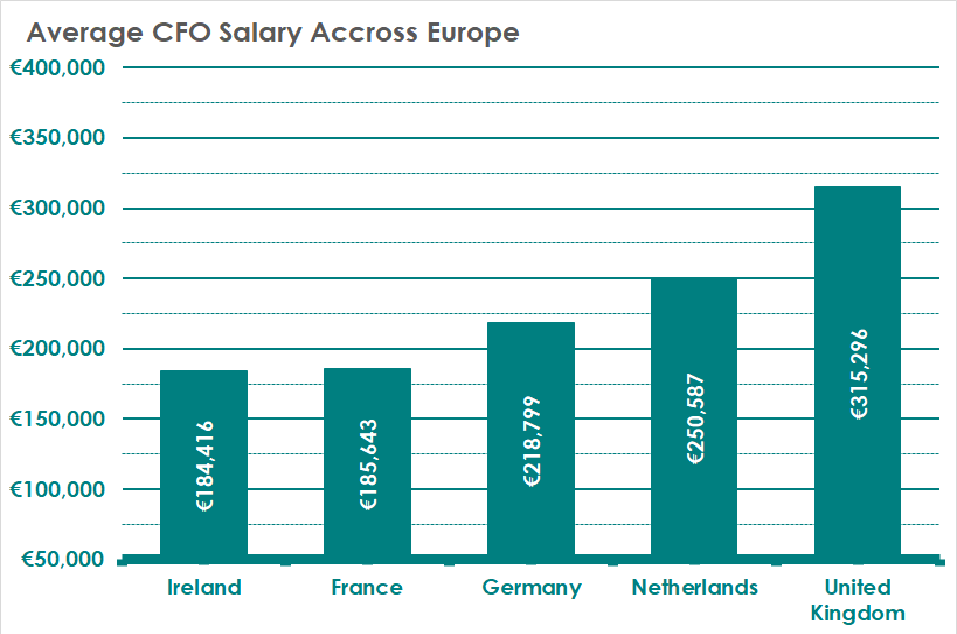

(Note: Salaries can differ based on industry, experience, and company policies. The above figures are estimates taken from glassdoor.com in 2023.)

These figures are averages. They vary by industry. They also vary by organisation size. They vary by responsibility level and by an individual’s experience and education.

The CFO is a top-level executive in an organisation. They are responsible for managing the company’s finances and accounting. The CFO reports to the CEO, COO, or Board of Directors. They play a critical role in shaping the organisation’s financial strategy and success.

The amount of responsibility and the size and complexity of the organisation affect CFO pay. So do industry standards, financial success, and the CFO’s expertise and track record. They are paid based on financial performance, risk reduction, and strategic decision-making.

What Factors Affect the Salaries of Chief Financial Officers?

Several factors can influence the salaries of Chief Financial Officers (CFOs). These factors include:

- Geographic Location: The company’s location plays a significant role in determining the CFO’s salary. CFOs are based in major financial hubs or expensive cities. They demand higher salaries to offset the higher living costs there. For example, CFOs in cities like New York, London, or Tokyo may earn much more than their counterparts in small towns or less developed regions. A CFO’s average salary varies by country. This is due to factors like the country’s economy, cost of living, tax policies, and demand for financial expertise. The images show the highest, lowest, and middle CFO salaries in various countries and regions.

- Company Size and Revenue: The average CFO’s salary often correlates with the company’s size and revenues. CFOs in big companies with more revenue tend to have higher wages. This is because of the added complexity and costs of managing larger finances.

- Education and Experience: Advanced degrees, like an MBA or ACA (Chartered Accountant), and more certifications can boost a CFO’s credentials. They also lead to higher salary expectations. Like other positions, a candidate’s level of experience and expertise can affect the CFO’s salary. CFOs have much experience in senior finance roles. They have successful track records and strong financial skills. They may command higher salaries.

- Industry: These are industries or sectors that need specialized financial expertise. They are known for high profitability. They may offer higher CFO salaries. For example, the tech, finance, and healthcare sectors often offer high pay to attract and keep top financial talent.

What Other Benefits Besides Pay Can CFOs Expect?

CFOs often receive various benefits and perks besides their salary. This is part of their compensation package. The benefits vary. They depend on the company’s policies, industry norms, and individual negotiations. CFOs often have more extensive benefits packages than other employees. This is due to the seniority and strategic importance of their organizational role. Here is a list of some expected benefits provided to CFOs:

- Bonuses and Stock Incentives: CFOs often have the chance to earn performance-based bonuses and stock incentives. These are linked to the company’s financial success. They can include yearly cash bonuses. They can also include profit-sharing schemes, stock options, or other equity pay.

- Retirement Plans: CFOs often get generous retirement benefits. These include pension schemes and deferred compensation plans for executives. These plans help CFOs build wealth for their post-career years.

- Health and Insurance Benefits: CFOs typically get full health insurance for themselves and their families. It covers medical, dental, and vision. They may also have access to life insurance, disability insurance and other insurance plans.

- Vacation and Time Off: CFOs often receive generous vacation allowances and paid time off to maintain a healthy work-life balance. The number of vacation days may vary depending on the company’s policies and the CFO’s seniority.

- Professional Development: Companies may support CFOs in their growth. They can do this by providing opportunities for continuing education. They can also help attend industry conferences. They can also attend executive education programs at top business schools.

- Relocation Help: In such cases, CFOs are hired from outside the company or need to move for the position. Companies may provide relocation aid to cover moving expenses, temporary housing, and other costs.

Photo by Clark Tibbs on Unsplash

What Are the Low-Cost Alternatives to Hiring a Full-Time CFO?

Hiring a full-time Chief Financial Officer (CFO) can be expensive. This is especially true for small or medium-sized businesses. Yet, several low-cost options can provide financial expertise and support. They do so without the high cost of a dedicated CFO. The following are some options to consider:

- Fractional or Part-Time CFO: You can engage a part-time or fractional CFO who works as needed rather than hiring a full-time CFO. Doing this lets you access their knowledge and tactical advice while paying the least amount possible. Part-time CFOs can provide valuable financial insights and help with budgeting and forecasting. They also assist with financial decision-making and ensure compliance with laws. They do all this on a flexible schedule.

- Outsourced CFO Services: Many companies offer outsourced CFO services. You can hire a third-party firm or consultant to fulfil your CFO responsibilities. These firms provide financial expertise and strategic guidance on a contract basis. Their services include managing the accounting departments of the whole company. Outsourced CFO services can be cheap. They work especially well for businesses that don’t need a full-time CFO but still need high-level financial advice.

- Virtual CFO: Virtual CFOs work remotely. They provide financial support through online platforms and tools. They can assist with financial analysis, budgeting and reporting without needing a physical presence in your office. Virtual CFOs are often more affordable than hiring a full-time CFO and offer flexible arrangements based on your needs. These alternatives can save costs. Yet, they may provide a different level of expertise and dedicated focus than a full-time CFO. Assess your business’s needs and budget constraints. Determine the most suitable option for your financial management requirements.

What Are the Benefits of Hiring a Virtual CFO?

Hiring a virtual CFO has many benefits for businesses. This is especially true for small and medium-sized enterprises (SMEs) or groups with budget constraints. Here are some key advantages to hiring a virtual CFO:

- Cost-Effectiveness: Virtual CFOs usually offer their services part-time or for a project. This lets businesses access top financial expertise for much less than a full-time CFO. This cost-effectiveness is especially beneficial for SMEs. They need more financial resources to afford a full-time executive.

- Flexibility: Virtual CFOs provide flexibility in terms of engagement. Businesses can tailor the scope and duration of the virtual CFO’s involvement based on their needs. Virtual CFOs can handle short-term projects, periodic financial analysis, and ongoing strategic support. They can adapt to the changing needs of the business.

- Specialised Expertise: Virtual CFOs often have a lot of experience and expertise in financial management. They know budgeting, forecasting, and strategic planning. They have gained much knowledge from working with many clients and industries. This lets them give valuable insights and guidance tailored to the business’s needs.

- Focus on Core Competencies: Outsourcing CFO duties to a virtual professional lets owners and managers focus. They can focus on their main skills and daily operations. Efficiency and productivity rise as a committed professional manages financial issues

- Scalability: Virtual CFO services can quickly scale with the needs of the business. As the organization grows or faces new financial challenges, the virtual CFO can adjust their level of involvement. They can also provide the needed support and guidance. This scalability ensures businesses have access to the right financial expertise at each growth stage.

It’s crucial to select a reputable and experienced virtual CFO who aligns with the specific needs and values of the business. Clear communication, defined expectations, and a well-defined scope of work are essential. Successful engagement with a virtual CFO requires clear communication. It also needs defined expectations and a clear scope of work.

Photo by Clark Tibbs on Unsplash

Critical Considerations for Recruiters Whilst Hiring a CFO

- Understanding CFO salary dynamics is crucial for HR recruitment teams: They work at companies that seek top financial talent. By considering the following key factors, recruiters can gain valuable insights. They can guide employers and candidates.

- It’s essential to understand the industry benchmarks for CFO salaries: Many sources provide insights. They include industry salary surveys, recruitment guides, labour statistics, and market reports. Consider consulting resources like Robert Half, Hays, and Glassdoor. They offer salary data and analysis for the finance industry.

- Understand the employer’s requirements deeply: This includes the company’s size, industry, and finances. Tailor your candidate search and salary negotiation strategies.

- Check candidates based on their experience, industry expertise, education and track record: Consider their ability to drive financial strategy, manage risks and navigate regulatory landscapes.

- Guide the employers and candidates through salary negotiations: Provide insights into market trends, salary ranges, and the value each party brings. Aim for a win-win outcome that satisfies both parties’ expectations.

- Remember, CFO pay is more than base salary. Total pay may include cash bonuses, profit-sharing, equity, benefits, and other incentives. Assess the compensation package to align with industry standards and candidate expectations.

Learn more about CFO careers by visiting our Jobs Resources section.

Search Jobs to find out about the job roles we currently have available.

Job Seekers

On the hunt for your next role? Upload your CV below and we’ll be in touch to discuss your requirements.

Employers

For employers seeking the right skills and cultural fit for your business, send us your vacancy to find out more about how we can help.

Submit CV Send Us Your VacancySearch Jobs

Popular this week

- What Qualifications And Skills Are Needed To Be An Accountant?

- How Does Industry 4.0 Differ From The Previous Generation?

- Agile For Accountants: Six Steps To Provide Necessary Tools And Relevant Processes

- What Are The Main Differences Between ACA and ACCA?

- What Are The Top Five Financial Accounting Facts For #AccountantsDay