Global CEO salary and pay

In recent decades, CEO pay has gone up. This shows a big difference between what executives and workers earn. CEO pay has gone up a lot in many countries because of globalisation and market competition. In this article, we will look at why CEO pay is important in corporate governance.

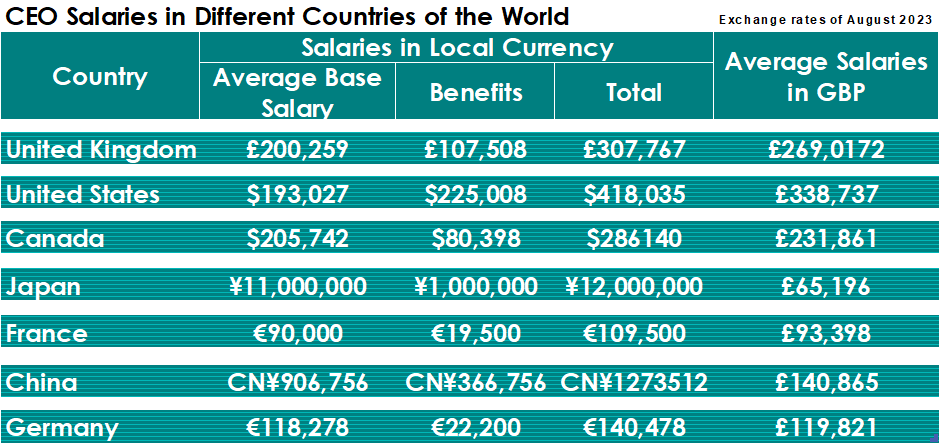

United States: The average pay of a CEO in the US is $193,027 p.a. According to Glassdoor, CEOs received an extra $225,008 in monetary benefits in 2023, on average.

People know the US for its high CEO pay and performance-based compensation. Many CEOs receive stock options and equity grants, leading to a large pay gap with workers.

In Japan, the average CEO’s base salary is ¥11,000,000 per year. They also receive an average of ¥1,000,000 in cash benefits. This information is from Glassdoor’s salary source for CEOs in Tokyo, Japan, in 2023. In Japan, executive pay practices are more conservative. They focus on long-term stability and don’t rely on performance-based incentives.

The CEO of a UK company earns an average yearly base salary of £200,259. They also receive average cash benefits of £107,508. This information is from Glassdoor’s salary source: CEO in August 2023. The UK emphasises transparency, accountability, and shareholder engagement. They prioritise voting for pay, committee duties, and sharing executive pay information.

The average yearly base salary for a CEO in China is CN¥906,756. They also receive average cash benefits of CN¥366,756. This information is from Glassdoor’s salary source for CEOs in China as of August 2023. China has an evolving compensation landscape due to economic growth. It combines traditional fixed salaries with performance-based incentives. Growing pay due to economic growth.

In Canada, the average CEO’s yearly base salary is $205,742. They also receive an average of $80,398 in cash benefits. These numbers come from a salary source called CEO in Canada, August 2023 | Glassdoor. The CEO’s compensation is based on performance. It includes equity grants and stock options.

Its focus is on responsible corporate governance.

European CEO salary and pay

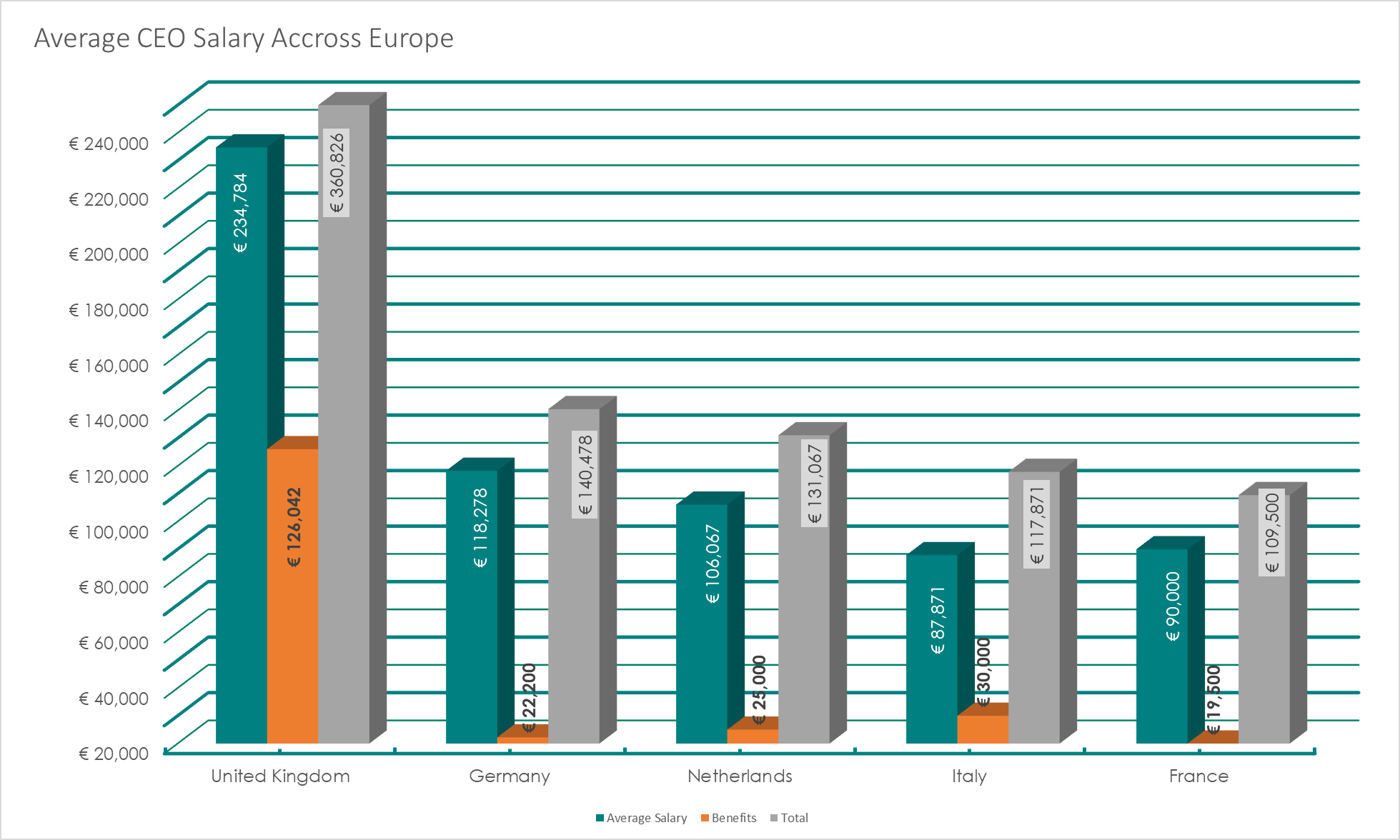

In Germany, CEOs earn an average base salary of €118,278 per year. They also receive an average of €22,200 in cash benefits. The salary information is from a source called CEO in Munich (Germany) 2023 | Glassdoor. Germany’s two-tier board structure with worker representation influences executive compensation decisions. It emphasises long-term performance and balanced compensation structures.

In France, CEOs earn an average yearly base salary of €90,000. They also receive extra cash benefits of €19,500 on average. This information came from Glassdoor. It’s about CEO salaries in Paris, France, in 2023. The main features are strict rules that limit the amount of money paid for leaving a job and for doing well. Shift towards linking executive compensation to environmental and social goals.

In the Netherlands, the average CEO’s base salary is €106,067 per year. They also receive an average of €25,000 in cash benefits. This information comes from Glassdoor’s CEO salary source for 2023. The Netherlands emphasises transparency, disclosure, and shareholder engagement. Strives for a balanced approach to executive compensation, emphasizing long-term performance.

According to Glassdoor, the average yearly base salary for a CEO in Italy is €87,871. They also receive an average of €30,000 in extra cash benefits. CEOs in Northern Europe earn more than their counterparts elsewhere. This is due to differences in salary and compensation regulations.

UK CEO salary and pay

The United Kingdom has a successful business history. Its approach to CEO pay has changed over time in response to different factors.

The UK aims to reward people for meeting the expectations of shareholders and other stakeholders based on performance. They want to be more transparent, accountable, and responsible in executive compensation.

Various trends have influenced CEO compensation in the UK.

These trends have caused changes and challenges, and people are looking for fair payment practices.

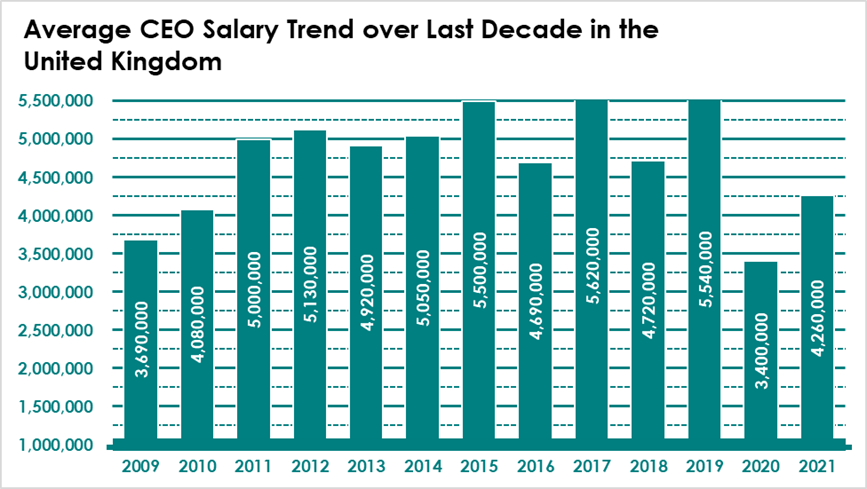

In the early years, CEO compensation in the UK was about fixed salaries and small bonuses. Yet, as global markets grew and competition increased, executive pay structures changed. They started to focus more on performance-based incentives like stock options and equity grants. Shareholders in the UK became more active in the late 20th century. They wanted executives to be more transparent and accountable when deciding pay. Shareholders vote on executive pay to link rewards with performance and shareholder interests.

The financial crisis in the late 2000s made people look at how executives were paid. People wondered if the problem came from taking too many risks for quick profits. In the early 2000s, Derek Higgs (2003) and Sir David Walker (2009) wrote influential reports. These reports stressed the importance of good corporate governance and fair executive pay. The reports suggested having more independent board members. They also suggested clear payment rules and better communication with shareholders.

The UK has rules and requirements to make executive compensation more transparent and monitored. The Companies Act 2006 made it necessary for companies to share executive pay details in annual reports. This helps shareholders and the public understand executive pay packages better.

UK shareholders have recently discussed executive pay. They want to promote diversity and long-term value creation. Companies collaborate with investors and advisors to decide fair and ethical compensation. Companies are linking executive pay to long-term value and sustainability. UK companies are considering environmental, social, and governance factors when deciding on compensation. They understand that CEOs’ decisions have wide-reaching effects beyond financial metrics. The UK’s focus on diversity and gender equality has also extended to executive compensation. Companies face pressure to reduce gender pay gaps and promote executive diversity. This has sparked conversations about fairness and compensation practices.

Current Statistics: According to a report by The Guardian, the median pay of FTSE 100 chief executives reached £3.9 million in 2022. Last year, Pascal Soriot from AstraZeneca made £15.3 million, the most of any CEO. The second highest paid was Charles Woodburn from BAE Systems, making £10.7 million. Albert Manifold from CRH was the third highest paid, earning £10.4 million.

The pay given to top executives, like CEOs, affects how companies behave and perform. Corporate governance has evolved, with executive compensation emerging as a central aspect.

CEO Compensation Packages

The compensation packages of top CEOs provide a window into the complex world of executive pay. When we look at various industries and countries, we can understand why salaries are high. This is due to factors such as competition and regulations.

CEOs’ pay includes many parts, making it a detailed and intricate system. These parts make sure that the CEO’s goals match the company’s performance, long-term value, and what shareholders expect. Here are some standard features of CEO compensation packages:

Base Salary: The fixed amount paid to the CEO. Their compensation package is based on it and shows their roles and responsibilities. In 2022, the average salary for a CEO in the FTSE 100 was £3.91 million. This is the highest it has been since 2017 and is 16% more than the median pay in 2021, which was £3.38 million. – source: High Pay Centre (highpaycentre.org).

The CEO receives an annual bonus, which is a cash payment that can change. The bonus is given for meeting short-term goals, like financial targets or operational milestones. 96% of FTSE 100 companies paid their CEO a bonus in 2022, compared to 87% in 2021. Yet, the mean bonus payment decreased from £1.43 million in 2021 to £1.41 million in 2022 – source: High Pay Centre (highpaycentre.org).

Long-term incentives connect the CEO’s pay to how well the company does over a long period of time. They encourage CEOs to make decisions that will impact the company’s trajectory over several years. 74% of FTSE 100 companies paid their CEOs a long-term incentive payment (LTI), up from 71% in 2021. The mean LTI payment increased from £1.49 million in 2021 to £1.79 million in 2022 – source: High Pay Centre (highpaycentre.org). A common form of LTI includes equity grants, which provide the CEO with ownership in the company. These can consist of stock options, RSUs, or performance shares.

Stock options are a way for CEOs to buy company stock at a set price, encouraging them to raise the stock’s value.

RSUs are shares of company stock granted to the CEO, but they can’t be sold or exercised right away.

Employees earn performance shares by reaching goals, like boosting income or meeting financial targets.

Unsplash+In collaboration with Getty Images

Contributions to retirement plans, like pensions, can accumulate over time. Deferred compensation plans may allow CEOs to defer a part of their salary or bonus until later.

Perks and Benefits: CEOs receive non-cash benefits as part of their compensation package. Employees get perks like cars, health coverage, housing help, club access, and personal helpers.

If the CEO’s job ends, these rules explain what happens, especially during business combinations. Severance packages may include cash payments, continued benefits, and accelerated vesting of equity.

Criteria for CEO Compensation Packages

CEOs’ pay is often designed to balance short-term results and long-term value creation. This way, the CEO’s goals match those of shareholders and stakeholders. The compensation committees and boards of directors consider these components. They do this to make sure they support the company’s strategic objectives and responsible governance. The CEO’s job contract often has conditions to be eligible for big pay.

Performance measures impact the CEO’s eligibility for equity awards and bonuses. These metrics vary based on industry, company size, and strategic priorities.

To encourage good behaviour, companies now use ESG, or sustainability metrics, to determine CEO pay.

Clawback provisions let a company get back money paid out when certain conditions are met. These conditions can include financial restatements due to misconduct.

Compensation Trends in Different Industries

We can learn about executive compensation by studying CEO pay in different industries. The pay varies depending on company size, performance, demands, and market conditions. Let’s look at how much CEOs in technology, finance, and healthcare get paid since these industries give out big rewards.

Tech and pharma companies give more compensation through equity grants due to possible stock price growth. Finance companies also include equity, but it’s lower due to regulatory considerations.

The performance bonus is the same in all industries and rewards short-term achievements. The percentage is higher in technology due to the sector’s rapid growth and innovation.

Compensation: Pharmaceutical and technology CEOs have higher compensation than healthcare and finance CEOs. The technology sector has a lot of potential for growth. Pharmaceutical companies invest in research and development. This makes a difference.

Finance companies have rules that limit how they pay their employees. This is why the finance industry has lower equity and bonus payments.

Unsplash+In collaboration with Getty Images

Remember, CEO pay can differ within industries due to company size, performance, and other factors. Comparative analysis like this provides a snapshot of trends but needs to capture the full complexity of executive pay. To conduct thorough research, use reliable industry reports, company filings, and compensation studies.

Factors Driving High CEO Salaries

The large salaries of CEOs have become a subject of intense debate and scrutiny. To understand executive compensation and corporate governance, we need to know why pay is high.

CEOs make a lot of money because companies need them; there aren’t many skilled people and the rules To have better discussions about executive pay, we need to understand these important factors. This will help align CEO incentives with shareholder interests and make sure CEO pay is fair and accountable.

High CEO salaries are influenced by these factors. People are discussing aligning executive pay with shareholder and stakeholder interests. They also want to address income inequality and promote responsible corporate governance.

The following list provides the factors driving high CEO salaries:

- Market Demand for Top Talent: CEOs are responsible for leading and driving the strategic direction of companies. In a competitive business world, the need for skilled leaders raises executive salaries.

- There aren’t enough skilled leaders to fill top positions in big companies. The scarcity makes CEOs more powerful in bargaining and lets them get higher compensation.

- High salaries often come with bonuses, stock options, and equity grants based on performance. These parts link CEO pay to how well the company does, so CEOs make choices that help shareholders.

- CEOs who make companies successful and increase shareholder value are often paid more.

- Modern corporations are complex and large, so CEOs must manage many tasks and make important decisions. This is why they receive higher compensation. CEOs of big companies have lots of duties, so they get paid more to stay. These companies operate globally and have many business units.

- Industry Competition. Industries like technology and finance compete for top talent. They offer higher pay to attract CEOs who can give them an advantage. Shareholders expect CEOs to deliver strong financial results and shareholder returns. Companies might offer higher payments to secure CEOs with proven track records.

Unsplash+In collaboration with Getty Images

- To stay competitive, compensation committees and boards compare CEO pay to that of peers and competitors. This benchmarking process can lead to an upward spiral in executive pay. Prevailing corporate governance practices and market norms can influence executive compensation decisions. Sometimes, these norms lead to higher pay levels to remain competitive.

- Market Perception and Reputation: A CEO’s reputation and market perception can impact a company’s success. Hiring a good CEO can help improve the company’s reputation, which could mean paying them more. Big investors can impact CEO pay by engaging and voting on executive pay proposals and pushing for better compensation.

Comparative Analysis: Global and European Perspectives

Executive pay varies around the world due to economic conditions, cultural norms, regulations, and corporate governance beliefs.

When we compare executive pay worldwide and in Europe, we see how economics, culture, and regulations are connected. To discuss executive pay, governance, and shareholder interests, you must comprehend these distinctions.

The US is the highest-paying country in the world for CEO compensation. Stephen Schwarzman, the CEO of Blackstone, received the highest pay in 2022. He earned $253 million. Sundar Pichai of Alphabet came in second, earning $226 million. Stephen Scherr, CEO of Hertz, came in third with total earnings of $182 million.

In a world where companies are connected, they learn from different perspectives. This shapes executive compensation globally.

In this section, we will compare executive compensation around the world and in Europe. We’ll look at different practices, trends, and challenges for companies and policymakers.

Unsplash+In collaboration with Ave Calvar

Historical Evolution of CEO Compensation

The history of CEO pay shows how business, economics, and governance have changed. Now, we’ll examine the key events and patterns that influenced CEO pay over time.

In the early years of corporations, CEO pay was low and often tied to business success. Shareholders saw the CEOs as stewards who acted in their best interests.

Performance-Based Compensation Era: In the mid-20th century, we shifted toward performance-based compensation. The CEO’s pay is based on how well they perform and the stock price. This connects their interests with those of shareholders. This created a bond between the CEO and the company’s success.

In the late 20th century, the “superstar” CEO became a popular trend. Companies wanted CEOs who were good leaders and had experience fixing struggling companies. CEOs said they deserved high pay because talented people wanted a lot of money. During this shift, the focus was on making money fast. This resulted in CEOs receiving large pay packages through stocks and bonuses.

CEO pay became high in the late 1990s and early 2000s. This worried shareholder activists and corporate governance advocates. We learned from the Enron scandal and other corporate failures that executive pay should be transparent and accountable. Shareholder activism gained momentum as investors demanded a better alignment between pay and performance.

In response to increasing concerns, regulatory interventions began to shape CEO compensation. In 2010, the United States passed a law called the Dodd-Frank Act. Shareholders could vote on executive pay to express their approval or disapproval. Similar regulatory changes also occurred in other countries, emphasising transparency and shareholder input.

Current Focus

In recent years, CEOs have been rewarded for creating long-term value instead of short-term gains. Performance metrics now consider environmental, social, and governance (ESG) factors, not finances. CEOs are now seen as having a bigger influence on their companies and society.

The difference in pay between CEOs and workers has led to discussions on income inequality and ethics. People want fair pay and wealth distribution. Activists, academics, and policymakers are advocating for this.

Unsplash+In collaboration with Getty Images

Common Challenges

Shareholder activism is on the rise. Institutional investors and shareholders have more influence in deciding executive compensation. They use “say-on-pay” votes and engagement to shape these decisions.

Executives’ pay should depend on how well the company performs and sustains value.

Compensation structures include non-financial metrics like environmental, social, and governance factors.

There is a growing focus on addressing the gender pay gap and promoting diversity in executive ranks.

Regulatory Reforms: Legislative interventions enhance transparency, accountability, and responsible executive compensation practices.

CEOs Pay in Startups

In startups, CEO pay can change depending on factors like stage, industry, funding, location, and experience. Startups often need to balance attracting top talent with managing limited resources.

According to research by Kruze Consulting (kruzeconsulting.com), a startup CEO’s average salary in the USA was $142,000 in 2023, down from $150,000 in 2022. The salary survey website Glassdoor reports that the average base pay of a startup’s co-founder and CEO in the UK was £127,287 in 2023.

Various factors contribute to the pay fixation of CEOs in startups, such as:

- Industry and Location: The industry and nature of the startup’s business can impact CEO compensation. Tech startups may offer higher equity stakes due to the potential for rapid growth and high valuations. The location of the business matters. CEOs in expensive cities might get higher salaries to attract talent.

- Stage of Startup In the early stages, when a startup is getting off the ground and has limited funding, the CEO might not receive a large salary. Instead, they might take a lower base salary in exchange for equity in the company. Equity can be in the form of stock options or equity grants, aligning the CEO’s interests with the startup’s success. In certain situations, when CEOs are also co-founders, they may decide their own pay. They might even work without pay, driven by their passion for the business.

- Growth of Startups: The CEO’s compensation might evolve as the startup secures funding and grows. The CEO might get a good salary and bonuses based on goals and milestones. Equity compensation is still important because the CEO’s role in the company’s success is crucial.

- CEOs of well-funded and growing startups can earn salaries like those of established companies. These salaries include base pay, bonuses, and equity. CEOs at this stage manage big teams, plan growth, and attract more investment.

- Experience and track record of the CEO The CEO’s experience and track record also play a role in determining salaries. CEOs who have built and grown startups may earn more money and stocks because of their proven skills. Startups focus on equity ownership because a big financial reward can come when they exit. Determining a CEO’s pay in a startup involves many factors, like the company’s finances, growth, competition, and skills.

Gender Gap in CEO Pay

The gender gap in CEO pay refers to the disparity in compensation between male and female CEOs. This gap reflects broader gender inequalities that exist in the workforce and society at large. Oracle’s Safra Catz is the only woman among the top 10 highest-paid CEOs, according to a report by CNBC (cnbc.com). According to the High Pay Centre, female CEOs in the United Kingdom earned £3.91 million, which is like the £3.96 million median income of male FTSE 100 CEOs.

The pay gap happens because women aren’t represented enough in top leadership roles, like being CEOs. Women may face obstacles like biases, stereotypes, and barriers that hinder career growth. As of July 2022, the Fortune 500 companies have 44 women CEOs, making up 8.8% of the total. In the Fortune 1,000 (501–1000), there are 37 women CEOs, which is 7.4%.

Photo by Meghan Lamle on Unsplash

According to a report from CEOWORLD magazine, as of August 2023, there are currently nine women who are chief executives in the FTSE 100. The FTSE 100 is a group of the biggest businesses traded on the London Stock Exchange. This means that 9 per cent of these companies have female CEOs. Although the number has improved from six female CEOs in 2019, progress could still be much faster.

Some key factors contributing to the gender gap in CEO pay are listed below:

- The glass ceiling is an unseen barrier that stops capable women from reaching top leadership positions. This phenomenon can limit women’s opportunities to become CEOs and influence the pay gap.

- Studies reveal that women request fewer raises and promotions, affecting their earnings and career growth.

- Women often work in lower-paying sectors and roles, limiting their access to higher-paid CEO positions.

- Women often have to take on many caregiving duties, which can disrupt their careers and hinder their path to CEO positions. By offering paternity leave and flexible schedules, companies can encourage men to help with childcare. This allows women to take on more challenging tasks and be freed from traditional childcare duties.

- A lack of mentorship and sponsorship can limit women’s access to the networks and relationships needed to become CEOs.

- Some people believe that women are less likely to take risks. This belief may impact their suitability for CEO positions that require bold decision-making.

- When executive pay and diversity data are not transparent or disclosed, gender bias in CEO pay can continue unchecked.

- Gender stereotypes affect how people view effective leaders, which can disadvantage women in evaluations and pay decisions.

- To fix the difference in pay between male and female CEOs, we need to do several things. First, we should address the unfair practices that favour one gender. Second, we should encourage more diversity in leadership positions. Third, we should offer more opportunities for mentors and sponsors. Fourth, we should challenge the idea that certain jobs are only for one gender. Finally, we should create organizational cultures that include everyone.

- To reduce the gender pay gap and promote gender equality in companies, we can do a few things. First, we can make payment information more open. Second, we can create policies that support families. Third, we can provide opportunities for leadership development.

Unsplash+In collaboration with Getty Images

The CEO-Worker Pay Ratio

The difference in pay between CEOs and workers is causing conflict in discussions about fairness. The difference in pay between CEOs and average workers has many important effects on society and businesses.

A report from Reuters in August 2023 said that S&P 500 chief executives made $16.7 million in 2022. This is 272 times more than what their median workers earn. A report by the Economic Policy Institute (epi.org) suggests that the CEO-to-worker compensation ratio reached 399-to-1 in 2021, a new high.

According to the High Pay Centre, in 2022, FTSE 100 CEOs earned an average of £3.91 million. This is 118 times higher than the earnings of a full-time worker in the UK, which is £33,000. The CEO at AstraZeneca earned the most, receiving £15.32 million. These figures are 464 times the pay of the median UK full-time worker. The median FTSE 250 CEO was paid £1.77 million in 2022, 54 times the median UK worker.

To promote fair economic growth, it’s crucial to grasp the causes and impacts of income inequality on workplaces. By knowing this, we can make sure compensation practices are fair.

Factors Driving the Gap

Economic, societal, and corporate factors influence the growing CEO and worker compensation gap. This gap keeps getting bigger. Statistical data shows how much more CEOs make compared to workers. It also talks about how this affects income inequality and organisations. This disparity has raised concerns about income inequality and social justice. The following are some key factors driving the gap between CEO and worker compensation:

- The scarcity of qualified CEOs and the high demand for executive talent can increase compensation. When there aren’t many experienced CEOs available, their pay can go up. But when there are lots of workers in certain industries, wages can go down.

- CEOs handle global operations, navigate international markets, and lead organisations through technological changes. Their responsibilities in a globalised and tech-driven economy can lead to higher compensation.

- CEOs often get paid more if the company does well and shareholders make money. This can happen through bonuses, stock options, and equity grants. Successful CEOs who achieve significant growth can earn large rewards.

- CEOs make important decisions, lead big teams, manage money, and deal with regulations. So, the complexity of their roles justifies higher pay.

- CEOs can negotiate their pay packages and demand higher pay because they are crucial to the company’s success.

- A reputable CEO can enhance a company’s brand and attract investment, justifying a higher pay package based on their market value.

- Compensation committees and boards set executive pay levels.

- When companies compare CEO pay to others in the industry, they may try to pay their executives even more to keep up with competitors. This can lead to high executive pay.

- If companies are secretive and avoid responsibility, it can lead to excessive CEO salaries.

- Sometimes, shareholders can vote on executive compensation, but it might not make a real difference. This means that compensation practices can continue even if shareholders are worried.

- Societal norms and acceptance of wealth accumulation can contribute to the gap. In some cultures, high CEO pay symbolises success and aspiration.

- If fewer workers join unions and have less bargaining power, wages may not go up, and executives may earn more than workers.

- To close the gap between CEO and worker pay, we need to make changes to how companies are run, the rules they follow, and how workers can negotiate. Businesses and society must balance executive talent while tackling income inequality.

Photo by Semina Psichogiopoulou on Unsplash

- Future Trends of CEO Salaries

- To understand why CEO pay changes, we must think about changes in the economy, society, and business. CEO compensation in the future will depend on various factors, like regulations and ethics. Shareholder activism and growing expectations of responsible corporate governance are also important.

- We should connect CEO pay to long-term value creation instead of using short-term financial measures. Companies can use ESG metrics to make responsible choices about the environment, society, and governance.

- As companies focus on ESG, CEOs could be paid based on ESG performance, benefiting stakeholders. To measure financial performance, we should consider employee satisfaction, company diversity, innovation, and ethics. CEOs could receive compensation for their holistic contributions to the company.

- In the future, companies could give CEOs more stock instead of cash bonuses. This helps them work towards the same goals as long-term shareholders. CEOs may have to take more responsibility for company failures. Factors such as ethical behaviour, customer satisfaction, and reputation can affect their salary. CEOs who create healthy cultures may get more money if they involve stakeholders and listen to employees and consumers.

- As people focus more on income inequality, regulations may need clearer disclosure of CEO-worker pay ratios. Companies could face more pressure to justify high pay disparities. Efforts to close the gender pay gap could lead to more scrutiny of gender disparities in executive pay.

- It’s possible to expect greater openness and corrective action. Shareholders may want more say in CEO pay, which could make CEO pay match company performance better. Governments could make rules to limit how much CEOs can earn compared to workers. They might also increase taxes on excessive pay and need some money to be returned.

- By analysing data and using new technology, we can make customised pay plans for CEOs. These plans will be based on their specific contributions. CEOs who prioritise sustainability, social impact, and community involvement receive unique compensation plans.

Conclusion

In this article, we have explored CEO compensation in detail. We have studied the history, global views, trends, and ethics and suggested changes in modern corporate governance. We have learned a lot about CEO salaries and pay. This includes the pay difference between CEOs and workers. It also involves inequality between genders. Additionally, it considers the influence of stakeholders and the concerns of regulators.

To learn more about a career as a CEO, please visit our resources page or search for senior management roles here.

Job Seekers

On the hunt for your next role? Upload your CV below and we’ll be in touch to discuss your requirements.

Employers

For employers seeking the right skills and cultural fit for your business, send us your vacancy to find out more about how we can help.

Submit CV Send Us Your VacancySearch Jobs

Popular this week

- What Qualifications And Skills Are Needed To Be An Accountant?

- How Does Industry 4.0 Differ From The Previous Generation?

- Agile For Accountants: Six Steps To Provide Necessary Tools And Relevant Processes

- What Are The Main Differences Between ACA and ACCA?

- What Are The Top Five Financial Accounting Facts For #AccountantsDay