An accounting director is a senior-level position overseeing an organisation’s accounting function. They are critical to ensuring the company’s financial operations run smoothly and efficiently. Thus, HR or the company’s recruitment team must hire the right candidate for this role.

When hiring an accounting director, you need a detailed job description. It must convey the role’s duties, requirements, and expectations well. It is crucial for attracting qualified candidates and ensuring successful recruitment. This article will outline the best practices. It will cover creating an accounting director’s job description. It will help both job seekers and employers.

Photo by Dan Dimmock on Unsplash

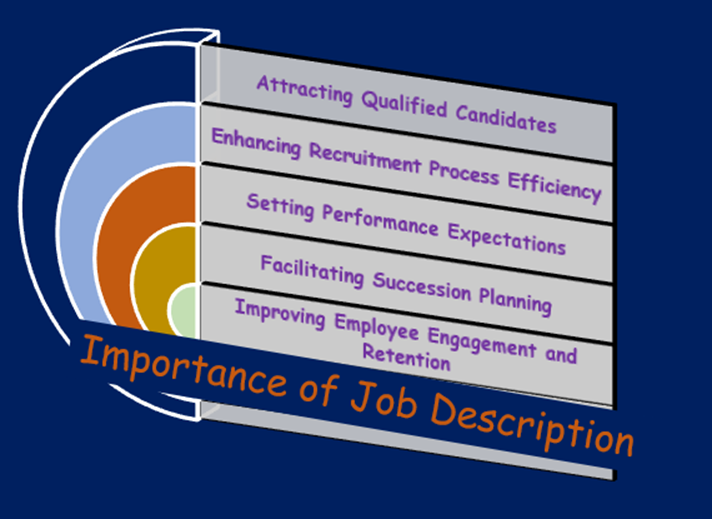

Importance and Benefits of a Good Job Description

- Attracting Qualified Candidates: A clear job description helps attract candidates. They need the necessary skills, qualifications, and experience. It sets clear expectations. Potential applicants can assess their fit and decide whether to pursue the opportunity.

- Enhancing Recruitment Process Efficiency: A clear job description helps streamline recruiting. It gives recruiters a good understanding of the position. This clarity helps them make focused sourcing strategies. They can screen candidates well and do relevant interviews.

- Setting Performance Expectations: A detailed job description sets clear performance expectations for the Accounting Director role. It aligns the candidate’s goals with the organisation’s priorities. This fosters accountability and a strong foundation for performance management.

- Facilitating Succession Planning: A precise job description is a valuable reference. It helps with succession planning within the organisation. It shows the skills and competencies needed for future leaders. It helps find and develop potential candidates.

- Improving Employee Engagement and Retention: A well-crafted job description clarifies expectations and parameters for measuring employee performance. When employees understand their role. They are more likely to feel confident and engaged.

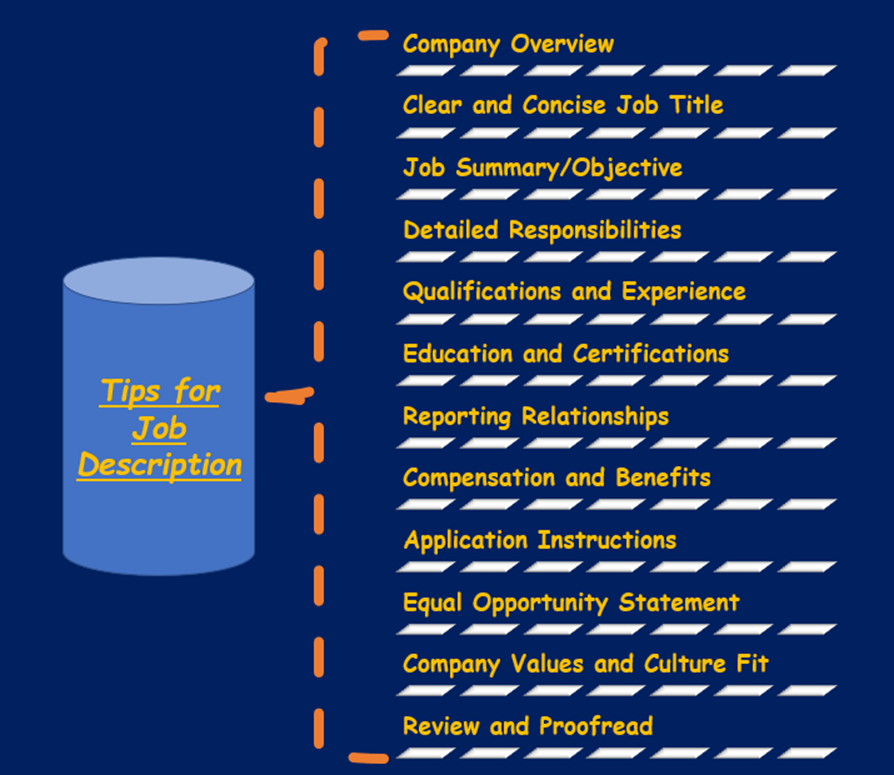

Tips for Writing the Robust Job Description of an Accounting Director Role

We’ve already covered the reasons why a good job description is crucial. It’s crucial for the position of accounting director. Here are some pointers to keep in mind when you draft the job description. You can write a full job description for an accounting director using the advice in this article. It will attract qualified candidates and help set clear expectations for the position.

- Give a brief overview of the organisation. Include its size, industry, mission, and values. This helps candidates understand the company’s context and culture.

- Use a job title that reflects the position. Example titles include “accounting director” or “director of accounting and finance.”

- The overview is brief. It highlights the accounting director’s main goals and duties. This helps candidates understand the job’s purpose and scope.

- List the accounting director’s job responsibilities and duties. Be specific. Highlight the role’s key functions. These include financial reporting, budgeting, and compliance.

- Outline the required qualifications, skills and experience for the role. Include technical skills. For example, financial analysis and knowledge of accounting standards. Also, include soft skills. For example, leadership, communication, and problem-solving abilities.

- Specify the educational background required for the position. For example, a bachelor’s or master’s degree in accounting, finance, or a related field. Additionally, mention any preferred or required professional certifications (e.g., ACA).

- Describe the reporting lines and the position’s level within the organisational hierarchy. State who the accounting director will answer to. Also, say whether they have any team members or direct reports.

- Say the salary range. Also, list any extra benefits. These include health insurance, retirement plans, and professional development. If the salary is competitive or negotiable, mention that as well.

- Outline the application process. It should explain how candidates should submit their resumes or CVs. It should also cover any extra required documents, like cover letters or references. Include contact information for inquiries or questions.

- Include an equal opportunity statement. Emphasize the company’s commitment to diversity, inclusion, and equal employment opportunities.

- Consider including information about the company’s values, culture, and work environment. Drawing in applicants who share the company’s values can boost finding the right fit.

- Ensure that the job description is free of errors, grammatically correct and well-structured. Review it for clarity and completeness before publishing or distributing it.

What are the Key Elements of an Effective Job Description?

A job description for an accounting director must include the following essential components:

- Job Title and Summary: Start by providing a clear and concise job title that reflects the position. The brief should outline the role’s responsibilities. It should also cover its importance within the organization. This part should list the main goals of the Accounting Director position.

- Responsibilities and Duties: Outline the essential responsibilities and duties associated with the role. This section should cover both strategic and operational aspects of the job. The following are the main duties included in an accounting director’s job description:

- Oversee the organisation’s accounting and financial operations.

- Develop and put in place financial strategies, accounting policies and procedures.

- Manage the budgeting, forecasting and financial planning processes.

- Ensure compliance with generally accepted accounting principles and regulations.

- Provide financial analysis and recommendations to senior management.

- Supervise and lead the accounting team.

- Maintain accurate financial records and produce timely financial reports.

- Collaborate with external auditors and tax advisors.

- Identify and install process improvements to enhance efficiency and effectiveness.

- Stay updated on industry trends, best practices and changes in accounting regulations.

- Qualifications and Experience: Specify the qualifications and experience required to perform the Accounting Director role. Include both essential and preferred qualifications, such as:

- Bachelor’s or Master’s degree in accounting, finance or a relevant field.

- Professional accounting certifications (e.g., ACA).

- Proven experience as an accounting manager or director.

Technical and Soft Skills: Provide a list of the technical and soft skills that accounting directors need to do their job. These skills may include:

Technical and Soft Skills: Provide a list of the technical and soft skills that accounting directors need to do their job. These skills may include:

-

- Strong knowledge of accounting principles, regulations and financial reporting.

- Proficiency in analytical skills, financial analysis, budgeting and forecasting.

- Excellent leadership and managerial skills.

- Practical communication skills and interpersonal abilities.

- Experience in implementing and optimising accounting systems.

- You should be familiar with relevant software and tools. For example, enterprise resource planning and accounting tools. You should also know about Microsoft Office applications.

- Reporting and Relationships: Say who the Accounting Director reports to and who they supervise. Also, mention the collaborations and relationships. The role should be cross-functional and keep them within the organisation.

- Benefits and Perks: Highlight the benefits and perks associated with the Accounting Director role. This section can include information on good pay, health, and retirement benefits. It can also cover learning, work-life balance, and unique perks.

How Does the Job of an Accounting Director Vary in Different Organisations?

The role of an accounting director can vary in different organisations. Here’s how the position may differ based on the size of the organisation:

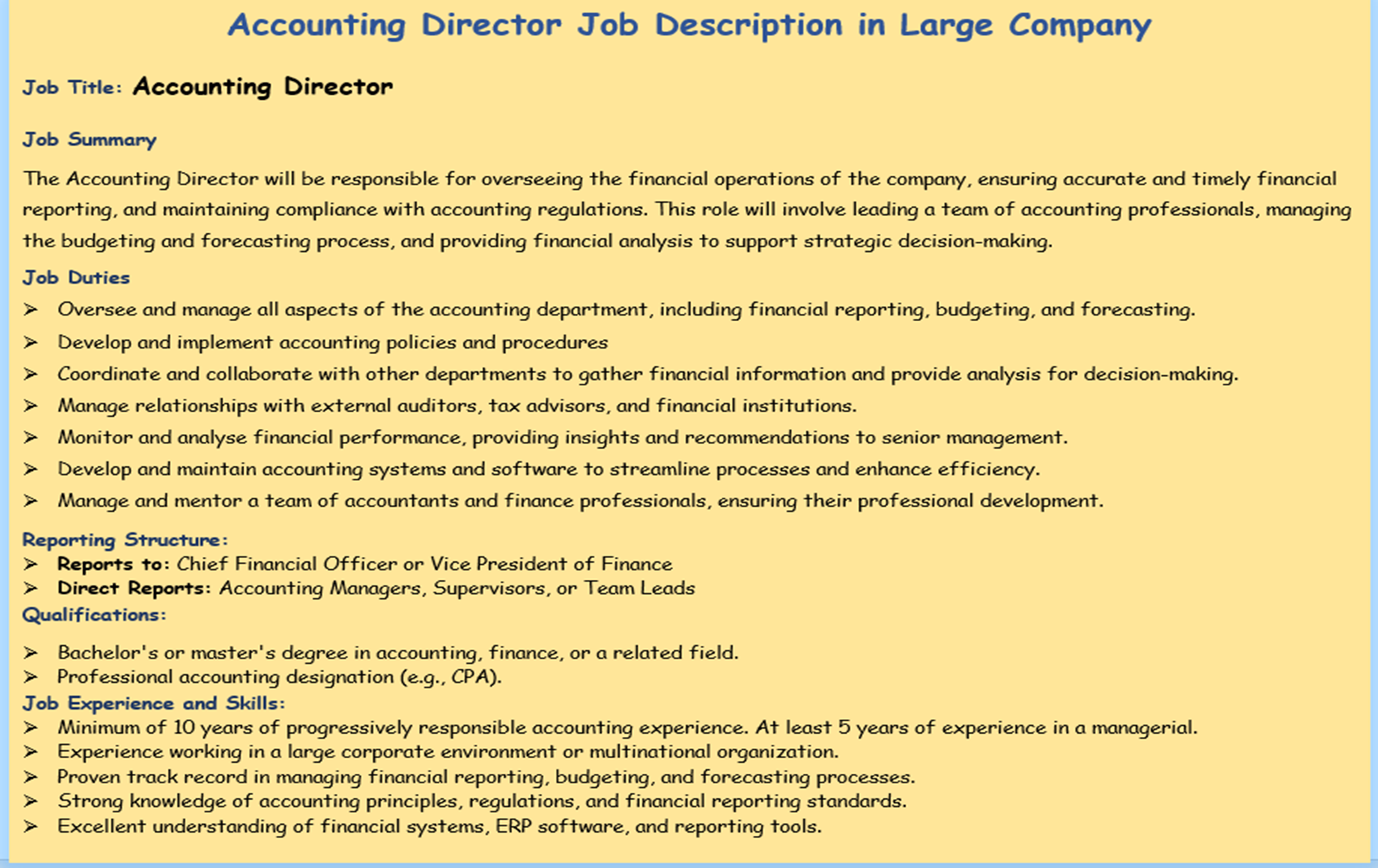

Accounting Director in Large Organisations

- The accounting director typically oversees a large organisation’s significant finance and accounting departments. They report to the Chief Financial Officer (CFO) or Vice President of Finance. They may have many direct reports, such as managers, supervisors and staff accountants.

- They have more responsibilities. These include financial functions like reporting, budgeting, planning, and compliance. They will likely work closely with senior executives and board members. They will provide insights into economic data and support decision-making. The accounting director in a large organisation may also manage relationships. They are with external stakeholders. This includes auditors, regulatory bodies, and financial institutions.

- To be an accounting director at a big company, you need a bachelor’s or master’s degree in finance or a related field. They also need professional certification, such as CPA or ACA. Candidates should often have over ten years of accounting experience. They should have at least five years in a managerial role.

- Skill in accounting software, such as ERP and Excel, is highly desirable. The annual salary ranges from $120,000 to $180,000. There are also enticing benefits and compensation provided. These include stock options, incentives, gratuities, and significant vacation time.

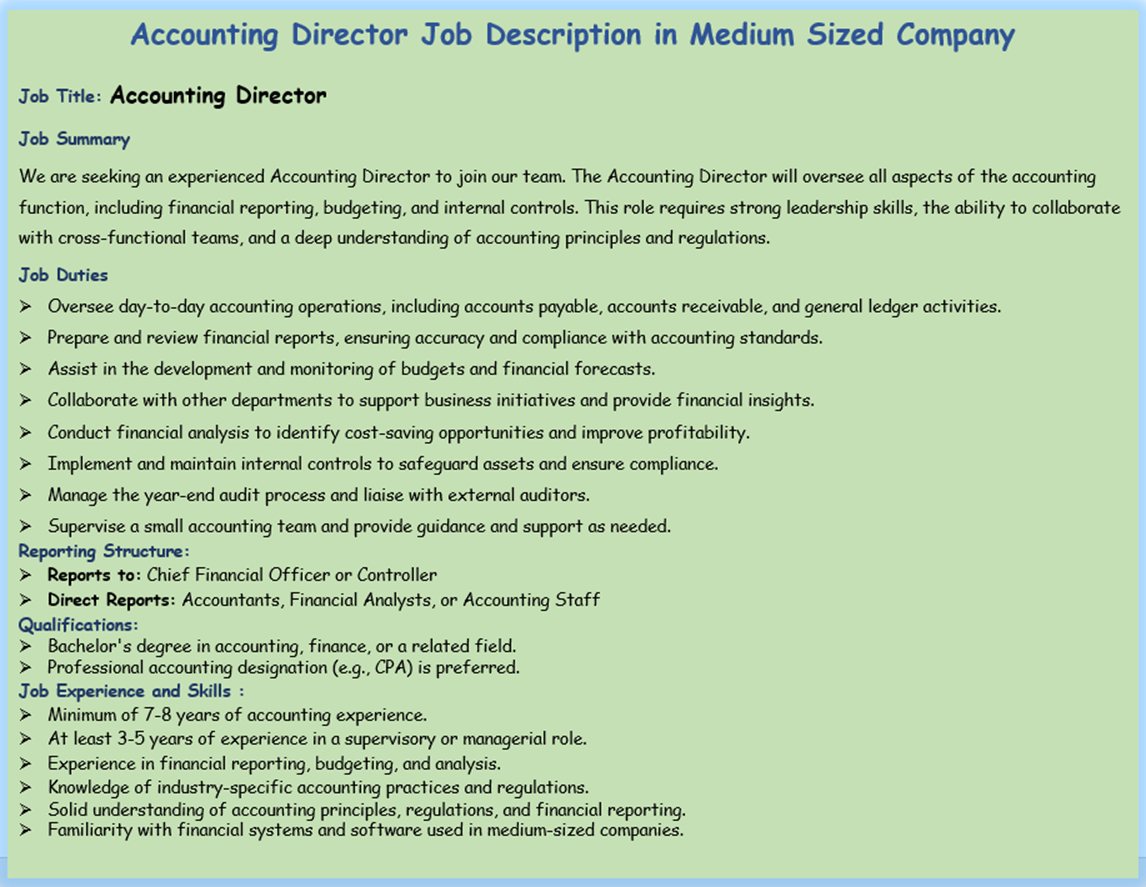

Accounting Director in Medium-Sized Organisations

- In medium-sized organisations, the accounting director reports to the CFO, or controller. They may have a small team or work alone. They manage the day-to-day accounting operations, financial reporting and compliance. They may oversee accounts payable, accounts receivable, and payroll. They also maintain good internal accounting controls.

- The accounting director in a medium-sized organisation has a hands-on role. They prepare financial statements, manage the budget, and analyse financial information. They do this to support business decisions. They may also collaborate with other departments. They work closely with the executive team.

- An eligible candidate must have a bachelor’s degree in finance or a related field. Candidates with professional certification are preferred. Experience of seven to eight years. Three years of supervisory experience is preferred.

- Typically, an accounting director’s responsibilities at a midsized business include overseeing accounting standards. This includes knowing regulations and tax laws. It also includes having experience setting up accounting systems. Pay and perks range from $90,000 to $130,000 annually. They include health insurance, retirement benefits, vacations, and stock options.

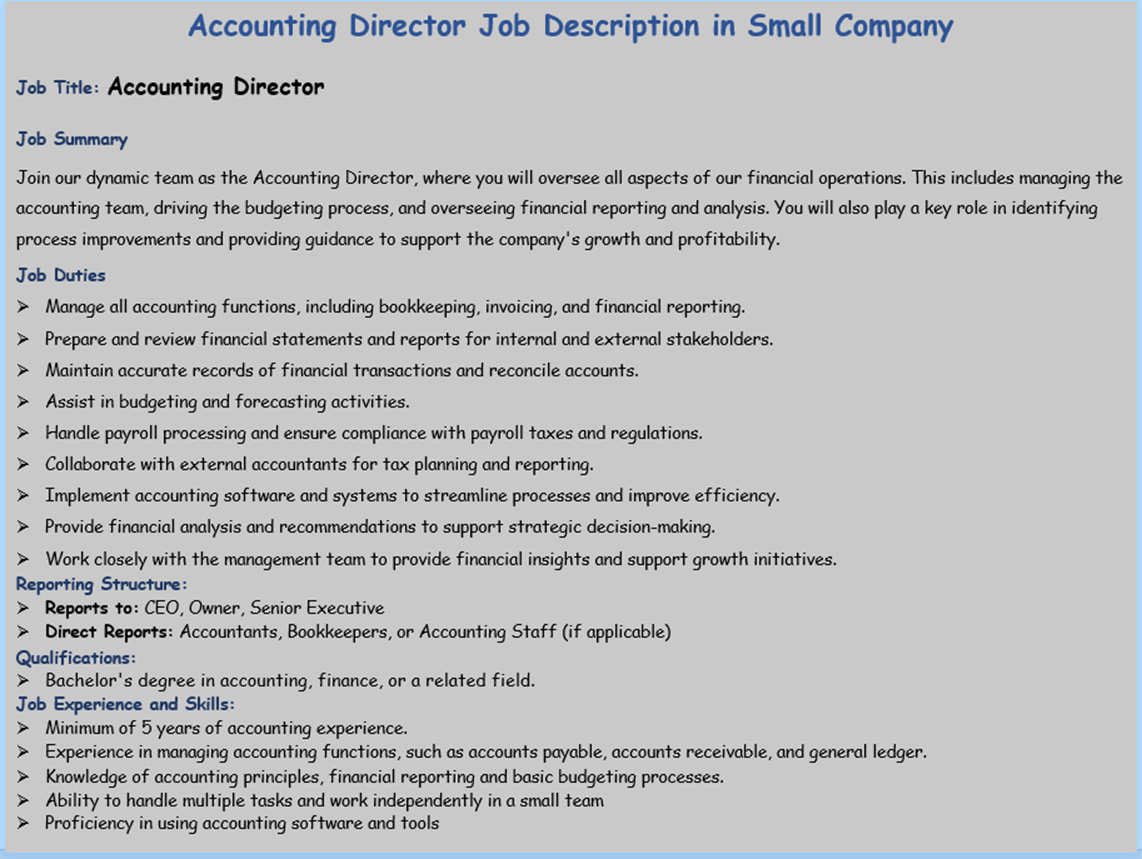

Accounting Director in Small Organisations

- In a small organisation, the accounting director is the whole accounting department. They report to the CEO or owner of the organisation. They do all accounting tasks. These include bookkeeping, financial reporting, budgeting, and compliance. The accounting director works at a small organisation. They are in charge of keeping accurate financial records. They also prepare financial statements and manage cash flow. They may also handle payroll processing and tax filings. They manage banking relationships and other transactions.

- They have accounting duties. They may also do strategic financial planning. They give financial advice to the executive team. The accounting director in a small organization needs to be versatile and adaptable. They often take on extra responsibilities related to business operations beyond accounting.

- In small businesses, the accounting director needs a bachelor’s degree. It should be in finance or accounting. They must also have 5–6 years of experience in managing financial operations.

- You could earn an average salary of $70,000 to $100,000 annually, plus other benefits. These include healthcare, annual bonuses, and profit-sharing schemes.

- The organisation’s size can also impact financial complexity. It affects the level of resources and the formality of processes. So, an accounting director’s duties and needs may vary. They depend on factors beyond the organisation’s size. These factors include the industry, structure, and growth stage.

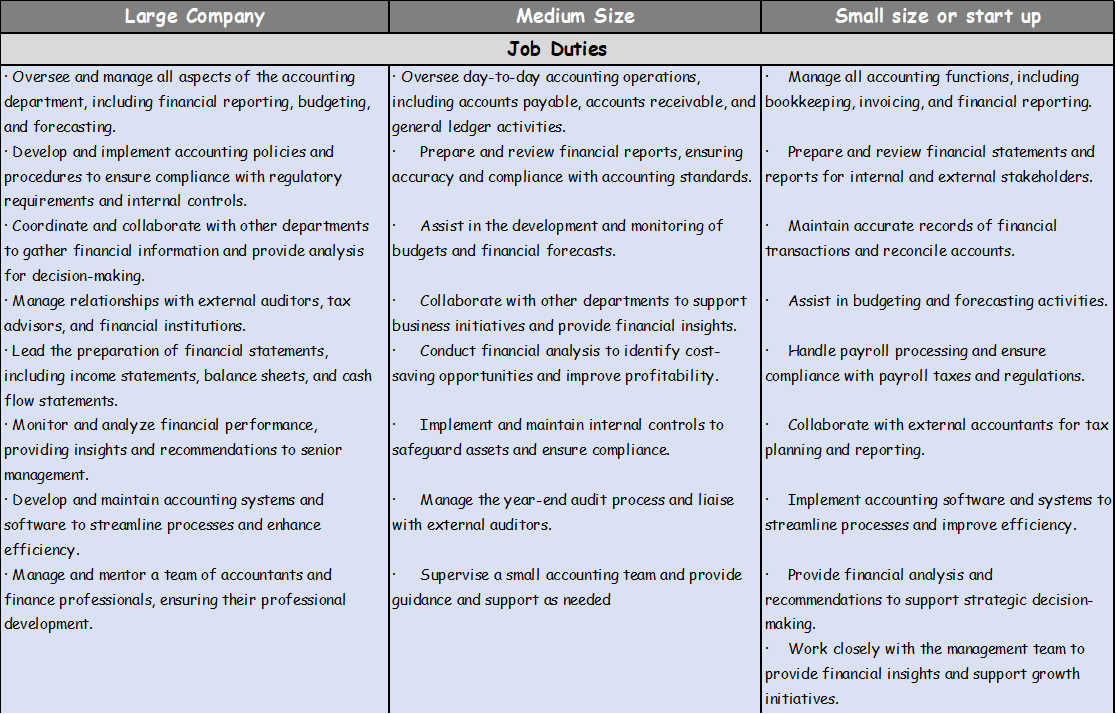

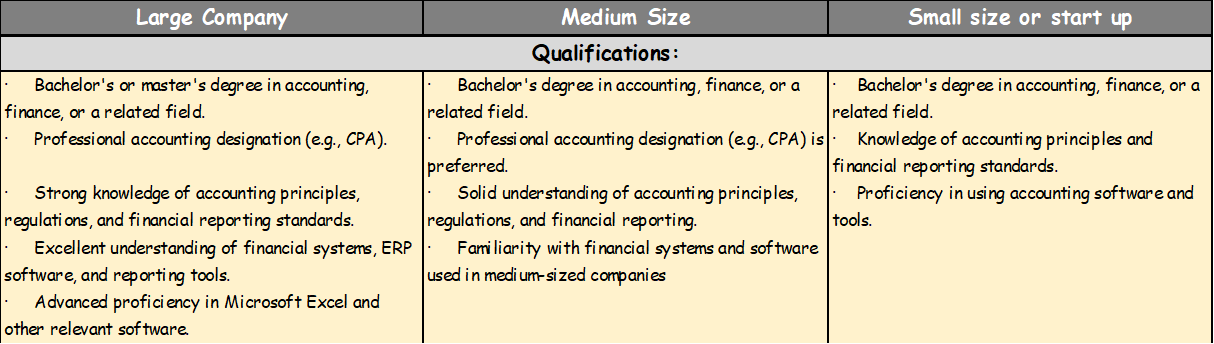

Comparison of Accounting Directors’ Job Descriptions in Various Sizes of Organisations

The tables compare accounting directors’ job descriptions. They cover job duties, reporting structure, qualifications, experience, pay, and perks.

Comparison by Job Duties

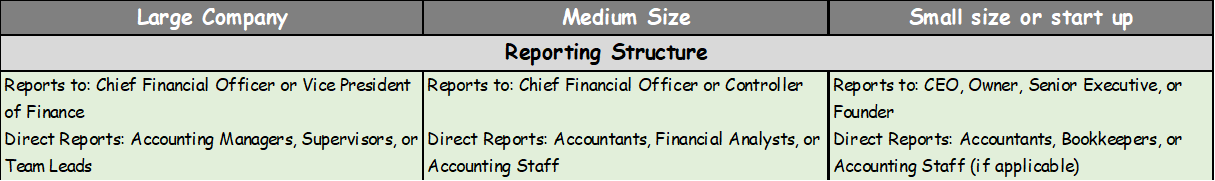

Comparison by Reporting Structure

Comparison by Qualifications

Comparison by Qualifications

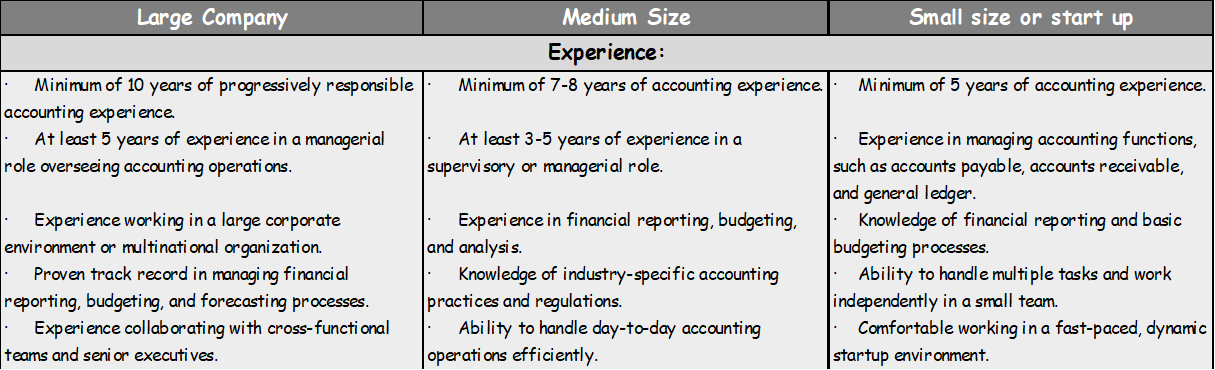

Comparison by Experience

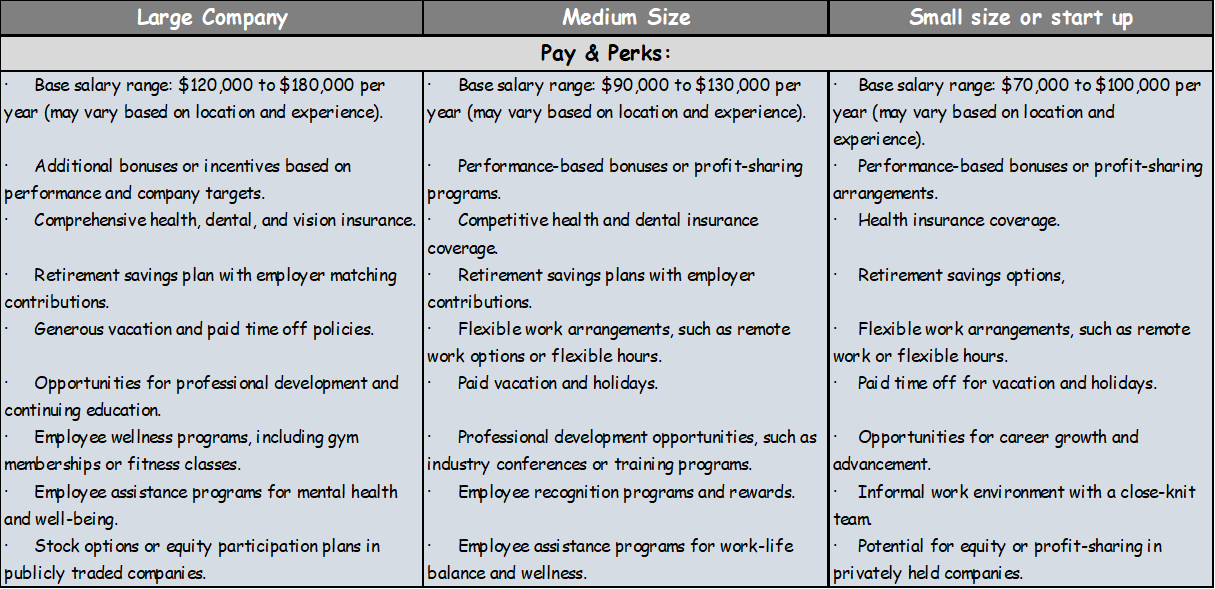

Comparison by Pay & Perks

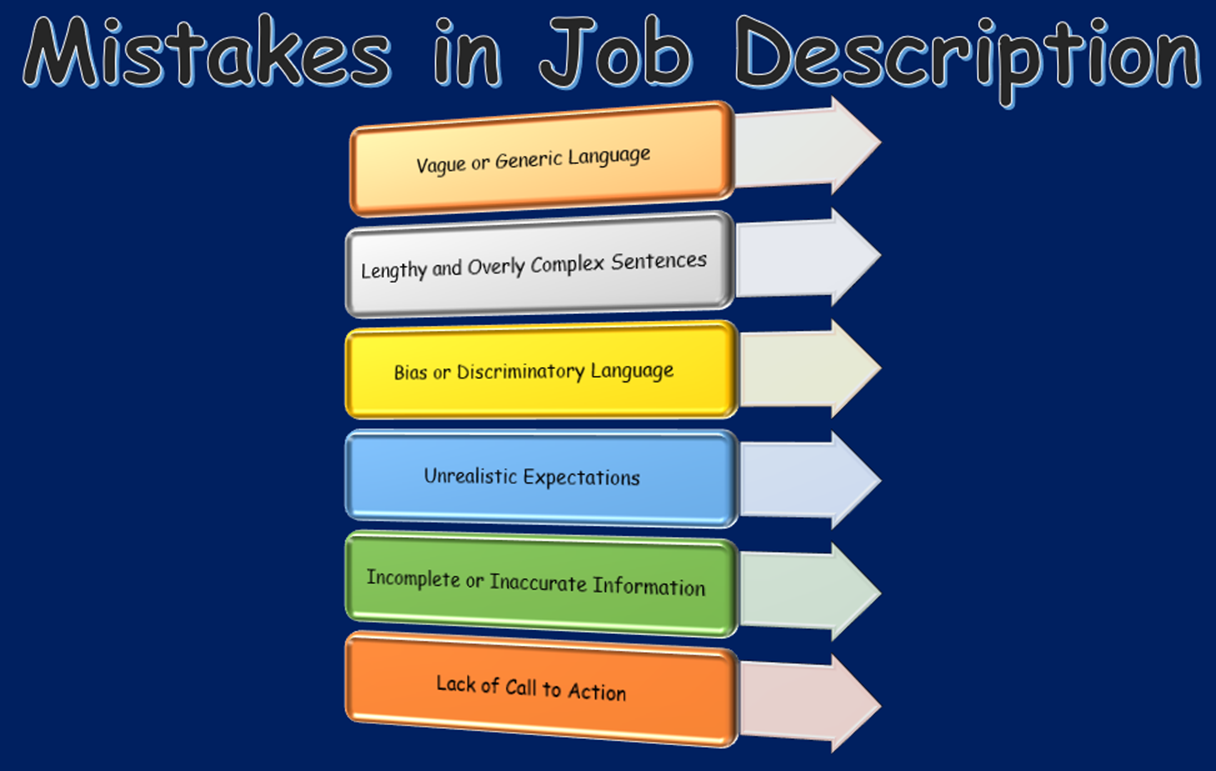

Things To Avoid While Writing the Job Description for the Accounting Director Role

When writing a job description for an accounting director, avoid certain pitfalls. They can hinder the narrative’s effectiveness. Here are some mistakes to avoid:

- Vague or Generic Language: Avoid vague and generic language. It doesn’t convey the role’s responsibilities and expectations. Be specific and provide detailed information about the essential duties and requirements.

- Lengthy and Complex Sentences: Long, complicated sentences can make the job description challenging to read and understand. Keep sentences concise and to the point, using clear language.

- Bias or Discriminatory Language: Ensure that the job description is free from any biased or discriminatory language. Use inclusive language and adhere to equal employment opportunity guidelines.

- Unrealistic Expectations: Avoid setting unrealistic expectations or qualifications that may discourage potential candidates. Pay attention to the fundamental competencies needed for the position. Be careful to establish realistic expectations.

- Incomplete or Inaccurate Information: Make sure to include the reporting lines. Also, ensure the job location and application instructions are accurate. Only complete or correct data can lead to clarity and satisfaction among applicants.

- Lack of Call to Action: State the next steps for candidates. This includes how to apply and the application deadline. It also includes the expected hiring process timeline. Include contact information for inquiries or questions.

Avoid these pitfalls. Then, you can create a job description. It should communicate the requirements of the accounting director role. It will also attract qualified candidates.

To learn more about a career in accounting, please visit our resources page. You can also search for accounting jobs here.

Job Seekers

On the hunt for your next role? Upload your CV below and we’ll be in touch to discuss your requirements.

Employers

For employers seeking the right skills and cultural fit for your business, send us your vacancy to find out more about how we can help.

Submit CV Send Us Your VacancySearch Jobs

Popular this week

- What Qualifications And Skills Are Needed To Be An Accountant?

- How Does Industry 4.0 Differ From The Previous Generation?

- Agile For Accountants: Six Steps To Provide Necessary Tools And Relevant Processes

- What Are The Main Differences Between ACA and ACCA?

- What Are The Top Five Financial Accounting Facts For #AccountantsDay