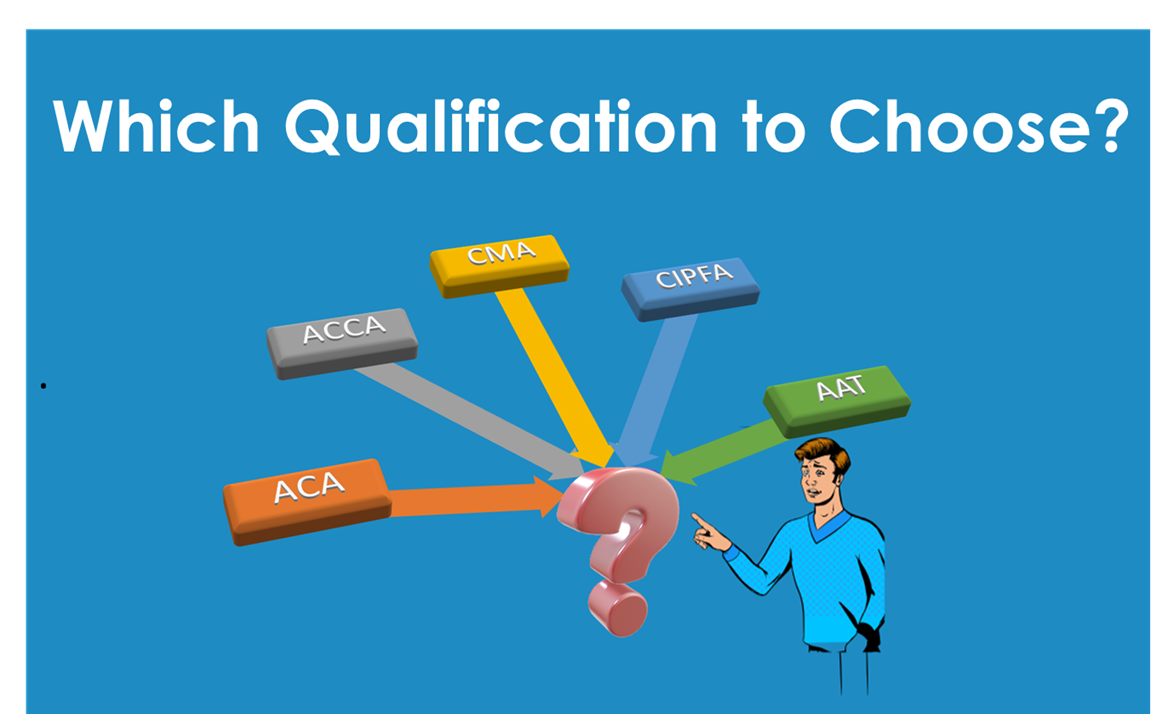

Which Is the UK Accounting Qualification for You?

Choosing the proper accounting qualification in the United Kingdom can be challenging, given the many options available. If you ask ten accountants which is the best, you’ll get different responses with a unique reason from each of them.

Whether you are a student embarking on your accounting career or a seasoned professional looking to enhance your skills, selecting the suitable qualification is essential to achieving your goals. In this article, we will explore some of the most popular accounting qualifications in the UK and help you determine which one is best suited for you.

What Accounting Degrees are Available in the UK?

The accounting qualifications provide specialised knowledge and recognition for professionals in accounts and finance. The choice of certification depends on your specific preferences. Following are some of the top accountancy qualifications which finance professionals may pursue in the UK to advance their careers.

- Association of Accounting Technicians | AAT. The AAT qualifications are the professional diploma suitable for individuals starting their accounting journey or those who want to gain a solid foundation in accounting principles. It offers a practical and vocational approach to accounting. The AAT qualification is well-regarded in the industry and provides a pathway for further professional development, allowing individuals to progress to higher-level qualifications, such as ACCA or CIMA.

- Association of Chartered Certified Accountants | ACCA The Association of Chartered Certified Accountants (ACCA) is recognised globally and highly regarded in the UK. It offers a comprehensive and practical approach to accounting, finance and business. With a focus on professional ethics, the ACCA equips individuals with the skills necessary to succeed in various accounting roles, including audit, taxation, and financial management. The qualification includes several exams, practical experience requirements and an ethics module. The ACCA qualification suits those seeking a flexible and internationally recognised certification.

- Chartered Global Management Accountant | CMA The Chartered Global Management Accountant (CMA) is a leading professional qualification in management accounting offered by the Chartered Institute of Management Accountants (CIMA). It focuses on strategic business management and provides individuals with the skills to support and drive business decision-making. The CIMA syllabus covers various topics, including financial reporting, risk management, performance management and business analysis. Management accountants are highly valued in business and may reach senior management positions.

- Associate Chartered Accountant | ACA The Associate Chartered Accountant (ACA) qualification is one of the most prestigious accounting qualifications in the UK. It offers a comprehensive curriculum that covers financial accounting, audit, tax and business strategy. The qualification is known for its rigorous training and high professional standards. It also provides opportunities for specialisation through optional modules, allowing individuals to tailor their studies to their career interests. Chartered Accountants are more likely to get roles in the Big 4 or top accounting firms.

- Chartered Institute of Public Finance and Accountancy | CIPFA The Chartered Institute of Public Finance and Accountancy (CIPFA) specialises in public-sector accounting and finance. The qualification is for people in the public sector, including governmental institutions, municipal governments, and non-profit organisations. It covers topics such as general financial management, auditing and governance. The CIPFA qualification is highly respected in the public sector and offers excellent career opportunities for those interested in public finance.

- Other Qualifications. In addition to the above, many other qualifications for accountants offer specialised knowledge and expertise; these include: The Institute of Financial Accountants (IFA) focuses on financial accounting and offers a practical approach to accounting principles and techniques. The Association of Taxation Technicians (ATT) is specifically designed for tax professionals and focuses on taxation principles and practices. Chartered Institute of Internal Auditors (IIA) offers the Certified Internal Auditor (CIA) qualification, which is globally recognised and suitable for professionals specialising in internal audit.

What Factors Should Be Taken Into Account When Selecting a Specific Qualification?

When choosing an accountancy qualification in the UK, take the time to research and assess each qualification’s suitability based on your career goals, preferences, and circumstances to ensure that you select the best option for your professional journey. Following are some key factors to keep in mind:

- Career Goals. Consider your long-term career aspirations within the accounting field. Different qualifications may align with specific career paths. For example, if you aim to work in auditing or taxation, you might consider qualifications such as ACCA or ACA. CMA might be a suitable choice if your interest lies in management accounting. Understanding your career goals will help you select a qualification that provides the necessary skills and knowledge for your desired role.

- Entry Requirements. Determine the entry requirements for each qualification. Some qualifications may have prerequisites, such as academic qualifications or prior work experience. Assess whether you meet the entry requirements for your chosen qualification or if you need to pursue prerequisite qualifications or gain relevant experience beforehand.

- Accreditation and Recognition. Evaluate the accreditation and recognition of the accounting qualification. Look for capabilities recognised by professional accounting bodies, employers, and regulatory authorities. Employers often prefer accredited qualifications which can enhance your job prospects. Reputable qualifications have established standards and offer a robust curriculum that meets industry requirements.

- Curriculum and Specialisations. Review the syllabus and modules offered by different professional qualifications. Assess whether the curriculum covers the areas of accounting and finance that interest you or align with your career goals. Some qualifications offer specialisations or optional modules that allow you to focus on specific areas of accounting, such as taxation or forensic accounting. Consider whether the capability provides a well-rounded education or aligns with your preferred specialisation.

- Flexibility and Study Options. Consider the flexibility of the qualification and the study options available. Some capabilities offer flexible study formats, including part-time or online options, allowing you to balance your studies with work or other commitments. Assess whether the study options align with your preferred learning style and availability.

- Professional Support and Networking Opportunities. Explore the support and networking opportunities provided by the accounting qualification. Some qualifications offer mentorship programs, networking events, and access to professional communities.

Photo by Randalyn Hill on Unsplash

- Cost and Financial Considerations. Evaluate the cost of the qualification, including exam fees, study materials and membership fees. Consider your financial situation and whether you can afford the investment required. Additionally, assess whether any scholarships, grants, or financial assistance programs are available to support your studies.

- Time Commitment. Assess the time commitment required to complete the qualification. Some qualifications have a modular structure, allowing you to study independently, while others have fixed examination dates. Consider your circumstances, such as work or family commitments, and choose a qualification that aligns with your available time and resources.

- Industry Reputation and Job Prospects. Research the reputation of the qualification within the accounting industry. Consider the demand for professionals with the capability and the job prospects available upon completion. Look into the employment rates and success stories of individuals pursuing the qualifications you are considering.

- Continued Professional Development. Determine whether the qualification offers opportunities for continued professional development. The accounting profession constantly evolves; ongoing learning is crucial to stay current with industry trends and advancements. Look for qualifications that provide access to professional development courses, seminars, or certifications that can enhance your knowledge and skills throughout your career.

Photo by Ashraf Ali on Unsplash

Which Qualification Is More Preferred by Employers in the UK?

It is important to note that employers generally prefer all the qualifications mentioned above; the specific preference can vary across industries, organisations and job roles.

Employers may have additional requirements or preferences based on their specific needs and the nature of their accounting work.

Therefore, it is advisable to research and understand employers’ preferences within your target industry or organisation and align your choice of qualification accordingly.

Additionally, practical experience, soft skills and industry knowledge are also highly valued by employers. Combining a recognised accounting qualification with relevant experience and a robust skill set will enhance your employability and make you a competitive candidate in the job market.

Photo by Ben White on Unsplash

Conclusion: Which Accounting Qualification Is Right for Me?

The UK offers various accountancy qualifications, each with a unique focus and benefits. Whether you aspire to become a chartered accountant, management accountant, or specialise in a specific sector, there is a qualification that suits your needs.

Consider your career goals, educational background, and industry preferences when selecting the most suitable accounting qualification. By choosing wisely, you can start a rewarding career in the accounting field that matches your professional ambitions.

Find out more about what being an accountant is all about. The following articles cover the job description, salaries, CV building tips and more.

Job Description & Profile, Salary & Pay, CV Template & Examples etc.

Search Jobs to find out about the accountant job roles we currently have available.

Job Seekers

On the hunt for your next role? Upload your CV below and we’ll be in touch to discuss your requirements.

Employers

For employers seeking the right skills and cultural fit for your business, send us your vacancy to find out more about how we can help.

Submit CV Send Us Your VacancySearch Jobs

Popular this week

- What Qualifications And Skills Are Needed To Be An Accountant?

- How Does Industry 4.0 Differ From The Previous Generation?

- Agile For Accountants: Six Steps To Provide Necessary Tools And Relevant Processes

- What Are The Main Differences Between ACA and ACCA?

- What Are The Top Five Financial Accounting Facts For #AccountantsDay