What Are The Main Differences Between ACA and ACCA?

In the accounting field, professionals respect the ACA and ACCA qualifications. You study many subjects, including strategy, reporting, auditing, taxation, management, and finance. They provide advanced classes as well. Candidates get in-depth knowledge. ACA and ACCA differ in exam patterns, number of exams, training requirements, and opportunities in local and global markets.

The ICAEW (the Institute of Chartered Accountants in England and Wales) in England and Wales offers the ACA qualification. It is a professional accounting qualification. The ICAEW is a global professional body for chartered accountants. The ACCA Association of Chartered Certified Accountants oversees the ACCA qualification. They are a professional organisation for globally recognised accountants.

Photo by Kelly Sikkema on Unsplash

How Do You Become an ACA or ACCA?

To become a fully qualified ACA or ACCA member, you must pass exams and fulfil practical experience requirements. Here are the steps you can follow to become a member:

Register as a Student

To begin studying for the ACA or ACCA exams, you must register with the relevant institute as a student member: the ACA from the Institute of Chartered Accountants in England and Wales (ICAEW) and the ACCA from the Association of Chartered Certified Accountants.

- ACA: To become an ACA student, you usually need a bachelor’s degree or an equivalent education. Yet, there are other options if you have finished A-levels or have more education or work experience.

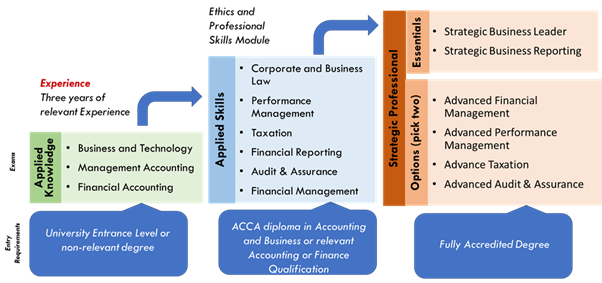

- ACCA: If you have finished secondary school or have an equivalent qualification, you can take the fundamental level of the ACCA qualification. You might not have to take specific primary exams if you finish college. Various entry routes are explained in the following diagram:

Study for the Exams

- ACA: The ACA focuses on accounting principles in England and Wales. There are 15 exams at three levels: certificate, professional, and advanced. The certificate and professional levels have six exams, while the advanced level has three. ICAEW has membership recognition agreements with CAANZ (Chartered Accountants Australia and New Zealand) in Australia and New Zealand. They also have agreements with HKICPA (Hong Kong Institute of Certified Public Accountants) in Hong Kong and SAICA (The South African Institute of Chartered Accountants) in South Africa.

- ACCA: To get the ACCA qualification, you must pass 13 exams. These exams are divided into three levels. The first level has three applied knowledge exams. The second level has six applied skills exams. The third level has two strategic professional exams. Additionally, you must complete an ethics and professional skills module. This module consists of two exams out of the four available options. You must finish a bachelor’s or postgraduate degree to achieve ACCA status. You must also pass 14 ACCA exams and work for three years in a related field. With ACCA status, qualified practitioners can work as accountants in 170 countries, including the UK, USA, and Canada. They can also work in South Africa, Germany, Malaysia, New Zealand, and Singapore. The ACCA may be more suited to those working in industry.

Fulfill Practical Experience Requirements

To qualify, you need practical experience in accounting or finance.

- ACA: The ACA qualification involves a minimum training period of 450 days, usually 3 to 5 years.

- For ACCA, you will need to complete practical training for three years. The required training must be completed through an ACCA or ICAEW-authorised training employer.

Apply for Membership

Once you pass the exams and gain practical experience, you can apply to be an ACA or ACCA member.

Maintain Your Membership

To keep your ACA or ACCA membership, you must meet the CPD requirements of 40 hours per year. You must also pay the annual fee and follow the Code of Ethics for Professional Accountants.

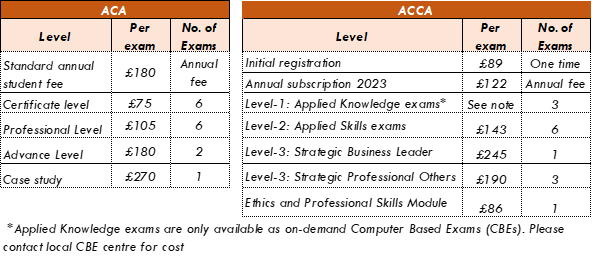

What is the cost of ACA and ACCA?

The costs of ACA and ACCA qualifications can vary. Several factors influence the cost. These factors include the country you study in, your chosen learning provider, and your specific learning path. The relevant institute sets the exam fee. The cost of study materials, like books and revision kits, and tuition fees can vary. It depends on the student’s learning plan.

Exam Fees

The following table shows the current fee structures for the ACA and ACCA exams. In addition to standard exam fees, a late entry fee is also applicable, which increases the cost.

How Long Do You Have to Pass the ACCA or ACA?

The time it takes to pass the ACA or ACCA exams depends on how quickly each person learns, how dedicated they are, and how much time they have available.

- ACA: Students can take up to four tries for each certificate and professional-level exam for the ACA qualification. They have unlimited tries for the Advanced Level exams. Generally, it takes 3–5 years to complete the ACA. Once you pass your first Strategic Professional exam, you have seven years to pass all the exams in the Strategic Professional series. To complete the qualification, you must pass all the strategic professional exams within seven years. If you don’t, you’ll have to retake the exams you already passed.

- ACCA: You can take all the necessary time to pass the Foundations in Accountancy and ACCA Qualification exams. It takes 3–4 years to complete the ACCA qualification.

Is the ACA or ACCA Difficult to Pass?

The ACA and ACCA qualifications are challenging programmes requiring dedication, hard work, and studying. Passing the exams is possible if students prepare and practice enough, even though they find it difficult. ACCA and ICAEW offer many resources and support, like study guides and online courses, to help students prepare for exams.

Which Exams Need to be Passed to Become ACA or ACCA?

ACA

- The ACA qualification has 15 exams divided into Certificate, Professional, and Advanced levels. You can take the exams in any order except for the case study. After all other exams or credits are received, the case study must be attempted last, in the final year of an ACA training agreement.

- Certificate Level: Six exams at this level introduce the fundamentals of accounting, finance, and business. Students may be eligible for credits for some exams if they have studied a qualification recognised by ICAEW. The Certificate Level exams are 1.5 hours each, have a 55% pass mark, and can be attempted throughout the year. The average pass rate for the exam is more than 80%.

- Professional Level. The six exams build on the basics and test students’ ability to use technical knowledge in real-life situations. The exams can be taken in March, June, September, and December. The Professional Level exams are 2.5 hours long, except for Financial Accounting and Reporting, which is 3 hours long. Each exam has a 55% pass mark. The Professional Level exams are flexible and can be taken in any order to fit with a student’s day-to-day work. The average pass rate for the exams is more than 78%.

- Advanced Level. The exams at this level are based on real-life situations. They are more complex and have more significant consequences than the professional-level exams. The case study tests all knowledge, skills, and experience gained so far. The Advanced Level exams can be taken in July and November. They are entirely open-book exams. The Corporate Reporting and Strategic Business Management exams are 3.5 hours long. The case study exam is 4 hours long. Each has a 50% pass mark. The average pass rate for the exams is more than 80%.

ACCA

- To earn the ACCA qualification, you must pass 13 exams. The exams are divided into knowledge, skills, and professional.

- Applied Knowledge Exams. The three exams at the Applied Knowledge level introduce students to finance and accounting. Students learn essential techniques. Exams consist of multiple-choice questions and can be completed in as little as 9–12 months. The average pass rate for the exams is 69%.

- Applied Skills Exams. There are six exams at this level. These exams build on your knowledge and help you develop practical finance skills. These skills are essential for future professional accountants in any sector or industry. The average pass rate for the exams is 52%.

- Strategic professional exams. The Strategic Professional Exams prepare students for future leadership positions. Teachers teach students technical, ethical, and professional skills to develop a strategic vision. Students can specialise in areas that best suit their career ambitions. Students must complete two essential exams and choose two of the options. The average pass rate for the exams is 40%.

Does Big4 prefer ACA or ACCA?

Top accounting firms, including the Big 4, favour candidates with ACA and CA (Chartered Accountant) certifications. You can learn many skills in accounting, like strategy, taxes, finance, management, and leadership.

- ACA: The ACA is more principles-based. The ACA teaches principles for problem-solving but needs real-world application guidance.

- ACCA: Like the ACA, the ACCA qualification is broad in scope but has more practical applications. The ACCA examines how the qualification applies in real-world situations. It covers basic accounting, tax, auditing, and treasury. It’s a practical introduction to finance.

How Much Does an ACA and ACCA Earn?

The opportunities and pay for people with ACA or ACCA qualifications can vary. It depends on experience, location, industry, and job.

Newly qualified accountants in the UK who have completed ACA start with a salary of £40,000–£50,000 per year. With experience and seniority, it can increase to £60,000–£80,000 or more, depending on the industry.

Newly qualified certified accountants in the UK who have completed ACCA can expect a starting salary of around £35,000–£45,000 a year. With more experience and seniority, this salary can increase to £60,000–£80,000 or more, depending on the industry.

These figures are not exact, and potential earnings can vary based on location, experience, skills, and other factors.

Conclusion: Which is better, ACA or ACCA?

Both qualifications are essential in their own right. They can lead to jobs in public accounting, private companies, or government. Choosing between ACA and ACCA depends on personal choice and career path.

People who want to become high-level CFOs in the FTSE are often from a Big Four background. This means they have an ACA qualification. It is difficult to determine if it is the qualification or the training provider that helps them succeed.

If you want to specialise in diverse accounting roles, being ACCA-qualified is better. ACCA covers practical applications. However, an ACCA cannot sign off audit reports in many countries because they need local certification.

The ACA is international, but it does not necessarily give the authority to sign off accounts in different countries. To achieve this, you must usually be a chartered accountant in that country, specialising in its accounting and laws.

What are the Equivalent Chartered Accountant Qualifications Across Europe?

In France, they have expert comptables. In Italy, they have Dottore Commercialistas, or Revisore dei Conti. In Germany, they have Wirtschaftspruefers. In Spain, they have the Censor Jurado de Cuentas. In Sweden, they have Auktoriserad revisors or Ggodkänd Revisors. Besides the ACA and ACCA, CIMA, the Chartered Institute of Management Accountants, is in the UK.

Some global certifications allow the chartered accountant to practice in multiple countries.

Remember that earnings and job opportunities aren’t everything when deciding on a career. Consider job satisfaction, work-life balance, and personal/professional growth.

Similar posts:

Which UK accounting qualification is for you – ACA, CIMA, or ACCA? What is the Renaix Guide to Finance Skills and Qualifications? What qualifications are needed to be an accountant?

To learn about accounting careers, visit our resources page or search for accountant jobs.

Job Seekers

On the hunt for your next role? Upload your CV below and we’ll be in touch to discuss your requirements.

Employers

For employers seeking the right skills and cultural fit for your business, send us your vacancy to find out more about how we can help.

Submit CV Send Us Your VacancySearch Jobs

Popular this week

- What Qualifications And Skills Are Needed To Be An Accountant?

- How Does Industry 4.0 Differ From The Previous Generation?

- Agile For Accountants: Six Steps To Provide Necessary Tools And Relevant Processes

- What Are The Main Differences Between ACA and ACCA?

- What Are The Top Five Financial Accounting Facts For #AccountantsDay