estimated that almost 99% of all companies fall into the small or medium category, employing two-thirds of the workforce. These companies are the drivers of economic growth, jobs, and innovation. However, it is a rough and tumble world to be in. An EU report estimated that almost half of all small companies started in 2001 didn’t survive their first five years!

Finance-shared service centres explored

Finance-shared service centres explored

Over the last decade, companies have invested in creating shared service centres to streamline their business processes and make operations more efficient. Speaking to Francisco Rodriguez, Director of Internal Controls at Genesys, a telecommunications company, who has had first-hand experience in building finance-shared service centres throughout his career, it is interesting to understand how these centres have come into being and since grown into something of a lucrative global enterprise.

The impact of over-regulation on the financial services industry

Regulations have become as commonplace to the finance industry as bread to a duck pond since the banking collapse of 2008 and 2009, and the question now is, is the finance industry suffering from having too much of a good thing? From Basel III and EMIR to Dodd-Frank and MiFID II, regulations come in many forms.

What will greater protectionism mean for finance managers?

Globalisation is no longer the buzzword that it was about 10–15 years ago. Domestic country politics and geopolitical tensions are pushing the world back into the protectionist cocoon of previous centuries. In the United States, for example, President-elect Donald Trump has been calling for massive tariffs to be imposed on imports from China.

The rise and rise of fintech

Across the major financial capitals of the world, fintech start-ups are booming. What initially started as essentially database solutions to store and protect data has now become the biggest driving force in finance. Whether it is the big banks or e-commerce firms utilising these innovations, or the finance and accounting department.

Too big to fail? The link between German banks and industry

Deutsche Bank has had a rough few months. Not only did it lose almost half of its market capitalisation, but its debt rating has been put on a negative watch by Fitch. Then, of course, there is the question of a multi-billion-dollar penalty in the United States. But Deutsche Bank is not alone in the current crisis, although it is its most recognisable name globally.

Surviving the ever-changing accounting regulations in Europe

There have been some less obvious casualties of the recent political events in Europe and the US. The American and European Accounting Standards Boards are no longer participating in joint efforts to create a standardised global paradigm for accounting as they used to in the past.

Looking for accounting and finance talent?

Send Us Your Vacancy and one of our consultants will be in contact to discuss your requirements and how we may assist, or give us a call at +44 (0)20 7553 6320.

Similar pages: Financial Services, Banking & Financial Services, Our Industry, What Our Candidates And Clients Say About Us, Employers

Job Seekers

On the hunt for your next role? Upload your CV below and we’ll be in touch to discuss your requirements.

Employers

For employers seeking the right skills and cultural fit for your business, send us your vacancy to find out more about how we can help.

Submit CV Send Us Your VacancySearch Jobs

Popular this week

- What Qualifications And Skills Are Needed To Be An Accountant?

- How Does Industry 4.0 Differ From The Previous Generation?

- Agile For Accountants: Six Steps To Provide Necessary Tools And Relevant Processes

- What Are The Main Differences Between ACA and ACCA?

- What Are The Top Five Financial Accounting Facts For #AccountantsDay