The head of treasury is the custodian of a company’s liquidity. They oversee investments and financial operations. They are critical to ensuring financial health and success.

Role of the Head of the Treasury

The role of the head of treasury in a company is dynamic. It encompasses managing cash and optimising investments. It also involves mitigating risks and making informed financial decisions. Additionally, it involves maintaining solid relationships with financial partners. The head of treasury in a company handles the following:

- Working capital management. Monitor and maximise the working capital available, which includes accounts payable, payables, and inventory.

- Investment management. Oversee the company’s investment portfolio. Decide where to invest excess funds to generate returns. Ensure capital preservation.

- Debt management. Managing the company’s debt obligations, including issuing new securities and refinancing existing debt.

- Financial reporting and compliance. You must maintain accurate and timely financial records and generate reports on cash, investments, debt, and other treasury activities.

Unsplash+ In collaboration with Getty Images

Head of Treasury Salary in the UK

The compensation of the head of treasury in the UK is a blend of base salary and other benefits. Salaries can vary based on the company’s industry, location, size, and financial performance. According to Glassdoor, the general range for the role is between £114,000 and £197,000 per year.

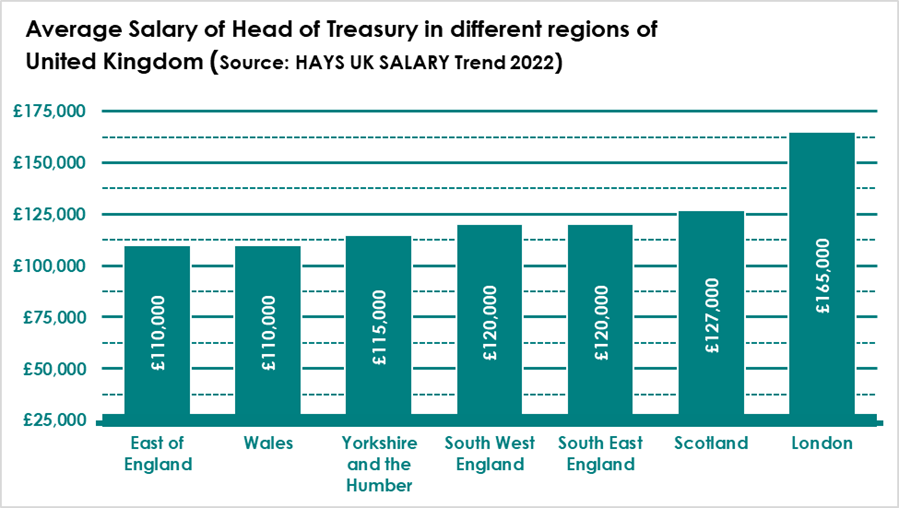

Head of Treasury Average Salary in Different Regions of the UK

Cities like London are known for their financial prowess. As a result, the head of the treasury often earns high salaries due to the high cost of living. Offering competitive salaries is essential to attracting and keeping top talent.

In contrast, smaller cities may offer lower salaries due to their lower cost of living. Additionally, the industry can influence compensation. Companies in the finance sector, such as banking and venture capital, manage their clients’ wealth. Complex financial operations are expected, which might lead to higher salaries than in other industries.

Comparative Analysis: Europe and the World

Comparative Analysis: Europe and the World

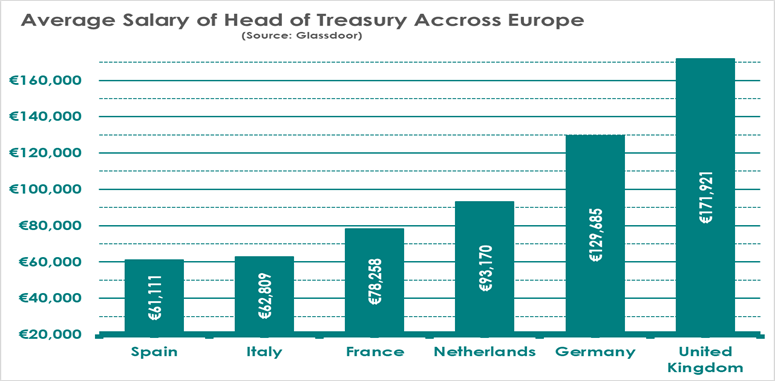

Benchmarking the pay and perks of the head of treasury in the UK against their counterparts in Europe and around the world is crucial.

In Europe, the UK’s compensation for this role is often on par with other financial powerhouses like Germany, France, and Italy.

These nations have similar economic climates. Yet, they differ in offering attractive salaries. They do this to attract and keep the best financial talent.

Similar roles in other parts of the world have different titles. For example, they might be called treasurer, treasury manager, or treasury director.

The compensation and perks offered to the head of treasury are attractive in different countries. Yet, it’s essential to recognize the weight of responsibility and accountability that come with the job.

Perks and Benefits

A career in the treasury is quite rewarding. Besides base salaries, the head of treasury also receives other perks and benefits. These perks often include performance-based bonuses and stock options. They include executive education allowances, retirement benefits, and health insurance.

Learn more about head of treasury careers. The following articles cover Job Description & Profile, Qualifications, Skills & Requirements, How to Become, etc.

Search Jobs to find out about the treasurer job roles we currently have available.

Job Seekers

On the hunt for your next role? Upload your CV below and we’ll be in touch to discuss your requirements.

Employers

For employers seeking the right skills and cultural fit for your business, send us your vacancy to find out more about how we can help.

Submit CV Send Us Your VacancySearch Jobs

Popular this week

- What Qualifications And Skills Are Needed To Be An Accountant?

- How Does Industry 4.0 Differ From The Previous Generation?

- Agile For Accountants: Six Steps To Provide Necessary Tools And Relevant Processes

- What Are The Main Differences Between ACA and ACCA?

- What Are The Top Five Financial Accounting Facts For #AccountantsDay