Top 10 Skills For A Successful Finance And Accounting Career

The finance and accounting sectors have changed. Globalisation, regulatory changes, and technological developments are its main drivers. Finance and accounting professionals need a diverse skill set to stay ahead. They need it in this dynamic environment. Technical skills remain essential. Yet, the demand for soft skills, analytical abilities, and digital literacy is growing.

In this article, we will explore the top 10 skills most sought after by employers in the accounting and finance sectors. We will also discuss how to get these skills.

Unsplash+ In collaboration with Getty Images

Professionals who invest in skill development can prove greater competency. They can contribute more to organisational success and position themselves for career growth. The demand for these skills may vary based on the organisation’s nature. It may also vary based on its size and complexity. Here are the most common skills in high demand for finance and accounting professionals:

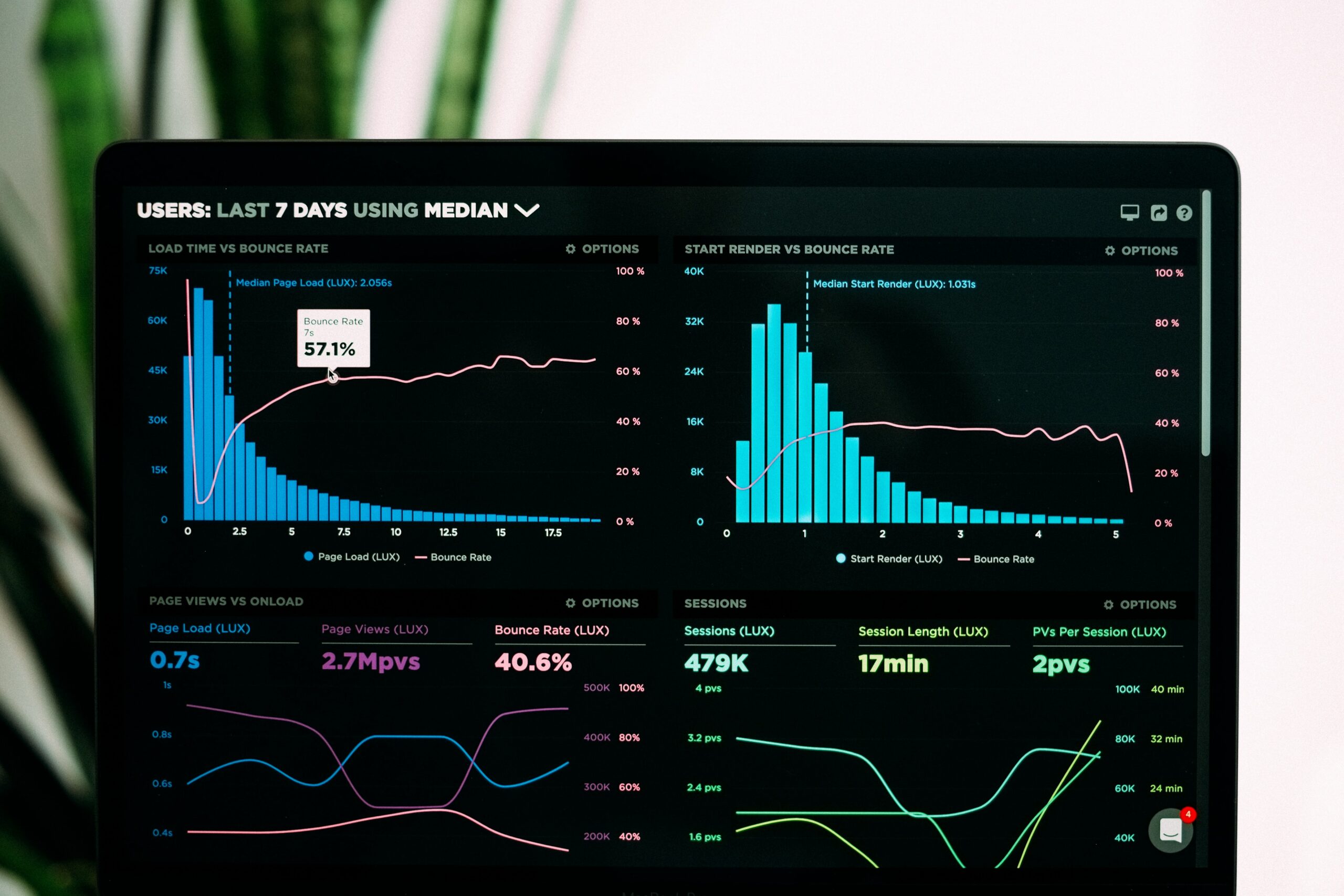

1. Data Analysis and Visualisation

Finance professionals must be adept at collecting, analysing, and interpreting data. This skill is critical because they must gain insights and communicate the data.

A multitude of data analysis and visualisation tools are available to assist them. These include Microsoft Excel, Power BI, Tableau, and Python. Each device offers unique functionalities and benefits. Employers prefer finance experts who are familiar with these tools. They work in financial and accounting roles.

Photo by Luke Chesser on Unsplash

2. Financial Modeling and Valuation

Financial modelling and valuation are essential for advancing in accounting and finance careers. These skills enable professionals to analyse financial performance. They also allow them to make informed decisions, value assets, and enhance communication.

If you work in corporate finance, investment banking, or analysis, you must have a solid grasp of financial concepts. This is necessary for building financial models and valuating assets. It also requires an awareness of valuation methodologies and risk assessment frameworks. By acquiring these skills, you can unlock exciting opportunities. You can enhance your decision-making abilities. You can also contribute to the financial well-being of your organisation.

Photo by Alice Pasqual on Unsplash

3. Risk Management and Compliance

Risk management and compliance are integral aspects of financial management. They ensure that organisations operate within legal boundaries. They also stay aware of potential risks. The risks could impact their objectives. Finance professionals are critical in identifying, assessing, and mitigating financial risks. They ensure the financial stability and integrity of the organisation.

Photo by Suraj Agrawal on Unsplash

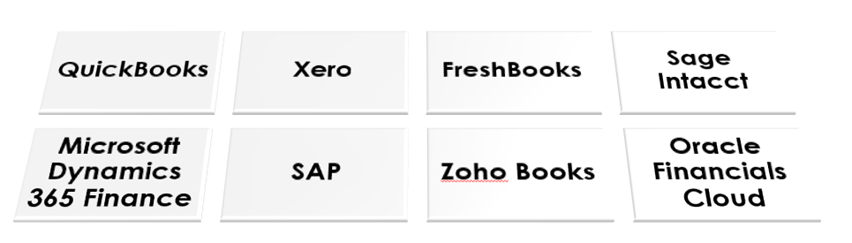

4. Accounting Software and ERP Systems

Finance professionals now rely on accounting software and Enterprise Resource Planning (ERP) systems. They do this to increase productivity, improve accuracy, and simplify financial procedures. Employers value skills in various accounting software and ERP systems. For instance, SAP, Oracle NetSuite, and QuickBooks are in high demand. 5. Tax Planning

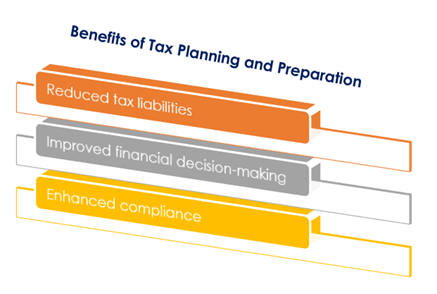

5. Tax Planning

Proactive tax planning can identify opportunities to reduce tax burdens. It can also maximise financial resources. It is for individuals and businesses. It can also help make informed choices that align with financial goals. Finance professionals play a crucial role in ensuring compliance. They also help cut tax liabilities for individuals and businesses. Effective tax planning and preparation require deep knowledge of tax regulations. It also requires the ability to analyse financial data. It also requires the skills to navigate an evolving environment. Accountants and tax professionals find it valuable to understand tax regulations. They apply the rules to minimise tax liabilities.

Effective tax planning and preparation require deep knowledge of tax regulations. It also requires the ability to analyse financial data. It also requires the skills to navigate an evolving environment. Accountants and tax professionals find it valuable to understand tax regulations. They apply the rules to minimise tax liabilities.

6. Auditing and Assurance

Auditing and assurance functions are crucial in the financial world. They ensure the integrity of financial reporting. They promote trust in the business environment. Auditing and assurance professionals need strong analytical skills. They also require attention to detail. They also need a deep understanding of accounting principles and auditing standards.

Auditors must test financial statements and identify potential errors or inconsistencies. This ability is crucial. Finance professionals have the necessary skills and knowledge in auditing and assurance. They can play a vital role in contributing to financial stability. They can also manage risks and foster good governance practices.

7. Financial Reporting and Analysis

Financial reporting and analysis are the lifeblood of any organisation. They provide crucial insights into the company’s financial health and performance. To communicate technical and financial concepts, one must compile financial reports. They should also assess financial outcomes and provide insightful feedback to stakeholders.

Finance professionals must communicate financial facts. For them, this is crucial. Professionals with skills in financial reporting may discuss financial performance. They can also see patterns and opportunities, improve decision-making, and uphold compliance.

Unsplash+In collaboration with Getty Images

8. Business Acumen and Communication

Accounting expertise and numbers are not only for finance experts. To thrive, they need a broader skillset beyond financial expertise. In non-technical skills, two key areas stand out: business understanding and effective communication. Business acumen is the ability to understand the business environment. It includes understanding how different functions contribute to its success.

Finance professionals are invaluable assets to any organisation. They have business acumen and practical communication skills. They can enable well-informed decision-making. They can promote organisational cooperation. They can transform complicated financial data into valuable insights. By investing in these essential skills, finance professionals can position themselves for success. They will prepare themselves for a competitive and dynamic business environment.

9. Project Management and Leadership

Professionals in finance are required to manage challenging projects and assume leadership positions. These projects can range from implementing new financial systems to streamlining budgeting processes. They can also involve spearheading strategic initiatives. Strong project management and leadership abilities are essential for finance professionals to develop. To be successful in these jobs, you must do this.

In today’s cutthroat corporate world, finance professionals will be well-positioned to succeed. They might invest in developing their leadership and project management skills. This will help them achieve this. They should also invest in their financial expertise. These skills empower them to spearhead complex projects. They also help them lead and motivate teams. They drive positive change within organisations.

10. Collaboration Tools Skill

In the era of remote work, effective collaboration is essential. Finance and accounting professionals should be comfortable using collaboration tools. Examples include Slack, Microsoft Teams, and Zoom. They should use these tools to ease communication. They should also use them to share documents and collaborate on projects.

How Can Accounting and Finance Professionals Acquire These Skills?

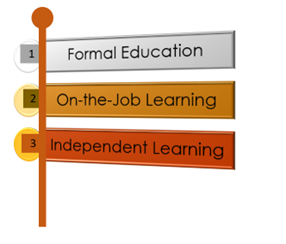

Becoming a finance professional involves ongoing education, training, hands-on experience, and continuous learning. It’s a process of acquiring skills. Finance professionals have many ways to gain and improve skills. The best approach often combines different methods. Here are some key considerations:

Formal Education

You can become certified as a project management professional (PMP). You can also become a certified management accountant (CMA) or a chartered accountant (ACA). You can also become certified in other areas. Certification verifies your expertise. It can also provide a structured learning environment.

Many online and offline courses and workshops on various finance-related skills are available. Harvard Business Review, Coursera, and the Project Management Institute (PMI) are reputable organisations. They offer these choices. They are about relative experience.

Look for opportunities to shadow coworkers in various areas inside your company. Operations and marketing are two options. Your comprehension of the company will expand as a result of this. Also, lead or take part in financial projects, even small ones. This hands-on experience will be invaluable for developing your skills. It will also be valuable for building your portfolio.

Seek guidance from experienced colleagues or senior leaders. They can provide feedback on your work. They can also share their insights on leadership and project management best practices.

Independent Learning

Stay current with finance and related fields. Read industry publications, blogs, and thought-leadership articles. Attend industry events, conferences, and meetups. Connect with other professionals and expand your network. These interactions can expose you to new ideas and provide valuable career insights.

Attend industry events, conferences, and meetups. Connect with other professionals and expand your network. These interactions can expose you to new ideas and provide valuable career insights.

Conclusion

A successful finance profession is built on technical skills, soft skills, and a dedication to lifelong learning. This foundation also makes the job rewarding. Finance professionals aiming for career growth must acquire and develop diverse skills.

Accounting and finance professionals can increase their marketability. They can do this by developing their knowledge and experience. They can also improve their capacity to take part and their professional possibilities. In light of the current shifting financial landscape, this is imperative. These skills contribute to personal and professional development. They also position individuals as valuable assets to their organisations.

Remember, the demand for these skills is evolving. Staying informed about industry trends is crucial for long-term success in this field. Learning new skills is also essential. Pursue learning opportunities and prove a commitment to continuous improvement.

What Strategies Can We Implement to Address Financial Year-End? What Does a Financial Controller Do in Accounting? How do you become a freelance accountant? What are the main differences between ACA and ACCA?

To learn more about a career as an accountant, please visit our resources page or search for accountant roles here.

Job Seekers

On the hunt for your next role? Upload your CV below and we’ll be in touch to discuss your requirements.

Employers

For employers seeking the right skills and cultural fit for your business, send us your vacancy to find out more about how we can help.

Submit CV Send Us Your VacancySearch Jobs

Popular this week

- What Qualifications And Skills Are Needed To Be An Accountant?

- How Does Industry 4.0 Differ From The Previous Generation?

- Agile For Accountants: Six Steps To Provide Necessary Tools And Relevant Processes

- What Are The Main Differences Between ACA and ACCA?

- What Are The Top Five Financial Accounting Facts For #AccountantsDay