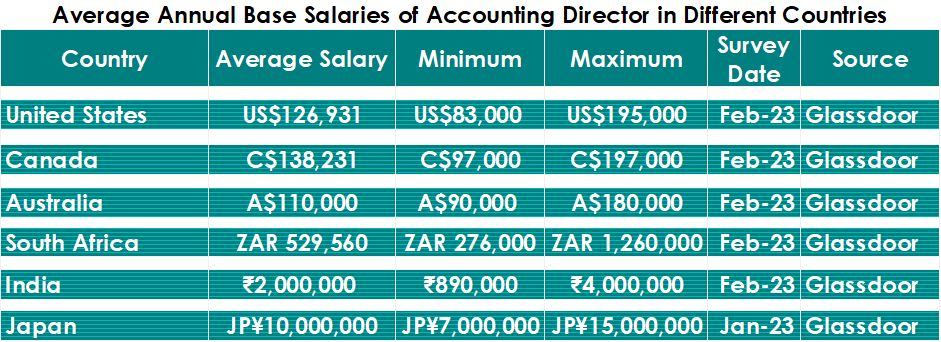

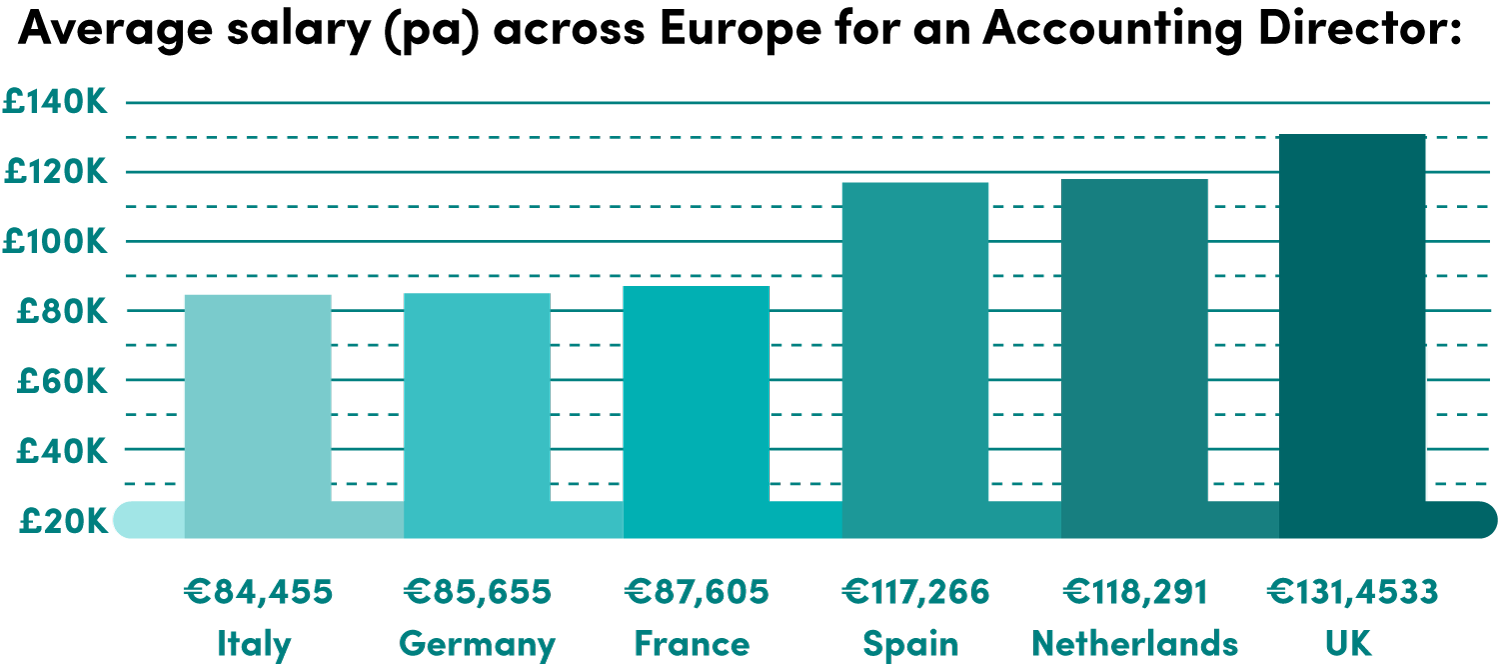

(Note: Salaries can differ significantly based on industry, experience, and company policies. The above figures are estimates taken from glassdoor.com in 2022.)

These figures are just averages. They may vary a lot. It depends on the industry. It also depends on the organisation’s size. It depends on the level of responsibility and an individual’s experience and education.

What Is the Average Salary of an Accounting Director in Different Countries?

The salary of an average Accounting Director can vary significantly, depending on the country and region they are working in. Below are accounting directors’ average annual base salaries in countries other than Europe.

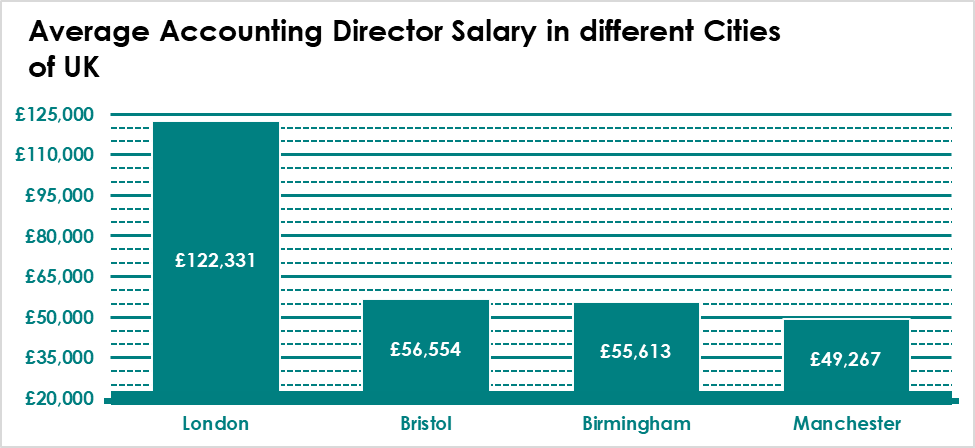

What Are the Highest cities for an accounting Director role in the UK?

The average pay and salary for an accounting director in the UK may vary in different cities of the same country. The value of the average annual salary at each location depends on its cost and standard of living. Below are some of the highest-paying cities for an Accounting Director role in the UK based on data from Glassdoor.

Who Is an Accounting Director?

The accounting director is a senior position in any organisation. They manage and oversee the financial operations and accounting systems. The role requires high skill. It also needs experience and a thorough understanding of financial rules and best practices. The salary and pay of an accounting director are often quite competitive, and in this article, we will explore the various factors that determine remuneration.

What Are the Common Factors That Determine the Salary and Pay of an Accounting Director?

An accounting director’s pay can vary a lot. It depends on factors like the organisation’s size and industry. Also, the level of responsibility and the person’s experience and education.

- Size and Industry of the Organisation: The size and industry of the organisation can significantly impact it. Bigger organisations have more complex accounting and bigger budgets. They offer higher salaries to attract and keep top talent. Also, certain industries, like finance and healthcare, may pay more. This is due to the specific financial regulations and requirements in those fields.

- Level of Responsibilities and Scope of the Role: The extent of responsibility required for the role of an accounting director can also impact their salary and pay. In some organisations, they may manage a large team of accountants. They also oversee the complex financial operations of many departments. In these cases, the salary and pay may be higher to reflect the increased level of responsibility.

- Individual’s Level of Experience and Education: The person’s experience and education level can also greatly determine their pay. Accounting directors have more experience and higher education. They have a bachelor’s degree or more, like a master’s in accounting or a Chartered Accountancy (ACA) certification. They may be able to command higher salaries. This is because of their specialised knowledge and expertise.

- Geographic Location: Geographic location is another critical factor. Consider it when setting the salary of an accounting director. Salaries can vary significantly depending on the cost of living and local market rates in a particular area.

- Market Trends and Competition: It is important to consider market trends and competition when setting the salary of an accounting director. Employers should research the salaries of similar roles within the industry and region. This ensures competitive pay.

- Geographic Location: Location is another critical factor. It must be considered when setting an accounting director’s salary. Salaries can vary significantly depending on the cost of living and local market rates in a particular area.

- Market Trends and Competition: It is important to consider market trends and competition when setting the salary of an accounting director. Employers should research the salaries of similar roles within the industry and region. This ensures competitive compensation.

- Performance and Potential: Consider an accounting director’s performance. Also, consider their potential for future growth in the organisation. This matters when setting their salary. People with a proven track record of accomplishment and room for future advancement may get a higher salary. This is compared to others who have yet to prove these attributes.

How Can Location Impact Salary?

The location of the job role can also impact the average salary of an accounting director. Financial and accounting managers make more money in bigger cities. This is due to the higher cost of living and the increased demand for talent. However, the cost of living can also impact an individual’s overall quality of life, so it is crucial to consider salary and living expenses when evaluating a job offer. Their salary is set based on the director’s performance and prospects for advancement within the company.

- Company Culture and Values: Consider the company’s culture and values when setting an accounting director’s salary. Companies that value and prioritise their employees may offer higher wages to attract and keep top talent.

- Accounting directors may receive various benefits and perks, besides their salary and pay. These benefits and perks are part of their total compensation package. Here are a few advantages and bonuses that they may typically expect:

- Performance Bonuses: Bonuses based on performance can be a big part of an accounting director’s pay. They provide extra income based on the organisation’s or department’s success. Yet, it is vital to ensure that these bonuses are based on achievable goals. They should not be overly reliant on factors outside the individual’s control.

- Paid Time Off: Accounting directors may receive paid time off, including vacation, sick days, and personal days.

- Professional Development Opportunities: Many organisations provide opportunities for their employees. They can continue their education and professional growth. They can do this by attending conferences, workshops, or courses.

- Flexible Work Arrangements: Some organisations offer flexible work arrangements. This includes remote working options and flexible hours. They do this to help employees maintain a better work-life balance.

- Employee Discounts: Some organisations offer their employees discounts on products or services. The discounts range from gym memberships to car rentals. Some employers also provide health and life insurance and retirement benefits.

It is important to note that the benefits can vary significantly depending on the organisation and the country or region in which they work. The value of these benefits can depend on many factors, such as the cost of living and the individual’s circumstances.

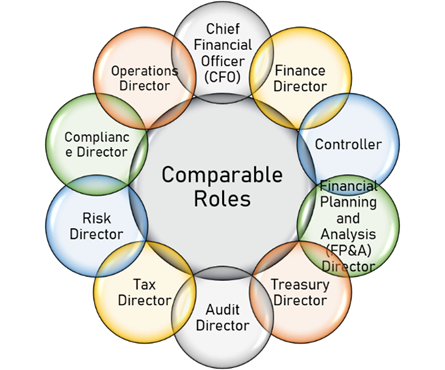

What Other Related Job Titles Are Comparable to the Accounting Director Role?

Several other job roles are similar to those of an accounting director in their job title, level of responsibility, and required skills. Some of these professions include the following:

- Chief Financial Officer (CFO): A CFO oversees an organisation’s financial operations. This includes financial reporting, budgeting, and forecasting. A CFO must have strong financial acumen. They also need strategic thinking and leadership skills, like those of an accounting director.

- Finance Director: A finance director manages the finances of an organisation. This includes accounting, budgeting, and financial reporting. They must have strong analytical skills. They must also have leadership abilities and make smart financial decisions.

- Financial Controller: A controller manages an organisation’s accounting. They handle financial operations, reporting, and compliance. They must have strong technical accounting skills and the ability to manage and lead a team.

- Financial Planning and Analysis (FP&A) Director: An FP&A Director manages an organisation’s financial planning and analysis. This includes budgeting, forecasting, and financial analysis. They need strong analytical skills. They must also communicate financial information well to senior managers.

- Treasury Director: A Treasury Director manages an organisation’s cash. They also manage their financial risks. They must have strong financial and analytical skills, as well as the ability to make sound financial decisions.

How Does Big 4 Experience Impact the Salary of an Accounting Director?

Experience in a Big 4 accounting firm can play a role in setting the salary of an accounting director. The Big Four accounting firms (Deloitte, PwC, EY, and KPMG) are highly respected and well-known within the industry, and the experience of working for one of these firms is often seen as a valuable asset.

Accounting directors who worked for a Big 4 accounting firm may have gained valuable skills. They provide audit, tax, and advisory services. This experience can make them highly sought-after by employers and result in a higher salary.

Also, Big 4 accounting firms can expose accountants to large, complex clients, projects, and chances for career growth. This experience can also contribute to a higher salary.

To learn more about a career in accounting, please visit our resources page or search for accounting job roles here.

Job Seekers

On the hunt for your next role? Upload your CV below and we’ll be in touch to discuss your requirements.

Employers

For employers seeking the right skills and cultural fit for your business, send us your vacancy to find out more about how we can help.

Submit CV Send Us Your VacancySearch Jobs

Popular this week

- What Qualifications And Skills Are Needed To Be An Accountant?

- How Does Industry 4.0 Differ From The Previous Generation?

- Agile For Accountants: Six Steps To Provide Necessary Tools And Relevant Processes

- What Are The Main Differences Between ACA and ACCA?

- What Are The Top Five Financial Accounting Facts For #AccountantsDay